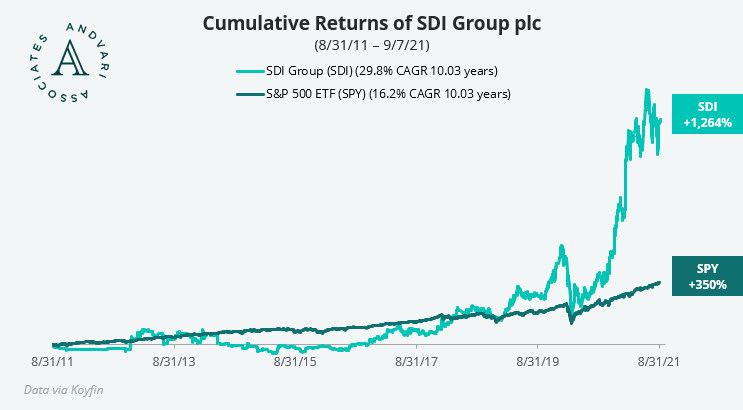

Andvari has recently discovered SDI Group, a company that could become the next great U.K.-based serial acquirer. Over the last decade, this small company has grown revenues nearly five-fold. SDI has done this organically and through over a dozen acquisitions.

Andvari’s Interest in Serial Acquirers

Good companies with management teams skilled at capital allocation have historically greater odds of producing market beating returns. Andvari recently studied a short list of serial acquirers. We analyzed how long it took these companies to reach various revenue thresholds. Many grew rapidly through acquisition, while some grew at a more moderate pace. The one thing nearly all of them had in common was superlative performance during these periods, both in absolute and in relative terms.

Fitting the Mold

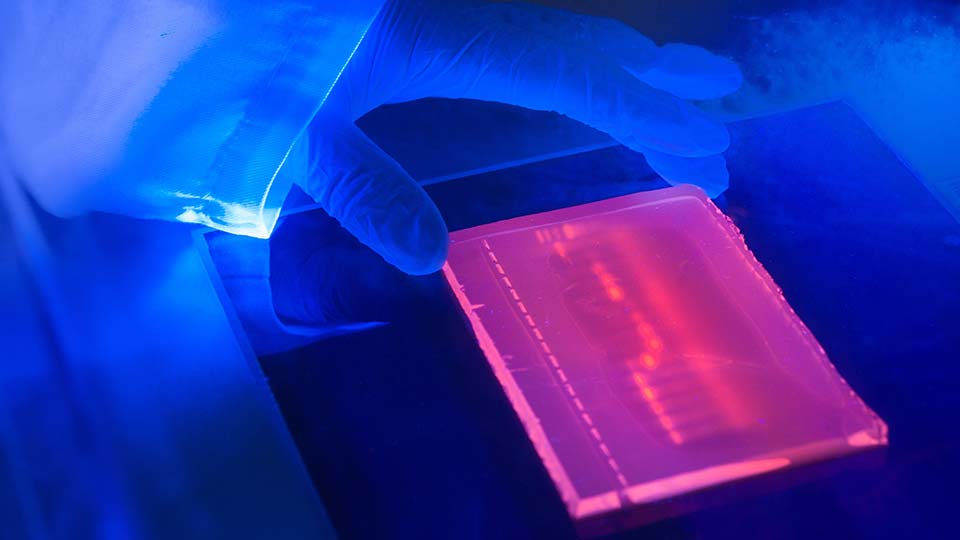

SDI seeks to buy and build niche businesses in the life science and technology markets. They have a variety of businesses in the digital imaging and sensing and control sectors. For example, SDI’s Synoptics Health manufactures ProReveal, a test to detect residual proteins on surgical instruments using fluorescence. SDI also owns Opus Instruments, a world leader in the field of Infrared Reflectography cameras for use in art conservation.

Acquisition Criteria

SDI has positioned itself as a sort of permanent home for niche businesses in the life science and technology markets. The company prefers to fund acquisitions from the cash flows of their existing businesses where possible. After acquisition, SDI implements financial controls and objectives, but otherwise allows the acquired business to run autonomously. The goal is to focus on the long-term and to “create an environment for the businesses to grow and develop with investment if required.”

Skilled Management

Regarding management, Mike Creedon has helmed the company as CEO since August 2011. Since then, Creedon has overseen the dramatic growth of the company. He has made over a dozen acquisitions. Annual revenues have grown from £7.2 million in 2012 to £35.1 million in 2021. Gross margins also grew from the high 50s to the mid-60s during this period. SDI’s share price has thus far reflected these excellent long-term results.

Andvari Takeaway

SDI Group appears to have the basic characteristics of a young serial acquirer that can produce excellent returns for shareholders (see our prior post on M&A wisdom from Halma plc). SDI’s management has proven to be capable over the prior ten years by acquiring good businesses at fair prices. Furthermore, with just £35 million in annual revenues, to say there is still room for SDI to grow would be a vast understatement. Based on Andvari’s study of other successful serial acquirers, it is certainly possible for SDI to grow revenues to £100 million within the next 7 years. If this turned out to be the case, we think it is likely shareholders will be quite happy.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of the conversation and as of the publication of this transcript, Andvari clients had no position in SDI Group. Furthermore, Andvari clients have not had a position in SDI Group in the past. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC