To understand the possibilities for new, emerging serial acquirers, Andvari has studied the financial history of the great serial acquirers. The greats are companies like Danaher, Roper, HEICO, and Constellation Software, all of which have acquired dozens of companies over the decades.

In our small sample size, we focused on how quickly these serial acquirers have been able to grow their revenues. In nearly every case, and in spite of the risks involved with M&A transactions, Andvari found that these companies outperformed the market for each period of their revenue growth.

QUANTIFYING PERIODS OF OUTPERFORMANCE

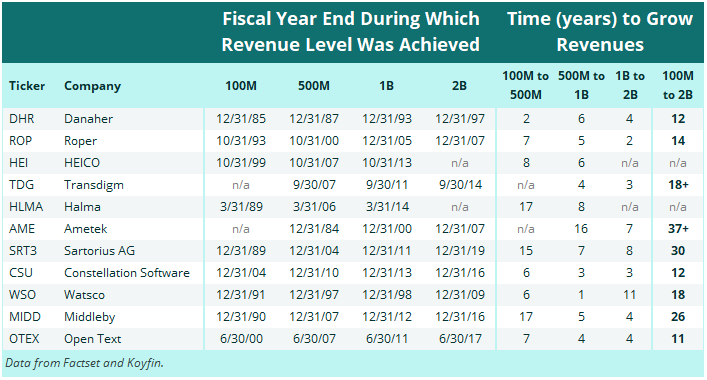

Our basic question is how quickly have the great serial acquirers grown from $100 million in revenues to $500 million? From $500 million to $1 billion? Below is a table of Andvari’s findings. We chose the first fiscal year end during which a company achieved a particular revenue number as the start or end date as the case may be.

WHAT IS BASELINE GREATNESS?

The findings are instructive as to what is possible. By knowing what is possible, it will be less likely for Andvari to dismiss an emerging serial acquirer on concerns the current valuation multiple might be way too high.

For example, Danaher took just 2 years to go from 100 million to 500 million in revenues while it took 6–8 years for most of the others. For the longer term view of growing revenues from 100 million to 2 billion, Danaher, Constellation, and Open Text achieved this feat in 11–12 years. Other companies in our list took (or will take) 20 years or more to go from 100 million to 2 billion.

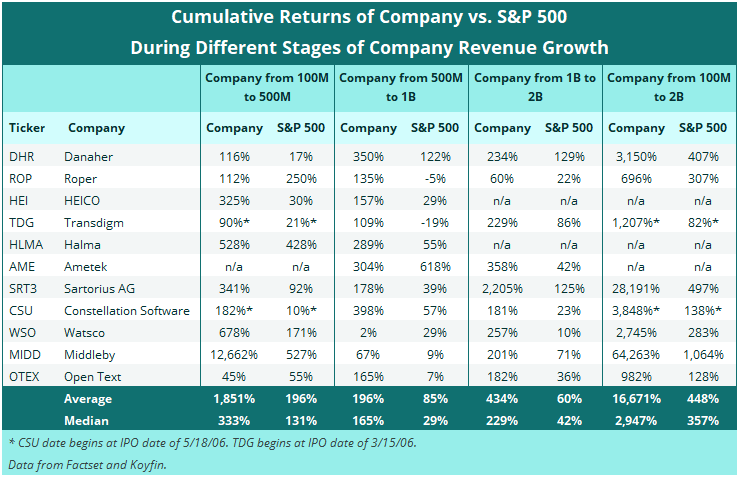

With a baseline for what is possible for revenue growth, how did shareholders of these companies fare? Any management team can grow their company via acquisitions, but it’s a special management team that doesn’t destroy value along the way in this process. Below we see the returns of each of these well-managed companies compared to the S&P 500 during each phase of their revenue growth.

With few exceptions, shareholders of these serial acquirer companies outperformed the market in all revenue growth phases. The companies that underperformed the market all shared one trait: proximity to the dot com bubble.

- Roper underperformed in their 100 to 500 million phase. This was from 1993 to 2000.

- Ametek underperformed in their 500 million to 1 billion phase. This was from 1984 to 2000.

- Open Text underperformed in their 100 million to 500 million phase. This was from 2000 to 2007.

- Watsco underperformed when they grew revenues from 500 million to 1 billion in less than 2 years from 1997 to 1998.

ANDVARI TAKEAWAY

In Andvari’s ongoing quest to outperform the market over the long term, we are always on the hunt for small and mid-sized companies that can become the next great serial acquirer.

Occasionally, Andvari might find a company we believe to be a nascent serial acquirer and also looks very expensive. Having studied the history of older serial acquirers, we appreciate that growth can come much more quickly than anyone can imagine. We also understand the historical returns shareholders have achieved with these types of companies.

Armed with an understanding of the range of outcomes a serial acquirer can achieve, Andvari hopes to never immediately dismiss such a company based purely on traditional valuation metrics. The potential returns are hard to ignore.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. Andvari clients currently have positions in HEICO and Constellation Software. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC