Below is our latest letter to clients. You may download the full PDF here. Please share and enjoy.

Dear Friends,

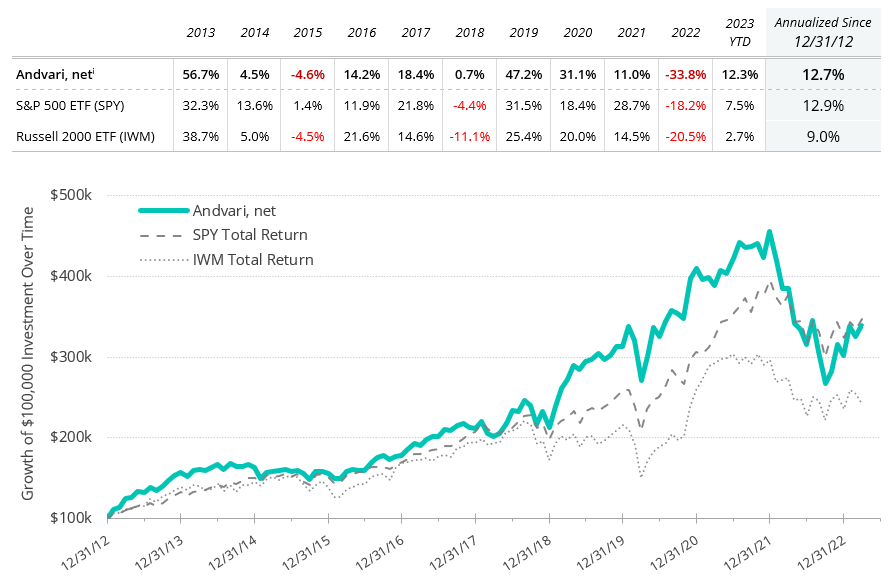

For the first quarter of 2023 Andvari was up 12.3% net of fees while the SPDR S&P 500 ETF was up 7.5%.* Andvari clients, please refer to your reports for your specific performance and holdings. The table below shows Andvari’s composite performance against two benchmarks while the chart shows the cumulative gains of a $100,000 investment.

WHY ANDVARI DISLIKES BANKS

The recent failures of Silicon Valley Bank, Signature Bank, and Credit Suisse reminded us why we are skeptical of investing in banks. To Andvari, banking—in general—is not a great business to be in for the long-term. This is because the industry has multiple unattractive qualities. The following five attributes are among our least favorite for any business we follow.

Commodity Products

First, banking is a commodity business. According to the Wikipedia definition, commodities are "economic goods that have full or partial but substantial fungibility; that is, the market treats their instances as equivalent or nearly so with no regard to who produced them." Loans from Bank A are generally indistinguishable from Bank B. Any business selling a commodity distinguishes itself by having the lowest price or by giving away the most concessions along with that commodity.

When customers have no regard for who produces the good or service in question, it means they look for the lowest price. It means lower margins and lower returns for the producer of the commodity. This does not lend itself to long-term profitability or above-average returns to shareholders.

At Andvari, we instead seek out businesses with highly valued products or services. This in turn enables higher than average margins and returns, more robust free cash flows, more dependable revenues, and often commands a stronger and longer lasting relationship with customers.

Rising Input Costs Difficult to Predict and Offset

Another sticking point for Andvari over banks is they have little control over a huge input cost to their product, which is interest rates. Uncontrollable and unpredictable input costs—like interest rates for a bank—do not heavily influence the cost structures of the companies Andvari favors. Even if input costs go up at an Andvari company, they can more easily raise prices to offset those costs. They have this ability because the products they sell are highly differentiated or else not easily switched out for a competing product.

Leverage is Necessary to Generate Acceptable Returns

Next, banks have low profitability from a ROA ("return on assets") perspective. Over the last ten years, the average ROA for all banks in the U.S. was a measly 1.08%. On the other hand, banks do earn a higher figure on ROE ("return on equity") that some find acceptable. Over the last ten years the average ROE for all banks in the U.S. was 10%.

However, this higher ROE is only possible because a small amount of capital supports a large amount of assets—i.e., they are highly leveraged. The businesses that interest Andvari have naturally high margins and returns on equity. They do not require debt or leverage to provide adequate returns to shareholders.

Highly Regulated

Although many of our companies sell products or services into highly regulated industries, they themselves are lightly regulated by comparison. On the other hand, a bank holding company that provides a multitude of financial services must deal with a handful of regulators. For example, here are the main regulators of JPMorgan Chase (JPM)1, the largest bank in the U.S.:

- The Board of Governors of the Federal Reserve System supervises and examines the holding company of JPM;

- JPM’s national bank subsidiary is supervised and regulated by the Office of the Comptroller of the Currency and by the Federal Deposit Insurance Corporation;

- JPM’s U.S. broker-dealers are supervised and regulated by the Securities and Exchange Commission and the Financial Industry Regulatory Authority. The Commodity Futures Trading Commission regulates subsidiaries that engage in futures-related and swaps-related activities.

- JPM and its national bank are subject to supervision and regulation by the Consumer Financial Protection Bureau with respect to federal consumer protection laws.

So many regulators and overlapping rules. This all detracts from profitability and the ability to serve customers.

Customers Can Cause the Business to Fail in a Matter of Days

Any business can make a mistake that causes customers to leave. However, only in the world of banking can customers tip the business into bankruptcy in a matter of days simply because of a lack of confidence. Andvari prefers to own businesses devoid of this "bank run" risk.

ANDVARI HOLDINGS: TYLER TECHNOLOGIES

One of Andvari’s worst performers in 2022 was Tyler Technologies. Tyler was down 40% while the S&P 500 was down 18.2%. We think Tyler currently sits at a valuation favorable to above average returns going forward. Furthermore, Tyler’s recent proxy statement2 supports Andvari’s view.

The proxy tells shareholders the board is incentivizing management to increase margins by several percentage points by the end of 2025. For context, Tyler’s margins used to be several percentage points higher than today. This is because the company sold more of its software via on-prem licenses as opposed to selling a subscription to use the software hosted “in the cloud” in an off-prem3 data center. Tyler historically let the customer decide how they wanted to purchase Tyler’s software. Since 2020, Tyler’s agnosticism has changed. Tyler now is a “cloud first” software company and has a partnership with Amazon Web Services (“AWS” is Amazon’s on-demand cloud computing platform). The company has been actively encouraging customers to choose the cloud version of their software products and to have it hosted on AWS.

While the change to a cloud-first, software-as-a-service (SaaS) business model has been a headwind for Tyler, it will lead to more predictable revenue growth and higher free cash flows in the long run. In the short term, Tyler has had lower revenue growth and profitability due to selling fewer on-prem software licenses and more subscription agreements. This stems from the fact that Tyler can recognize more revenues and profits up-front with the sale of an on-prem license. A subscription agreement means Tyler recognizes revenues ratably over the life of a contract.

During this transition period, Tyler has also been paying for duplicate costs and one-time expenses. They are optimizing software for the cloud and supporting multiple versions of the same software. However, as Tyler's transition progresses, these costs will decline and the boost to long-term profitability will be significant. Tyler’s management has stated 2023 will be an inflection point for the company. They estimate the adjusted operating margins4 of Tyler will begin to increase in 2024 at a rate of ½% to a full 1% per year. Based on Tyler’s proxy statement, Andvari thinks management might be sandbagging with these estimates.

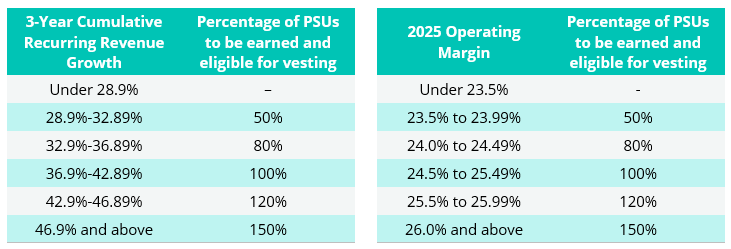

For 2023, the Compensation Committee of Tyler’s board of directors approved grants of long-term, performance-based stock units (PSUs) to the CEO. The total target value of awards is divided into two equal parts, with 50% of PSUs granted subject to 3-year cumulative recurring revenue growth performance and the other 50% subject to operating margin performance. If Tyler’s CEO achieves maximum targets of two financial metrics, he stands to earn upwards of $6.5 million worth of Tyler shares. The following tables set forth the criteria that must be met for 2023 PSUs to be earned and eligible for vesting.

For 2022, recurring revenues were $1.47 billion (out of a total of $1.85 billion). Tyler’s adjusted operating margins for 2022 were 23.6% versus 28.0% in 2017. For the CEO to earn 100% of PSUs, the cumulative recurring revenue growth would need to be at least 36.9% and operating margins would need to reach 24.5%. Given that most boards give executives achievable goals, Andvari believes Tyler’s CEO will likely earn 100% or more of the PSUs. This in turn will mean excellent financial performance that hopefully translates into good returns for shareholders.

If we assume recurring revenue growth of 40% as the base case, by 2025 recurring revenues will have grown to $2.06 billion. We’ll also assume non-recurring revenues grew at a slower pace, a cumulative 30%, to $494 million. This would bring total revenues to $2.55 billion. Then, multiplying the revenues by a 25% adjusted operating margin (they had these margins in 2021), this gets us $638 million in adjusted operating profits for 2025 versus $437 million for 2022. Assuming the multiple the market puts on Tyler’s revenue or adjusted profits remains the same, this would potentially produce annualized returns for shareholders in the range of 11% to 15%.

ANDVARI TAKEAWAY

As we finish writing this letter, Andvari will have served its first set of clients for ten years. We personally will have been in the investment profession for over 13 years. Our goal since the beginning has been to achieve above average performance, net of our fees, over the long term. Our method towards this goal is through a concentrated portfolio of high-quality businesses purchased at sensible prices. After a valuation reset during 2022, we are excited to see how our portfolio of companies will grow over the coming years.

As always, I love to hear from clients and anyone else. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

Further Reading

- Andvari wrote about Tyler Technologies in its Q1 2022 letter, as well as Constellation Software and Topicus.com.

- Speaking of Constellation, here is a blog we wrote in 2020 about Constellation's "permanent home" advantage.

DISCLOSURES AND END NOTES

* Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees—assumed to be 1.25% per annum, paid quarterly, as currently advertised—net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The index ETFs are listed as benchmarks and are total return figures and assumes dividends are reinvested. The S&P 500 ETF (SPY) is an exchange traded fund based on the S&P 500 index, which is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The Russell 2000 ETF is an exchange traded fund based on the Russell 2000 Index, which is an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal. Investment strategies managed by Andvari Associates LLC may have a position in the securities or assets discussed in this article. Securities mentioned may not be representative of the Andvari's current or future investments. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.

- These bullet points are taken nearly verbatim from JPMorgan’s most recent 10-K filing.[↩]

- The proxy statement is an important document that allows shareholders to make informed decisions about the matters to be voted on at the annual meeting of a company. Among other things, it also contains information about executive compensation.[↩]

- “On-prem” is the abbreviation for on-premises software, which is software that is installed and runs on computers on the premises of the organization using the software, rather than at a remote facility.[↩]

- Tyler’s adjusted operating margins starts with operating profits and adds back one-time expenses and other non-cash items. The two largest expenses added back are amortization expenses and share-based compensation (i.e., stock given to employees).[↩]