EverArc Holdings, the special purpose acquisition company (SPAC) co-chaired by Nick Howley and Will Thorndike, announced last month it will acquire Perimeter Solutions for $2 billion. Howley founded and led TransDigm, a company which has delivered a >35% IRR since 1993. Thorndike, aside from being the well-known author of The Outsiders, is a founding partner of successful private equity firm Housatonic Partners.

As they write, Perimeter is a "leading global manufacturer of high-quality firefighting products and lubricant additives." Given the success of both Howley and Thorndike in their respective careers, and the acquisition criteria they laid out, Andvari believes EverArc found a quality business.

EverArc Acquisition Criteria

EverArc laid out five criteria they wanted in a business:

- Recurring and predictable revenue streams

- Long-term secular growth tailwinds

- Products or services that account for critical but small portions of larger value streams

- Significant free cash flow generation with high returns on tangible capital

- Businesses in industries with potential for opportunistic consolidation

It's hard not to think a business that meets all these criteria would not be the epitome of a great business. Andvari has written about several of these criteria in the past. Flavor and fragrance makers like Robertet Groupe and McCormick are examples of businesses with products that account for critical but small portions of larger value streams. MSA Safety ("A Picks-and-Shovels 100-Bagger") falls into this category as well and also sells products that protect the lives of people like Perimeter. Constellation Software and HEICO are good examples of companies with significant free cash flows operating in industries with high potential for consolidation.

Revenues: Growing and Recurring

Andvari believes Perimeter and its Fire Safety segment (which accounts for 80% of total EBITDA) meets EverArc's criteria. Fire Safety revenues are recurring and predictable and the segment has secular growth tailwinds. The following charts are from a recent webinar presentation by Perimeter's CEO Eddie Goldberg.

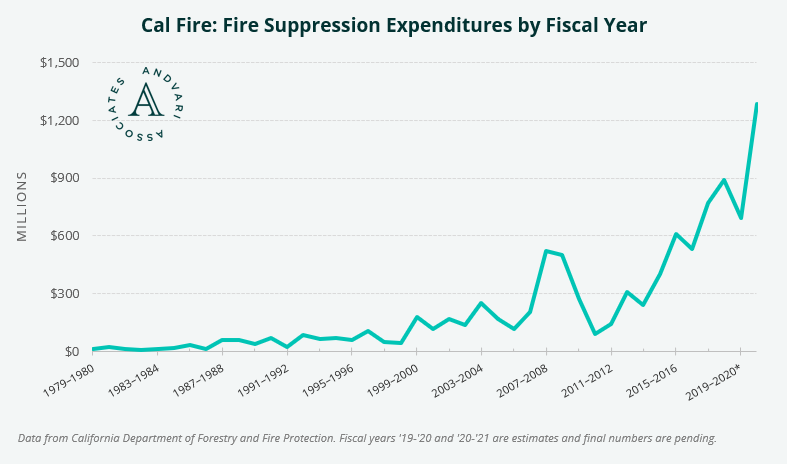

Spending to suppress forest fires has steadily increased over the decades. Acres per fire has steadily increased. The length of the fire season has also increased over time. Andvari then looked at data from California Dep't of Forestry and Fire Protection ("Cal Fire"), a state that has been plagued with costly fires in the last several years. Fire suppression expenditures in California have increased over a hundredfold in the last 40 years.

Small, But Critical Component

With the federal government regularly spending over $1.5 billion a year on suppressing fires, Fire Safety's retardant products are a small but critical component to these efforts. EverArc writes that fire retardant "consistently represents only approximately 2–3% of suppression costs in the US." This feature should allow the Fire Safety segment to operate with above average margins and a greater ability to raise prices.

Attractive Financials

Lo and behold, Perimeter indeed has extremely attractive financials. EBITDA margins are in the 40% range. Capital expenditures as a percent of revenue is ~2%. Even more interesting is EverArc's statement that Perimeter’s products enable value-based pricing. This means Perimeter can price its products based on the economic value it offers to the customer and not just the cost of the product. Nick Howley's TransDigm has expertly used value-based pricing as a way to continually raise prices on the thousands of different aerospace parts they sell to their customers.

Extensive Qualification of Products

Also similar to TransDigm, whose parts must undergo extensive testing and qualification by the Federal Aviation Administration, Perimeter's Fire Safety products must also undergo "extensive performance, safety and environmental testing." The Wildland Fire Chemicals Test Procedures section of the Forest Service website has a very long list of the tests that must be performed. Only after a fire chemical has successfully completed all the required tests will it gain listing on the Forest Service Qualified Products List (QPL). A chemical’s presence on the QPL is what allows federal agencies, states, and others to purchase it. This constitutes an effective barrier to entry for would-be competitors.

Potential for Consolidation?

Andvari does not have a great sense if there is an opportunity to consolidate parts of the fire suppression industry. Whether the industry is fragmented is a question a potential investor will have to answer through their own efforts. However, a good place to start would be looking at the QPLs of the Forest Service.

For example, in the category of long-term retardants, there are only two companies that have qualified. One is Perimeter's Phos-Chek brand and the other is Fortress's product. In fact, Fortress touts that its product is "the only new entrant in over two decades to achieve placement on the USFS Qualified Products List (QPL)." For Perimeter to have such a long-held position in this product category is a strong signal of business quality. However, this might not leave room for consolidation opportunities.

On the other hand, the QPLs for Class A Foams and Water Enhancers have a longer list of products that compete with Perimeter's products. There might be consolidation opportunities in these two categories. There might also be opportunities for Perimeter to acquire makers of equipment used to store, transport, and disperse firefighting foams.

Andvari Takeaway

Perimeter checks off many boxes in terms of business quality. Its products are small, yet critical parts to the end product or service. It has secular growth winds at its back. The financials of the business are excellent. Finally, we believe Co-Chairmen Howley and Thorndike will be excellent stewards of capital. Whenever Perimeter becomes publicly listed in the U.S., Andvari believes it is a company worthy of addition to any investor’s watch list.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. Andvari clients do not have currently have positions in EverArc Holdings or Perimeter Solutions. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC