What We Look For

We seek a comprehensive understanding of the strategy, the people, and the culture of a business before we invest a penny.

Our research process is designed to isolate high-quality businesses. We seek out:

Exceptional businesses with tangible pathways to growth.

Well-aligned management teams and strong corporate cultures.

Companies which can continuously invest capital at high rates of return.

Learn more

The Andvari investment strategy is low cost, tax-efficient, and long-term oriented.

Stay up to date

Read our recent commentary, published papers, and press about Andvari Associates.

Andvari's

Performance

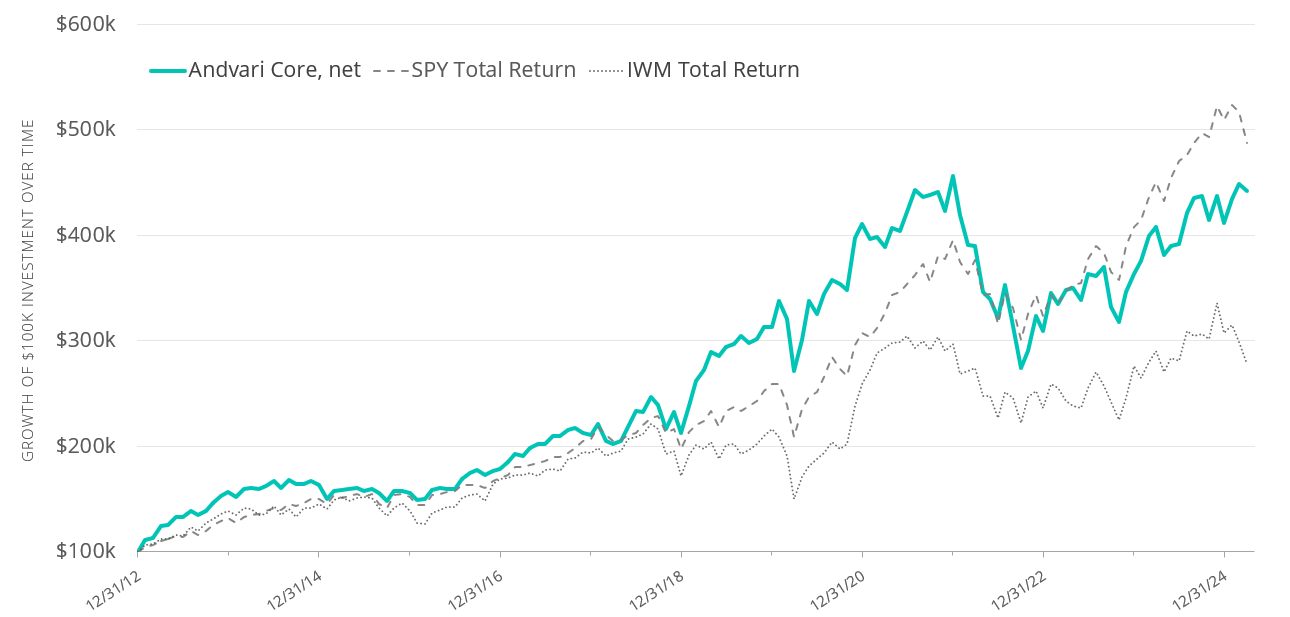

Since the firm's launch in 2013, our consolidated 'Andvari Core' strategy outperformed the SPY ETF until the end of 2021, net of fees. Andvari Core has meaningfully outperformed the IWM ETF since inception, net of fees.

DISCLAIMER: Data as of June 30, 2023. Andvari’s Core strategy represents actual trading performance of actual fee-paying clients beginning on 4/12/13, managed under the primary Andvari investment strategy. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance pursuant to the Core Strategy, including the initial proprietary period, are net of assumed and currently advertised management fees (1.25% per annum paid quarterly), net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Past performance is not indicative of future results and is no guarantee of future results. Actual client results may differ from the composite results depicted above. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential of complete loss of principal. The exchange traded funds (ETFs) are listed as benchmarks and are total return figures and assumes dividends are reinvested. The SPY ETF is based on the S&P 500 Index, which is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The IWM ETF is based on the Russell 2000 Index, an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. The Core Strategy engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage. Because Andvari is non-diversified, the performance of each holding will have a greater impact on Andvari’s results and may make them more volatile than a more diversified index.

©Andvari Associates 2021

All Rights Reserved