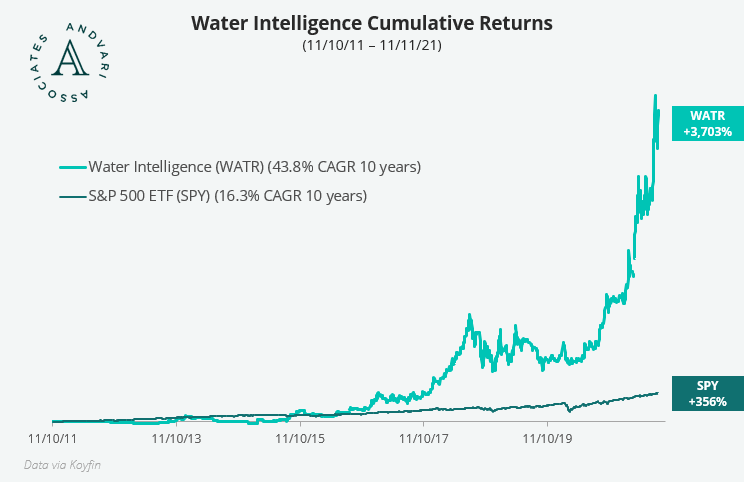

Andvari has found yet another highly profitable and fast-growing services business. The business is Water Intelligence plc. It’s based in London, but it’s core subsidiary, American Leak Detection (“ALD”), does business in the States. ALD is a franchise business and a leader in using technology to pinpoint and repair water leaks without destruction. ALD possesses several attributes of a high quality business. In fact, ALD shares many of the same qualities of Chemed’s Roto-Rooter business (see "How a Boring Service Business Produced Tech-Like Returns"). The qualitative features of the business has led to astounding share price performance: 3,700% cumulative returns over the last decade.

RECESSION-RESISTANT AND HIGH MARGINS

ALD's purpose is to help find and repair water leaks without tearing open walls, ceilings, or floors. Leaks and water damage happen regardless of whether the economy is good or bad. Finding and repairing the leak is something a homeowner must do. Further, because these situations are non-discretionary and somewhat urgent, the consumer is less sensitive to price. This is very similar to the situation of a Roto-Rooter customer. Thus, ALD currently has operating margins in the upper teens and there is still room to increase these margins.

REACQUIRING FRANCHISEES

Over the last decade, ALD has reacquired the operations of its franchisees (also similar to Roto-Rooter). This has unlocked significant value as it transforms indirect royalty income to higher margin direct corporate income. To illustrate, if ALD’s $17.4 million of revenues (as of 2020) from corporate-operated locations were executed by franchisees, ALD would only receive $0.27 million of pre-tax profit instead of $3.8 million. Although ALD certainly seeks to grow the number of franchisees, the selective reacquisition of these franchises to operate them internally has created tremendous value.

MANAGEMENT WITH SKIN IN THE GAME

Patrick DeSouza is the current Executive Chairman of Water Intelligence. He also is the largest shareholder of the company, owning 28.19% of outstanding shares. With the market cap at about $270 million (USD), DeSouza’s shares are worth $76 million. Andvari always appreciates management with a lot of skin in the game. This makes it more likely a manager will invest for the long-term. It also aligns the manager’s interests with all other shareholders. By doing well for himself, DeSouza has done well for all other shareholders.

OPPORTUNITIES FOR CONTINUED GROWTH

There is still a long runway for growth. First, Water Intelligence is still a small business. Reported annual revenues are just now approaching $35 million. However, the gross revenues have passed $140 million million. This gross revenue figure includes the indirect sales by franchisees from which ALD’s franchise royalty income is derived.

Second, as noted in the above paragraph, there is a huge opportunity to reacquire franchisees. There is nearly $100 million of revenues ALD can acquire from which it can earn greater profits.

Finally, Water Intelligence is in the beginning innings of expanding internationally. Although they are starting from a low base, operations in the UK, Australia, and Canada grew at a combined rate of 27% during 2020.

ANDVARI TAKEAWAY

Although Water Intelligence currently trades at a very high multiple of earnings, there are many reasons why it should. It’s a profitable, growing, and recession-resistant service business run by an owner operator with skin in the game. Finally, the corollaries to Chemed’s Roto-Rooter business, or even Rollins with their Orkin pest control business, should give a potential shareholder conviction Water Intelligence deserves to be highly valued. Water Intelligence is a recent, and well-deserved addition to Andvari’s watch list. We look forward to keeping tabs on this company in the years to come.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had no position in Water Intelligence or Rollins. Andvari clients do have a position in Chemed. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC