Below is our latest letter to clients. During the past quarter, Andvari unfortunately underperformed the S&P 500. We also introduce Topicus.com, a spin-out from Constellation Software.

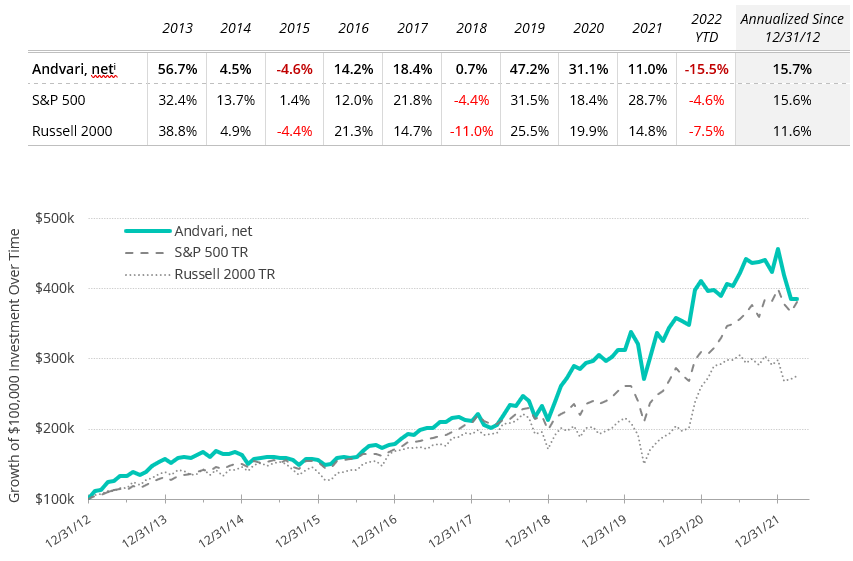

For the first quarter of 2022 Andvari was down 15.5% net of fees while the S&P 500 was down 4.6%. Andvari clients, please refer to your reports for your specific performance and holdings. The table below shows Andvari’s composite performance against two benchmarks while the chart shows the cumulative gains of $100,000 investments.

ANDVARI HOLDINGS

With the exception of Visa and Mastercard, all of Andvari’s holdings underperformed a market that declined 4.6% this past quarter. The decline is due to the Federal Reserve signaling a strong desire to raise interest rates to combat 8%+ inflation. All else equal, higher rates depresses the values of all assets. The assets most impacted by higher rates are companies with fast growth rates, high returns, or very high shareholder expectations. Most of the companies in Andvari’s portfolio have one or several of these qualities. We’ve thus had poor performance relative to the market.

For example, Tyler Technologies is a software company focused on the state and local government vertical. The company has grown revenues over the last decade at a 17.8% annualized rate. Operating margins have ranged from 18% to 23% and can go much higher. The market has recognized the quality of Tyler’s business by putting an extremely high multiple on what it is likely to earn over the next year. Tyler traded at 48x EBITDA at the beginning of the year. It now trades at 37x EBITDA. Tyler’s share price went down 17.3% in the quarter versus the market being down 4.6%.

CONSTELLATION SOFTWARE AND TOPICUS.COM

Constellation Software (a long-time Andvari holding) recently spun out one of its operating groups. The spin-out is Topicus.com, formerly known as TSS. TSS is based in the Netherlands and Constellation acquired it in 2014. Under Constellation, TSS in turn has acquired over one hundred vertical market software (VMS) companies. TSS’s largest acquisition was another Dutch company, Topicus.com, in 2020. A condition of that deal was for TSS to adopt the Topicus name and for the combined group to be spun out as a separate public company.

With the share price of Topicus declining over 40% since October 2021, Andvari has turned it into a substantial position. We like Topicus for the same reasons Constellation originally attracted us.

Skin in the Game

Mark Leonard started Constellation in 1995 and owns nearly 7% of the company. Leonard’s shares are worth about $2.4 billion right now. The founder of TSS is Robin van Poelje who is now the CEO and Chairman of Topicus. Robin and other managers own nearly 40% of Topicus, Constellation owns 30%, and public shareholders own the remaining 30%. Management at these companies are well-aligned to create long-term value for themselves and other shareholders.

The Advantage of Being a Permanent Home

Similar to Warren Buffett at Berkshire Hathaway, Constellation and Topicus pitch themselves as the permanent homes for people who want to sell their business. However, in the case of Constellation and Topicus, they are only acquiring VMS companies that serve niche markets.

In exchange for the promise to be a permanent home, Constellation and Topicus can pay lower prices for businesses. Private equity buyers that flips a company to another buyer 5–7 years down can pay a business founder more, but then they must cut costs, fire employees, and take on debt to achieve their return targets. We are impressed that Constellation and Topicus have achieved returns on acquisitions of >20% on average and they’ve done it without employing private equity tactics.

The Advantage of Data and Experience

Constellation and its operating groups have acquired hundreds of software businesses over the last two decades. This data and experience gives them an enormous advantage when looking at any potential acquisition and the appropriate price to pay. They also share this data and best practices with the leaders of the acquired business to help them maximize growth and profits.

VMS Businesses Are Inherently Attractive

VMS Businesses have many important qualitative features that lead to attractive financials. Here are a few:

- The threat of new competition from a large company is low. The size of the addressable market for software that addresses the unique needs of horticultural nurseries is tiny compared to the market for enterprise software. It’s not worth the time for software giants like Oracle and SAP to compete in tiny markets.

- VMS businesses require a high degree of customer intimacy. This intimacy is required for the VMS to create a piece of software that addresses the unique needs of the user. This requirement of detailed knowledge of a small, niche market is another form of protection against new competition.

- Constellation and Topicus seek to acquire VMS businesses whose products are essential to the everyday operation of their customers. The switching costs for the customers are high. Sometimes there are no other software choices. This gives Constellation and Topicus pricing power.

- Finally, as Mark Leonard has written, “For an annual cost that rarely exceeds 1% of a customers’ revenues, our products help them run their businesses efficiently, adopt their industry’s best practices, and adapt to changing times.” Because their software is a low cost relative to revenues, this again gives Constellation and Topicus pricing power.

The aforementioned qualities all lead to an attractive financial profile. Revenues are extremely predictable and come primarily in the form of software licenses and maintenance contracts. Margins and returns are high given the low incremental cost to sell the same software to another customer. Growth can be achieved with little or no capital expenditures. Finally Constellation and Topicus serve an enormously diverse set of customers across all industries. The misfortunes of one or several customers will not have a large impact.

Topicus still has a vast opportunity to apply the Constellation playbook in Europe. There are hundreds of VMS businesses in Europe that Topicus can acquire over time. The original TSS had revenues of €174 million in 2012. If Topicus earns revenues of over €900 million in 2022, they will have achieved an annual growth rate of about 18%. Andvari believes Topicus can maintain a mid-teens growth rate for the next decade. This will come from low to mid-single digit organic growth and the rest from acquisitions.

ANDVARI PARTNERS LP

In August 2021 we launched our first investment fund, Andvari Partners LP. For more information please contact us at info@andvariassociates.com.

ANDVARI TAKEAWAY

Despite most of our holdings being down in the first quarter, and down some more in April, these are still strong businesses. Short-term declines in share price do not necessarily equate to declines in business quality. Our holdings have excellent management teams striving every day to increase the value of their businesses over the long term.

As always, I love to hear from clients and interested parties about anything on your mind. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

DISCLOSURES AND END NOTES

[i] Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees (assumed to be 1.25% per annum, paid quarterly, as currently advertised), net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The indexes are listed as benchmarks and are total return figures and assumes dividends are reinvested. The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The Russell 2000 Index is an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal. Investment strategies managed by Andvari Associates LLC may have a position in the securities or assets discussed in this article. Securities mentioned may not be representative of the Andvari's current or future investments. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.