David Barber is the co-founder and now retired CEO of Halma plc. For the 20 year period preceding David’s 1997 speech on delivering shareholder value, Halma shares had returned 22.5% per annum.

In his speech, Barber described the reasons behind the success of Halma. Although there are several, Andvari focuses on the criteria Halma used in its highly effective M&A program. When nearly everyone agrees most acquisitions destroy value, we can learn much by studying a company with a track record of creating value through M&A (see our prior post, “The ‘Permanent Home’ Advantage”, on the same topic).

Barber’s guidance can be boiled down to four, key recommendations:

#1: USE INTERNALLY GENERATED FUNDS

Barber says the first factor that will improve the odds of an acquisition creating value is whether one funds the deal with surplus cash or by issuing shares. The idea here is if the acquired company was purchased at a fair price and performs well, the value creation will be greater if shareholders weren’t diluted in the process. Simple and logical.

#2: FIND A REPLICA

Next is whether the acquisition target is a “replica” of one already owned by the purchaser. Anyone selling a business likely has more information than the buyer. The owner also wouldn’t be selling unless they thought they could get the better end of the deal. Thus, to reduce the risk stemming from a disparity in information, the buyer should be as much or even more of an expert in the field of the seller. The buyer of businesses should therefore be looking to purchase other businesses that are replicas of the ones they already own.

#3: PURSUE BOLT-ONS

The third way to reduce M&A risk is by seeking to acquire “bolt-ons”. Barber defines a bolt-on company as one that “when purchased can then be readily integrated into an existing Group company.” This necessarily means the target will be of a smaller size, which also usually means lower complexity, both of which increase the odds of generating value.

#4: DO NOT SACRIFICE EARNINGS QUALITY

The last predictor of value creating M&A is if the acquired company will improve the quantity and quality of earnings. From Barber’s perspective, “quality of earnings is paramount” and “you can never pay enough for a good acquisition and never pay too little for a bad one.”

ANDVARI TAKEAWAY

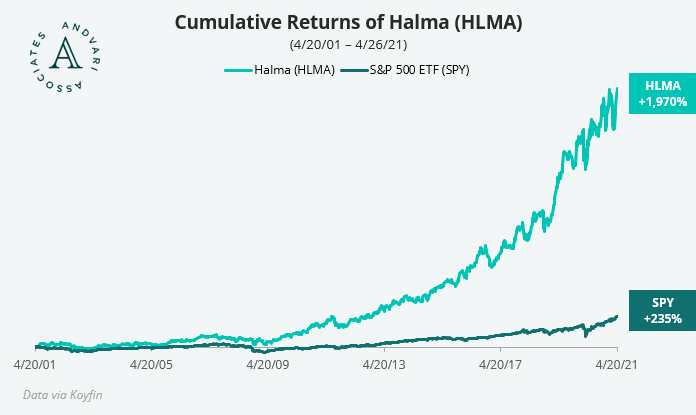

Thanks to the combination of sensible M&A criteria and a focus on quality, niche businesses with high returns on capital, Halma provided extraordinary returns to its shareholders. Furthermore, thanks to Barber cementing the strategy and culture into the business, shareholders have enjoyed great results even after his retirement in 2003.

A great deal of M&A is value destructive, but not always. Companies with excellent management and sensible M&A programs have beaten the odds. HEICO, Constellation Software, Roper, Danaher, Ametek, Teledyne, and Waste Connections are just a few examples of other companies that have similarly successful M&A programs. High-performing, serial acquirers that can compound returns for decades are exactly the sort of companies for which Andvari is continually on the hunt.

Further Reading

- David Barber’s 1997 speech on delivering shareholder value

- Halma plc Investor Relations website

- “Do Shareholders of Acquiring Firms Gain From Acquisitions?”

- “Do M&A Deals Create or Destroy Value? A Meta-Analysis”

-

_________

--

-

_________

-

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. Andvari may re-evaluate its holdings in such positions and sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC