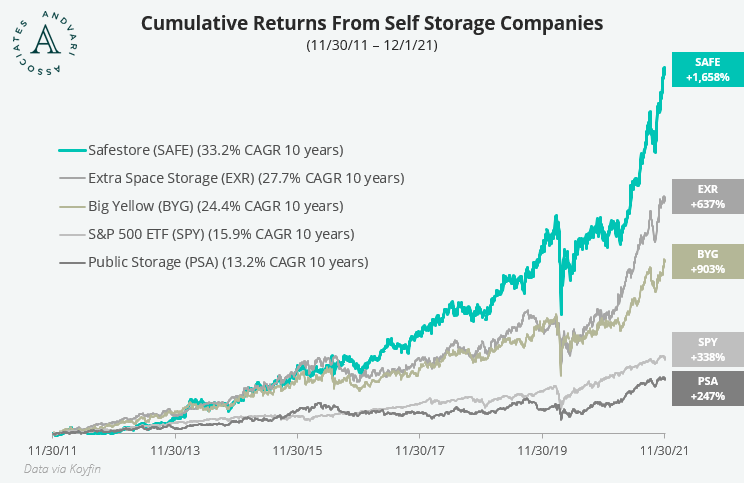

Self storage companies have been some of the best-performing real estate companies over the last decade. UK-based Safestore particularly stands out. Spurred by a recent In Practise interview, Andvari delved deeper into Safestore and discovered it exhibits many of the features for which Andvari looks in a high quality business.

LONG-TERM GROWTH TAILWINDS

Safestore was founded in 1998 with just a handful of locations and has grown to be the largest self storage company in the UK. Safestore has 126 wholly owned sites followed by Big Yellow with 75 wholly owned stores. Safestore has also ventured into Europe in the last few years.

With Safestore, there’s still opportunity to grow the business. The company will continue to consolidate a highly fragmented market and will continue to grow organically. In terms of fragmentation, there are roughly 1,900 storage sites in the UK. However, the six largest operators own just 352 of these, barely 20% of the total UK market.

In terms of organic growth, there remains a huge opportunity for the self storage industry to continue growing in the UK and Europe. First, according to Dave Davies, a former Operations Director at Safestore (see the In Practise interview), the UK has 0.7 square feet of self storage per capita compared to nearly 10 square feet in the US, 1.9 in Australia, and only 0.2 throughout Europe. Second, surveys indicate that roughly half of consumers in the UK either knew nothing about the service offered by self storage operators or had not heard of self storage at all.

PREDICTABLE REVENUES, RECESSION RESISTANT

Although customer churn is high at 100% to 120% per year (meaning Safestore must replace all its customers every year), revenues are still steady and predictable. For example, customers that existed prior to the start of 2020 contributed 70% to 80% of Safestore’s 2020 revenues.

Andvari also likes that the self storage business is recession resistant. Births, marriages, deaths, divorces, and downsizing happen regardless of the economy. All these life events drive the need for storage space. (See also Andvari’s blogs on other recession resistant businesses like Chemed's Roto-Rooter and Water Intelligence).

COMPETITIVE MOAT

The self storage industry cannot be disrupted by tech companies. If you need physical space to store physical items, a self storage company is the only option outside of moving into a larger home or office. Another barrier to entry that is specific to Safestore is that the majority of its revenues come from its locations in London and Paris. Both are densely populated areas where land is scarce and land values are high. This means extremely limited availability for new sites. Safestore also enjoys the protections of city planning regulations as well as laws that strongly favor the rights of leaseholders.

LOW CAPEX REQUIREMENTS

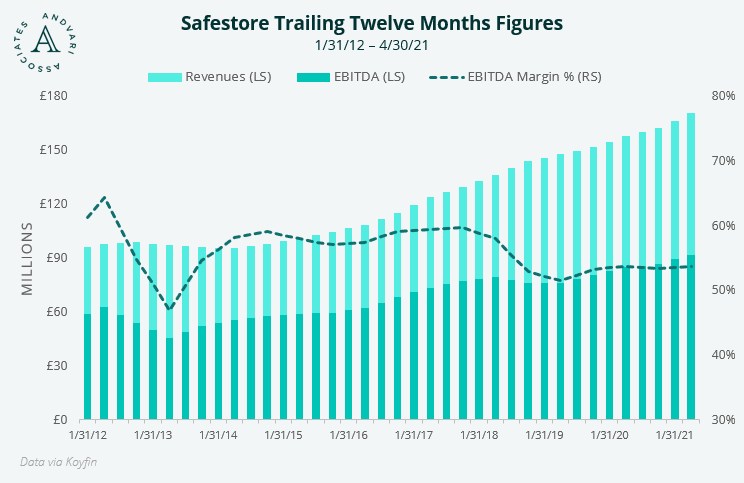

Capital expenditures to maintain Safestore’s current business are small relative to total revenues at just £7 million on £162 million of revenues. This allows Safestore to allocate generous cash flows towards building or buying new stores. This will in turn provide more fuel for Safestore to buy and build a greater number of stores each year.

ANDVARI TAKEAWAY

Safestore’s qualitative features combine to create a high margin, resilient business with a high probability of many decades of growth left ahead of it. Andvari believes Safestore and its peers are worthy of addition to our investment watch list.

_________

Further Reading

- In Practise interview of Former Operations Director at Safestore Holdings

- Safestore Investor Relations

- Big Yellow Self Storage Investor Relations

- Extra Space Storage Investor Relations

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had no position in Safestore or Water Intelligence. Andvari clients do have a position in Chemed. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC