Two weeks ago Andvari looked at a pair of companies that use live video streams to announce quarterly results, which we view as a potential signal to dig deeper.

This week we extend the theme by looking at a few companies that have taken relevant inspiration from Berkshire Hathaway. We maintain that companies who engage with their shareholders in unique ways likely do so because there is something special about the company, its leadership, or both.

Taking Cues from Omaha

Berkshire is known for having never done live conference calls for quarterly results. Berkshire releases their results on the weekend so all shareholders have time to read and digest them before the market opens. The only time a shareholder has an opportunity to pose a question to Berkshire’s CEO is at the annual shareholders meeting. Even then, Berkshire installed a panel of journalists and business analysts to ask questions rather than field unvetted questions.

In 2013, Netflix loosely followed suit. The company stopped using audio-only conference calls to discuss its quarterly results and to take questions from a gaggle of sell-side analysts. Instead, Netflix created a new format altogether, what they call an “Earnings Interview”. The company invites a single sell-side analyst to query management for 30–40 minutes. This analyst is the same interviewer for 3–4 quarters and then Netflix moves on to a different interviewer.

The reasoning behind the more intimate format is similar to Berkshire’s decision to install a panel of journalists and experts at its annual meeting. Reed Hastings, Netflix Founder and Co-CEO, explains the change to the interview format in 2013:

“We’ve focused on efficient and effective investor communication for a long time.… In terms of the Q&A, we’ve always admired the fireside chat format at investor conferences as being the most dynamic and interesting. This is our attempt to bring that value to the broad, online public.”

Investors on the buy side and the sell side welcomed the new format and it remains in place eight years later.

Eliminating the Quarterly Call

By never hosting a live quarterly conference call, Warren Buffett has more time to focus on the business. The absence of a quarterly call also helps focus investors’ attention on the longer-term.

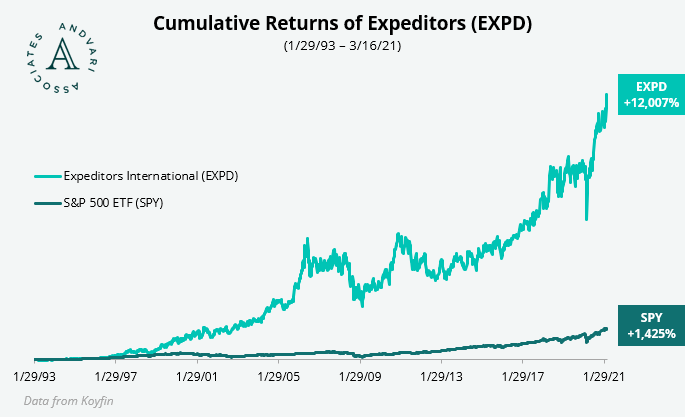

In addition to Netflix, a few others have followed Buffett’s lead. Constellation Software stopped its quarterly calls in 2018 (see our prior writing on Constellation and its “permanent home” advantage). Expeditors International is one company that never had live quarterly calls to begin with and we feel that’s worth exploring.

In the Spirit of Regulation Fair Disclosure (“Reg FD”)

Although Constellation and Expeditors lack a quarterly call, they remain engaged with shareholders. They each have a written Q&A format where they accept questions by e-mail and publish their answers for all to read. By using this format, they operate in the true spirit of Reg FD.

For context, Reg FD is a rule promulgated by the Securities and Exchange Commission since 2000. It provides that “when an issuer discloses material nonpublic information to certain individuals or entities—generally, securities market professionals…—the issuer must also make public disclosure of that information.” The goal of Reg FD is to promote greater fairness in the public markets. Implementation of the rule falls to the underlying entity—so some invariably ‘do it’ better than others.

A More Thoughtful Approach

Expeditors and it’s pugnacious founder Peter Rose have earned a cult following due to their occasionally amusing and scathing answers in their written Q&A format during earnings season. Their commentary on the traditional, sell side-focused conference calls are perfect examples.

On November 15, 2000, the company wrote, “We have listened to enough industry conference calls to decide that we can forego the empty compliments (‘Nice quarter guys’).” In December 2004, Expeditors added, “Conference calls are staged events, and in case you don’t know where we stand, we think they are half past worthless.”

More important is Expeditors’ belief that the written Q&A format “seemed to us to be the only way to put everyone on the same footing.”

"If fair disclosure means letting everybody access information simultaneously, how could this obligation be met in an environment where only professional stock analysts could participate? If the information companies were going to give out was meant to be meaningful, how could spontaneous answers in a conference call always supply thoughtful and factual responses?"

Expeditors form 8-K filed 10/26/04

Finally, similar to Netflix’s belief that their Earnings Interview format produces higher quality answers, Expeditors also believes their chosen format is better than the typical live conference call.

“We think that being able to take a serious question, research the response, write it down, think about it, have a couple of sets of eyes look it over, even have a discussion about the response if need be, is superior to a spontaneous non-answer to a spontaneous almost non-question.”

Expeditors form 8-K filed 12/23/04

Andvari Takeaway

This set of conference call mavericks are notable for their desire to impart high value information to shareholders in the fairest way possible. Most importantly, these unique forms of shareholder engagement demonstrate the character of these mavericks and hopefully reflect the cultures of the businesses they run. As hard as it is to gauge the quality and motivations of leadership, the ways in which they communicate can provide enormous insight.

Further Reading

- Expeditors International, 11/15/2000 8-K

- Expeditors International, 10/26/2004 8-K

- “Seattle Shipper Responds to Street By Putting 'Dis' in Full Disclosure.” The Wall Street Journal, 6 June 2002.

- “Buffett Invites Analysts to Berkshire Annual Meeting.” The Wall Street Journal, 21 Nov 2011.

-

_________

--

-

_________

-

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. Andvari may re-evaluate its holdings in such positions and sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC