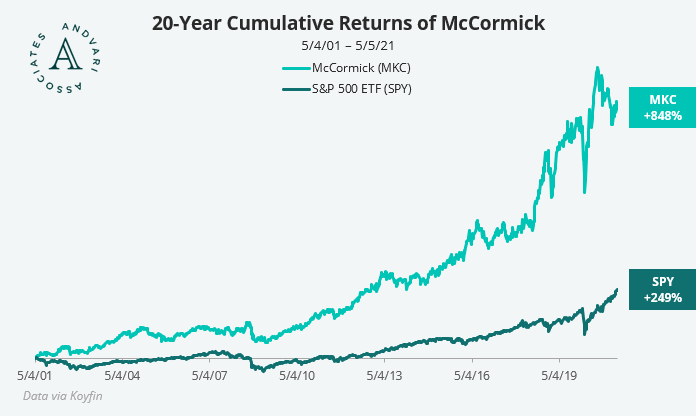

McCormick, the seasoning and spice company, is an outstanding business with several of the qualitative traits we seek. Spices are a small, but essential part of end products that consumers often grow to love. It has dominant positions in its markets and its CEO is highly aligned with shareholders. The combination of these traits have enabled McCormick shareholders to outperform the S&P 500 over the long term.

SMALL AND ESSENTIAL

According to McCormick, spices are typically 10% or less of the cost of a meal, yet provide 90% of the flavor and satisfaction. Andvari has written about this concept before in “Robertet Groupe: Accounting for Good Taste”. Being a small part of the total cost while also being an essential component gives a company pricing power. This allows the company to more easily raise prices over time, an especially important quality in times of inflation.

MARKET DOMINANCE

Further, the majority of their products and brands are #1 in their respective categories. Market dominance generally leads to higher margins and more stable revenues due to less intense competition. Andvari likes to see this in all companies.

Dominance of McCormick’s type can often come with the price of increased scrutiny from the Federal Trade Commission (FTC). This can be both a good and bad thing. Good because it’s a high-value indicator of a company’s strength but bad because the company may be forced to divest assets to restore market competition (see “The Fertile Ground of Forced Divestitures”).

RELIABLE SIGNALS OF STRENGTH

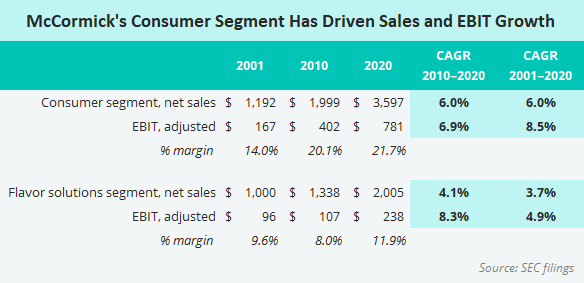

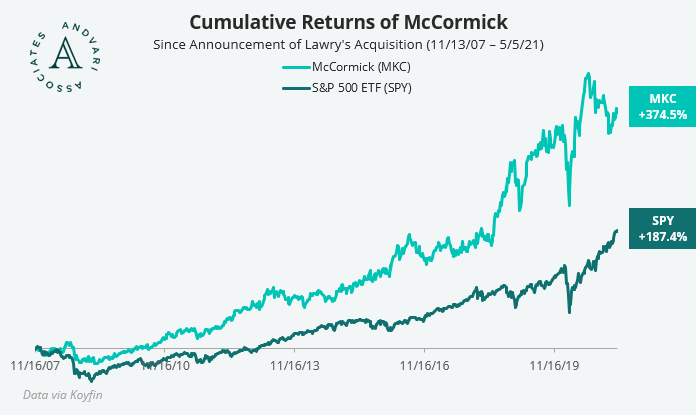

In the case of McCormick’s proposed $605 million acquisition of Lawry’s and Adolph’s consumer brands in 2007, the FTC alleged McCormick would control 80% of the $100 million U.S. market for branded seasoned salt. To complete the deal, McCormick had to (1) sell it’s Season-All business to Morton and (2) abstain from acquiring another seasoned salt brand for 10 years. Despite the divestiture and 10-year ban, McCormick’s share price continued to produce savoury returns with its consumer segment leading the charge.

VALUE-CREATIVE M&A IN A HIGHLY FRAGMENTED MARKET

McCormick has created value through an effective M&A program. It has acquired dozens of brands and products in the flavors, spices, and condiment categories. It has stuck to acquiring businesses it knows well, one of the key reasons why it's M&A efforts have succeeded (see “M&A Wisdom from the U.K.”).

Despite a robust M&A program, McCormick still only has a 20% market share. A highly fragmented market like this gives a company a very long runway for both organic and inorganic growth. As of 2017, the company’s SVP of Corporate Strategy & Development said they had a list of 1,000 assets it could potentially acquire under the right conditions. Significant opportunities for growth reinvestment are two other qualitative factors Andvari likes to see.

ALIGNED CEO

Finally, McCormick’s current CEO is Lawrence Kurzius. He was CEO and President of Zatarain’s for 12 years when McCormick bought the company in 2003. Since then, Kurzius steadily acquired and retained McCormick shares as he climbed through the ranks of leadership.

In 2016 Kurzius took over as CEO of the entire company and now owns 5.8% of McCormick’s voting class of shares. These shares are worth roughly $100 million. Kurzius has skin in the game, has an excellent track record, and it's highly likely he will continue to maximize his and shareholders’ wealth over the long run.

ANDVARI TAKEAWAY

Whether a company sells spices, software, or rents out space on cell towers, Andvari always seeks out the qualitative factors that increase the likelihood of earning above-average returns over the long run. We like to see a company selling a highly valuable product that’s just a small part of the customer’s total cost. We like market dominance, value-creating M&A, and consolidation of fragmented markets. We like highly aligned CEOs. In the case of McCormick, the returns to shareholders from this recipe have been extremely satisfying.

-

_________

--

-

_________

-

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. Andvari may re-evaluate its holdings in such positions and sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC