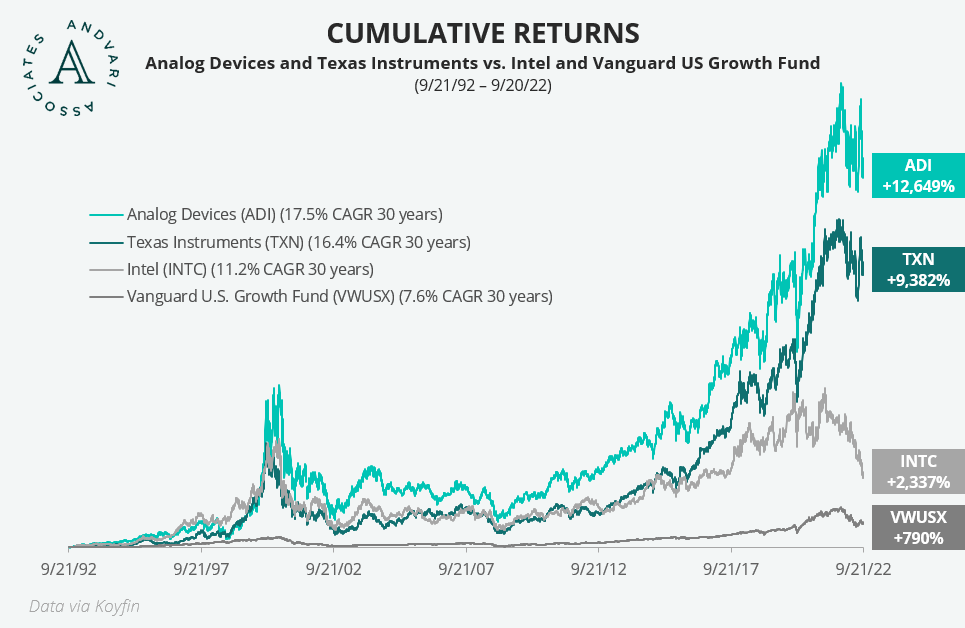

Over the last 20 years, Analog Devices (ADI) and Texas Instruments (TXN) have become two of the largest and most profitable manufacturers of analog semiconductors in the world. Both achieved margins well above their closest competitors and have produced exceptional long-term returns for shareholders. They’ve accomplished this via two ways that always grabs Andvari’s attention. One is by consolidating their industry through selective acquisitions and the second is by selling products based on the value they create for the customer.

ANALOG VS. DIGITAL SEMICONDUCTORS

Before learning more about ADI and TXN, let’s go over the difference between an analog and a digital semiconductor or chip. We know that semiconductors are essential to the function of all our electronic devices. Our devices require a combination of digital and analog chips. Analog chips are the ones that capture and change real-world signals such as sound, temperature, pressure, electrical current, or images. This real-world data captured by analog chips can then be converted to a binary format and sent over to a digital chip that can further process or store that data. Analog products from both TXN and ADI are present in thousands of different products, but primarily in industrial, automotive, and personal electronics.

HIGHER MARGINS THROUGH CONSOLIDATION

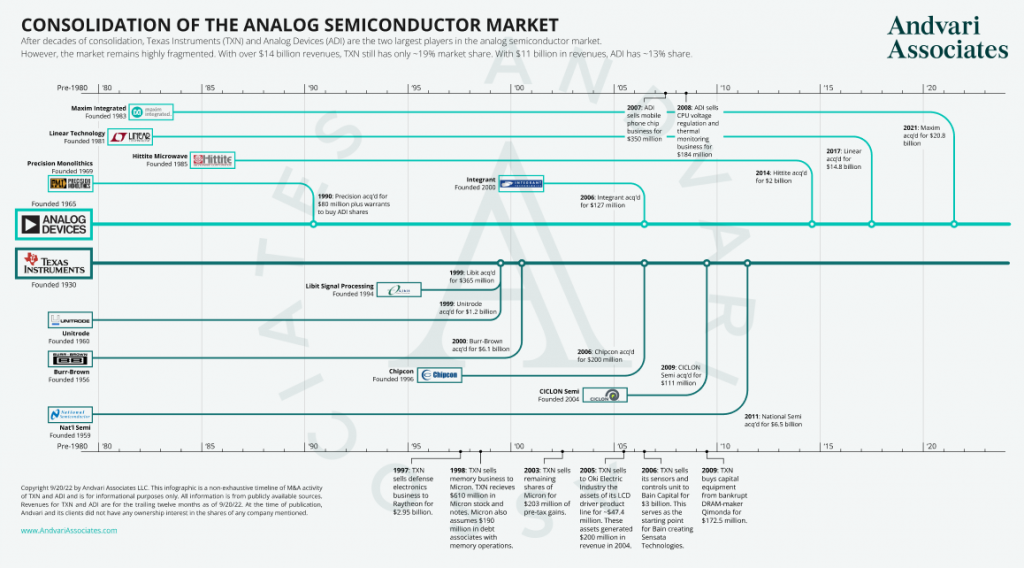

Both ADI and TXN have made a total of 11 significant acquisitions since 1990. As a result, their margins have increased over time. First, a larger catalog of high-end products (80,000+ in the case of TXN) means more customers can buy more products from a single company. Thus, it’s easier to sell more without spending more to make those additional sales. Second, both companies have reduced redundant positions in the Sales, General, & Administrative expense categories after making their acquisitions.

The infographic below shows the major acquisitions and divestitures by ADI and TXN since 1980. Please click here to view a high resolution PDF.

HIGHER MARGINS THROUGH HIGH-END PRODUCTS AND VALUE-BASED SELLING

The first reason behind the high margins at ADI and TXN is their focus on the high-end of the analog semiconductor market. By focusing on the high-end, both companies design and manufacture products for which they can charge a price based on the value the product delivers. This means they can charge more and thus earn higher margins.

Linear Technology (acquired by Analog Devices in 2017) summed up what encompasses high value in 2005:

Our whole strategy has been to develop unique parts that solve a problem a customer has and sell it for its value. And its value is based on its performance. It’s also based on reliability, … support, delivery, all of that. So when we have a unique product, we can sell that product based on its value. As soon as somebody else, some other competitor, manages to catch up with any given product and produce a product that in a customer’s eyes is indistinguishable then we can’t sell it based on its value.

So in addition to just a product that is of physically high quality, factors like the company’s ability to have available inventory of the product, the ability to provide support, and an ability to ship on time, are all reasons that enable the high margins of ADI and TXN. Without these qualities, the product would just be a low-value commodity for which no company can charge a premium.

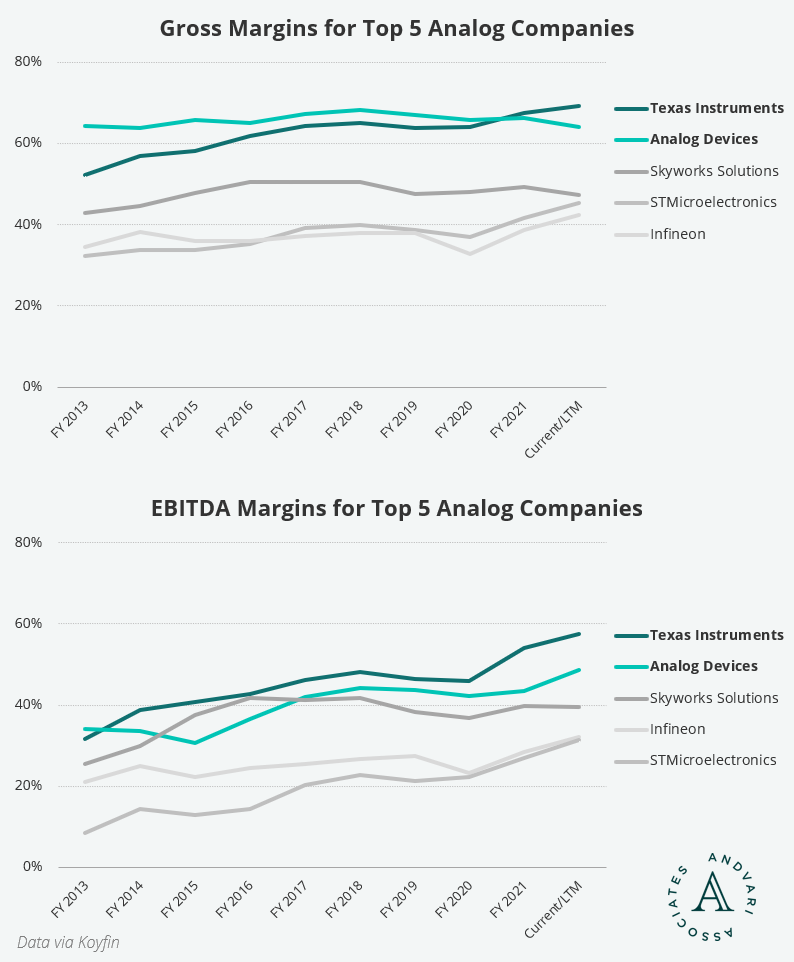

As the chart below shows, gross margins and EBITDA margins at ADI and TXN have grown and have remained consistently higher than their peers.

ANNUITY-LIKE PRODUCTS WITH LONG LIFETIMES

Another feature of high-end analog semiconductors is they can have extremely long lifetimes. Bob Dobkin, a co-founder of Linear Technology (see Andvari's recent blog on "The Analog Chip Company That No One Leaves"), confirmed the potential for long-lived analog products in a 2014 interview:

“It’s interesting that standard circuits, when they’re done well, will sell for 20 years plus in high volume. We’ve got circuits that we came out with when we first started that are still selling in really high volume 30 years plus later.”

When a product can live for 10 years or more, this means there is less need for capital expenditures on new equipment. From 2013 to 2021, capex as a percent of revenues has averaged 5.6% for TXN and 4.4% for ADI. This in turn means ADI and TXN produce very high free cash flows that in turn can be used to further consolidate market share or be returned to shareholders in the form of dividends and share repurchases.

ANDVARI TAKEAWAY

Through consolidation and a focus on high-value products, ADI and TXN have grown their margins and grown their market shares in the analog semiconductor markets. The business model also lends itself to highly predictable revenues and high free cash given the long lives of the high value analog products both companies sell. Finally, there is still room for both to taking market share in a highly fragmented market. With over $14 billion revenues, TXN still has only ~19% market share. With $11 billion in revenues, ADI has ~13% share. Both are worth adding to any watch list of high quality companies.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had no position in any company mentioned. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC