Imagine a company. It's not based in or anywhere near Silicon Valley. It's enterprise value is $7.5 billion and has revenues of $2 billion. It doesn't have a sexy, fast-growing tech business. It clears drain pipes and provides hospice care. Yet the shares of this company have achieved "tech-like" returns over the last decade.

Chemed, the owner of Roto-Rooter and hospice care provider VITAS, has many qualities that Andvari finds attractive in an investment. The main four are:

- Being in steady, recession-resistant service businesses that require little capital;

- Being a large player in markets that are still highly fragmented and populated with "mom-and-pop" competitors;

- Excellent capital allocation; and

- A long-tenured management team that is in alignment with shareholders.

ROTO-ROOTER AND VITAS

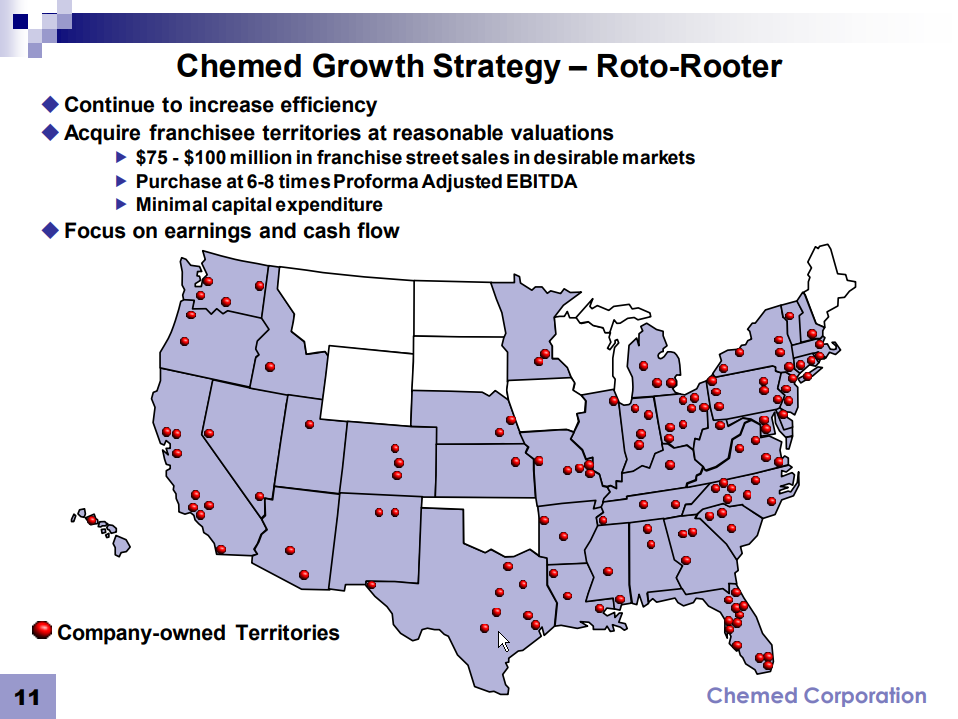

Roto-Rooter is the largest provider of plumbing and drain cleaning services in North America. It has a presence in 127 company-owned territories and 369 franchise territories. EBITDA margins are in the mid-20s. VITAS Healthcare is the largest hospice services in the U.S. with a presence in 14 states and the District of Columbia. EBITDA margins for VITAS are in the high teens.

Both VITAS and Roto-Rooter have grown annual revenues in the 5–6% range for many years. Both require little capital expenditures—capex as a percent of revenues has ranged between 2–3%. Both are recession resistant. The state of the economy has no bearing on the decision of anyone with a plumbing emergency or anyone with a terminal illness who needs or desires hospice care.

From Andvari's perspective, steadily growing, and recession-resistant businesses are great qualities to have in an investment. These businesses ought to deserve a premium valuation due to their greater ability to make it through an economic downturn and little need for capital to continue growing.

LARGEST PLAYER IN HIGHLY FRAGMENTED MARKETS

Roto-Rooter and VITAS are each the largest players in highly fragmented markets. Roto-Rooter has an estimated 15% of the drain clearing market and a 2–3% share of the same day service plumbing market. VITAS has about a 7% share of the U.S. hospice market. This positioning allows both ample opportunity to grow organically and by acquisition for decades to come.

Furthermore, because Roto-Rooter and VITAS have greater scale, and the competition for both are coming from "mom-and-pop" organizations operating on thinner margins, both can spend more on branding, advertising, training, and offering new services. This gives both Chemed companies a solid advantage over their competitors.

A HISTORY OF CAPITAL ALLOCATION

Another quality for which Andvari always looks is a management team skilled at capital allocation. The first proof of Chemed's seriousness about capital allocation comes straight from its 2020 form 10-K (emphasis Andvari's): "Chemed purchases, operates and divests subsidiaries engaged in diverse business activities for the purposes of maximizing shareholder value. The Company's day to day operating businesses are managed on a decentralized basis."

In Andvari's words, Chemed views itself as a pure allocator of capital seeking to maximize long-term shareholder value. Furthermore, Chemed's head office does not meddle too much in how its subsidiaries run their respective businesses. Both qualities—excellent capital allocation and decentralized operations—could make Chemed a good candidate for a second Outsiders book.

More proof of Chemed's dedication to maximizing shareholder value is evident from the extraordinary action it took in 1999. The company announced they'd be cutting their dividend from a quarterly $0.265 per share to $0.05 per share. The dividend yield on their shares went from over 7% to 1.4%.

The reason for the dividend cut was to have more resources for internal growth and acquiring more Roto-Rooter franchises. Companies rarely cut their dividend. When they do it's usually forced upon them by awful capital allocation decisions from prior years. A company with the fortitude to make an unforced decision that is unpopular in the short-term, yet could ultimately create more value in the long-term, will always be worth Andvari's time to investigate.

ALIGNED AND LONG-TENURED MANAGEMENT

Chemed has a management team with long tenures and who are aligned with Chemed shareholders. Importantly, Chemed executives have significant personal wealth tied to the long-term performance of the company. Yet another important quality for which Andvari always looks.

- Kevin McNamara has been with Chemed since 1986. He has served as President since 1994 and CEO since 2001. He is a beneficial owner of shares worth over $93 million.

- David Williams has been with Chemed since 1990. He has served as CFO since 2004. He is a beneficial owner of shares worth over $43 million.

For long-term compensation, management is compensated based on a combination of: 3-year adjusted earnings per share growth and 3-year total shareholder return as compared against their peer group. This incentive plan combined with management’s already significant shareholdings means that management is well-aligned with all other Chemed shareholders (see also Andvari's "Quick Guide to Executive Comp").

HISTORICAL FINANCIAL RESULTS

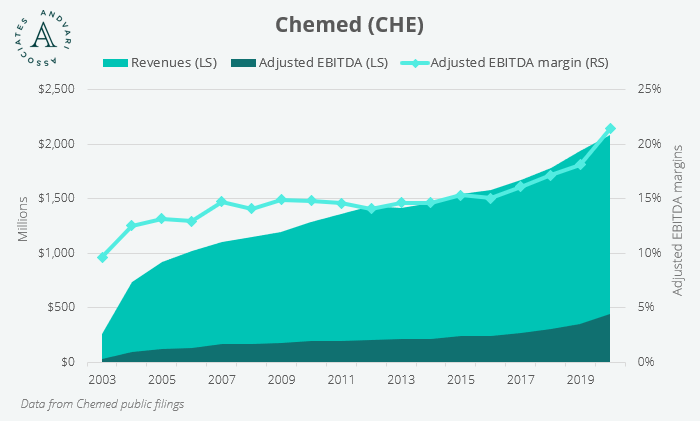

Chemed's intangible qualities have coalesced into the production of excellent financial results. The chart below shows steady growth of revenues and adjusted EBITDA.

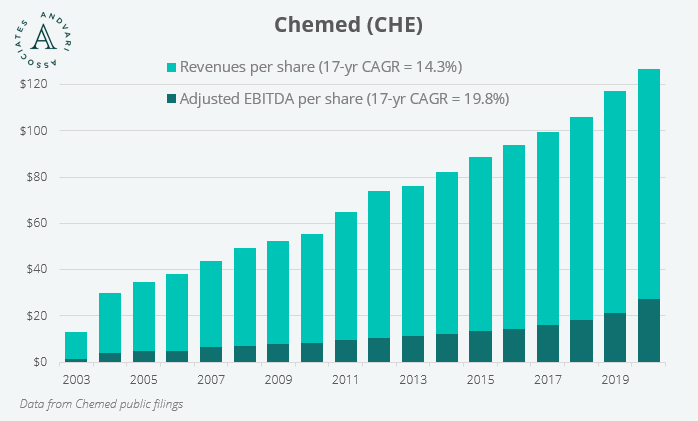

The next chart shows growth of revenues and adjusted EBITDA on a per share basis since Chemed's acquisition of VITAS (acquired February 2004). Given Chemed's large and continuing share repurchases, adjusted EBITDA per share has grown at an annualized rate of nearly 20% since 2003.

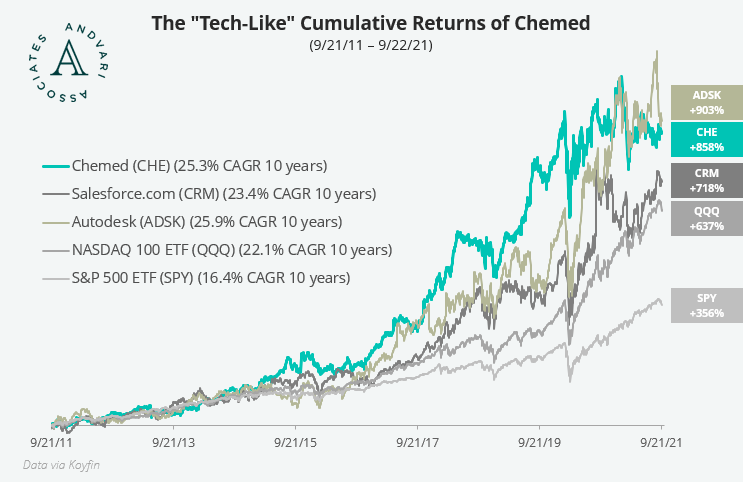

Finally, Chemed shareholders have enjoyed exceptional cumulative performance over the last 10 years. Chemed has outperformed the S&P 500 and NASDAQ 100 indices. The company has also kept up with or outperformed several other tech and software businesses (like Salesforce and Autodesk) that are all wonderful in their own right.

ANDVARI TAKEAWAY

A decidedly non-tech business with annual revenues growing at "just" a 5–6% pace can still outperform an index of tech stocks. A combination of important qualitative factors are the necessary ingredients for success. Chemed's two service businesses will always be in demand regardless of the economy. Roto-Rooter and VITAS have low capital requirements. Both businesses are the largest in highly fragmented markets which gives them the opportunity to gain more scale through acquisitions. Finally, Chemed's management team are skilled allocators of capital and are well aligned with other shareholders given their large holdings of Chemed shares.

Chemed fits squarely within the framework of Andvari's qualitative-focused investment process. This unassuming and under-the-radar company is well worth a look for inclusion in any long-term investment portfolio.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had a position in Chemed. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC