We are pleased to share a summary version of a recent research report we compiled on American Tower Corp (AMT), a business that embodies several of the intangible business qualities we seek at Andvari.

Access to the full, 11-page thesis is available through our client/prospective client document portal. If you would like access to the portal or the individual report, please contact Info@AndvariAssociates.com.

Executive Summary

American Tower (AMT) is the largest global owner of wireless towers and related real estate, with a portfolio of >210K of such sites. Roughly 41K of these sites are in the U.S. with the remainder international. This is inclusive of the ~31K international sites AMT is acquiring via the Telxius Towers acquisition announced in January.

AMT is a business with highly predictable and growing revenues. It requires minimal capital expenditures and free cash flow margins are in the upper 40s. A high quality and properly incentivized management team runs the business. Andvari expects American Tower to provide us with annualized returns of at least 13% over the next 5-10 years at current prices.

How the Business Works

AMT owns and leases the tower structure and associated land to wireless operators and other customers (e.g. radio & television broadcast companies). Customers own the equipment physically installed on the towers. These are antennas, related arrays, coaxial cables, etc.

AMT leases space on its towers to customers under long-term, non-cancellable contracts. The initial terms are 5-10 years followed by 5-year renewal periods. Contracts include annual price escalators. In the U.S., price increases have averaged ~3% per year. Internationally, price escalators are typically tied to inflation.

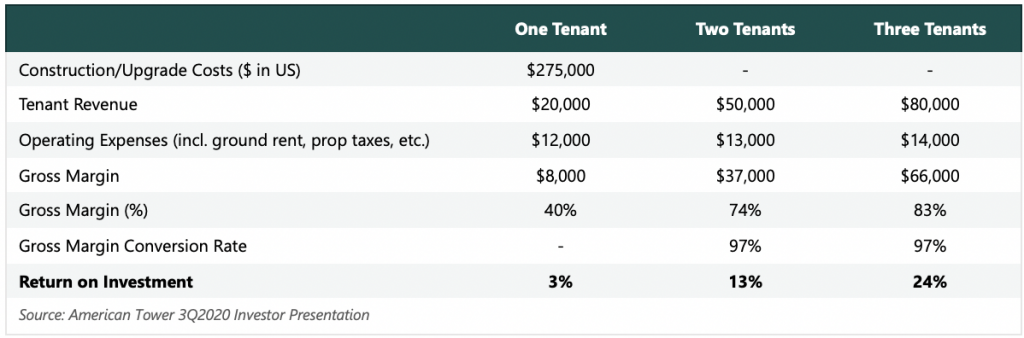

A typical tower can accommodate up to 4 or 5 tenants. From a financial perspective, it is not the initial tenant on a tower that makes the tower leasing model so attractive, but rather the incremental tenants. The unit economics for a single tower are outlined in the following table.

True Economies

The returns on a single-tenant tower are mediocre, but they provide an effective barrier to entry from upstart competition. However, the 2nd/3rd/4th tenants on a tower generate incremental gross margins of nearly 100% because AMT’s operating costs at the tower level are almost entirely fixed.

Key Andvari Attributes

AMT’s business model is one of the most competitively advantaged among publicly traded companies. The company has multiple characteristics, a number of which we have highlighted in past research reports, that make it a high quality and extremely valuable business.

- Tens of Thousands of Local Monopolies - In essence, AMT’s global portfolio of tower sites is a collection of localized geospatial monopolies. Once a tower is sited and developed, it is more cost-effective for a wireless operator to co-locate on that tower rather than to build a new one. Building a new one takes time and money and jumping through hoops of permitting rules and regulations. For perspective, at the end of 2017 (when it was last disclosed), AMT had an average of 1.9 tenants per tower globally after having been in the business since 1995. To say upstart competitors face an uphill battle is an understatement.

- High Switching Costs, Pricing Power, Low Customer Churn - AMT’s offering is mission-critical to their customers’ (AT&T, Verizon, T-Mobile) businesses. Wireless providers differentiate themselves by offering the fastest, most reliable service possible. Doing something like switching their antennas to another tower operator is something the wireless providers would never do as it could result in lower-quality and/or interrupted service—either or both of which can drive Verizon’s customers into the arms of AT&T or T-Mobile. This dynamic gives AMT pricing power and a customer base that churns at <2% annually.

- Minimal CapEx Requirements - Andvari loves businesses that require little capital expenditures to grow. Maintenance capex hovers around 2% of revenues.

- High Quality and Aligned Management - Tom Bartlett took over as CEO in March 2020, succeeding Jim Taiclett. Taiclett had served as CEO since the beginning of 2003. During his tenure, AMT compounded revenue and EBITDA at annualized rates of ~14% (roughly 10x increase) and ~20% (21x), respectively. Before stepping into the CEO role, Bartlett had served as AMT’s CFO for a decade. Prior to AMT, he had been with Verizon for more than 25 years. Executive ownership of shares is modest at just 1% of shares outstanding. However, we commend AMT for its incentive compensation structure. Long-term equity compensation is based on achieving growth in AFFO per share (70% weighting) and return on invested capital (30%) targets, measured over three-year periods. We believe these metrics most directly correlate with long-term shareholder returns (our framework for analyzing executive comp is summarized here).

Reinvestment & Growth

American Tower’s reinvestment playbook remains unchanged from years past: to organically build or acquire macro towers on a global scale.

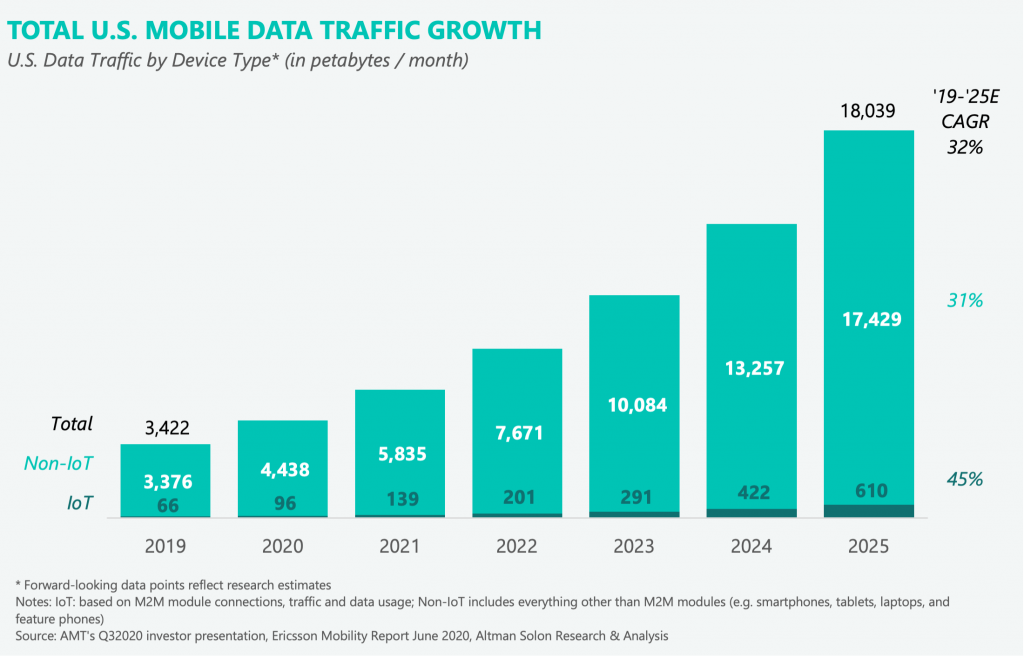

Ever-increasing demand for wireless network capacity will continue to fuel demand for AMT’s towers. The growth rate will be even higher in developing economies. In addition, the physics of wireless signal propagation and spectrum use are most cost-effectively addressed by large, macro tower deployments. The combination of increasing data demand and increasing network speeds (i.e., going from 4G LTE to 5G) requires denser cellular networks. This translates to more towers and more equipment per tower.

Valuation

Andvari estimates AMT will achieve a normalized $6.1 billion of EBITDA for 2021 when factoring in the Telxius and Insite acquisitions. We assume 70% of EBITDA converts to AFFO of $4.27 billon. For the sake of simplicity, we assume AMT will pay the combined purchase price of Telxius and Insite with $12.9 billion of debt. In reality, AMT will likely issue some amount of equity or converts.

With AMT trading at nearly a 3% AFFO yield and with a history of achieving annualized AFFO per share growth of 17.5%, shareholders can easily achieve a 13% annualized return over the next 5 years. Adding the current yield to an achievable 10% AFFO per share growth rate gets us to the 13% annualized return.

Key Risks to Our Thesis

- Leverage - Leverage will be high at >5x net debt-to-EBITDA following the announced Telxius Tower acquisition. However, the durability and quality of AMT’s revenue stream supports a high debt load.

- Customer Concentration - More than half (54%) of AMT’s revenues come from just three customers: AT&T, Verizon, and the new T-Mobile. For the most part, these dynamics are similar in countries outside the U.S., with only 2 or 3 carriers accounting for the lion’s share (60% to 80%) of AMT’s revenue in each country.

Andvari Takeaway

American Tower is simply a great business due to its many qualitative attributes:

- Revenues are highly predictable;

- Growth runway is long and substantial due to increasing wireless data usage;

- Pricing power is strong;

- Barriers to new competition are high; and

- Management has a long and excellent history of capital allocation.

With a current AFFO yield of nearly 3% and an ability to grow AFFO per share at a 10% annualized rate (far lower than historical CAGR of 17.5%), Andvari expects to earn 13% annualized returns over the coming years.

As a reminder, access to the full, 11-page thesis is available through our client/prospective client document portal. If you would like access to the portal or the individual report, please contact Info@AndvariAssociates.com.

-

_________

--

-

_________

-

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. Andvari may re-evaluate its holdings in such positions and sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC