Constellation Software (CSI) acquires and manages industry-specific, vertical market software companies. Since its founding in 1995, CSI has acquired over 600 businesses that provide specialized, mission-critical software to customers. To better understand how and why CSI has earned extraordinary returns with its business strategy, Andvari looks at CSI's mining vertical. (See also our previous blog: "The 'Permanent Home' Advantage").

STEP ONE: ENTER A NEW VERTICAL

The first step in CSI's playbook is to simply find an attractive software business in a new vertical. In this case, CSI acquired Datamine in 2015 from CAE for $32 million with the potential for CAE to earn another $10 million based on Datamine’s results. CAE itself acquired Datamine in 2010 for $23 million.

STEP TWO: CONSOLIDATE AND ADD VALUE

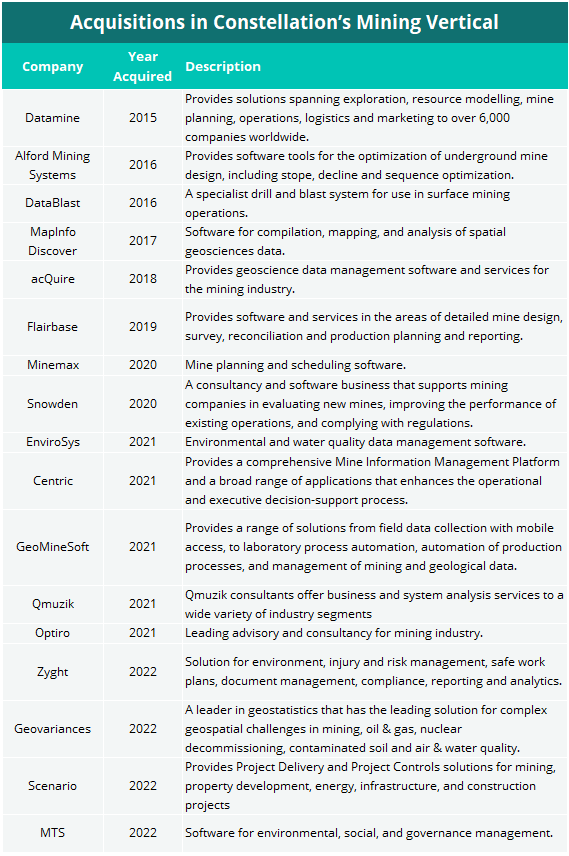

Since the Datamine acquisition, CSI (primarily through Datamine) has acquired 16 more businesses that provide software and services to mining companies. Through its acquisitions, CSI accomplishes three things. First, CSI has consolidated various facets of the mining software vertical. Second, CSI has added new services and functions to further enhance the value of previously acquired businesses. Finally, the acquired companies benefit greatly from being part of CSI because leadership of the acquired company has access to greater resources as well as CSI's handbook of best practices.

Simply put, operating under the CSI umbrella can enable an acquired to company grow revenues and profits at a greater pace than before.

In an interview in August 2022, Datamine’s CEO Dylan Webb confirms the benefits of being owned by CSI. Webb said the acquisition was "a pivotal moment in the history of Datamine." Webb also talks about how CSI has a large group of developers that work as "outsourced" developers for all the various businesses in CSI:

"We tap into some internal groups with hundreds of developers; [we've] got two main groups in Romania and another one in Pakistan. That expertise is really the main thing. But also the ability to scale up and down our teams using those groups. All up we’ve got access to probably around 800-to-1000 developers for projects that we have."

STEP THREE: CONTINUE GROWING

The benefits to being a part of CSI have been enormous for Datamine. In the past five years, Datamine’s headcount has grown from 135 to more than 700. Webb expects the company to continue growing in the double-digits and are ready for staff numbers to go "beyond 1000 in the next couple of years."

ANDVARI TAKEAWAY

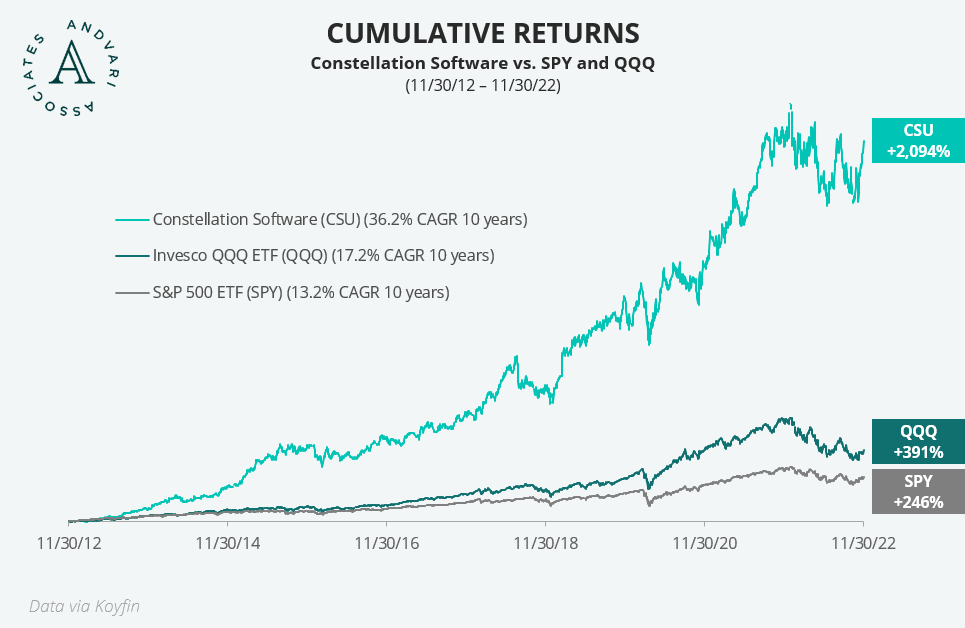

The CSI playbook of entering and succeeding in a vertical market is on full display in the mining vertical. Through consolidation of the mining vertical, CSI created a stable base of customers. By adding new functions and features to its products, CSI increased the value and the stickiness of its already sticky products. As CSI founder Mark Leonard wrote in his 2016 letter, "partnering with the right clients, and helping them survive and prosper is an important part of our job." CSI today helps 125,000 customers in over 100 countries survive and prosper. CSI's acquisition playbook and its focus on customers are why it has earned exceptional returns for its shareholders over the years.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients own shares of Constellation Software. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2022 Andvari Associates LLC