Andvari’s founder and Chief Investment Officer, Douglas Ott, is proud to announce the first episode of the Preferred Shares podcast.

Douglas helped create the Preferred Shares in partnership with Devin LaSarre (author of the Invariant newsletter) and Lawrence Hamtil (co-founder and principal at Fortune Financial Advisors). The podcast will explore the forgotten and lesser-known subjects of business, history, and business history. In the first episode, they explore the brief mania of vending machine stocks that occurred in the early 1960s.

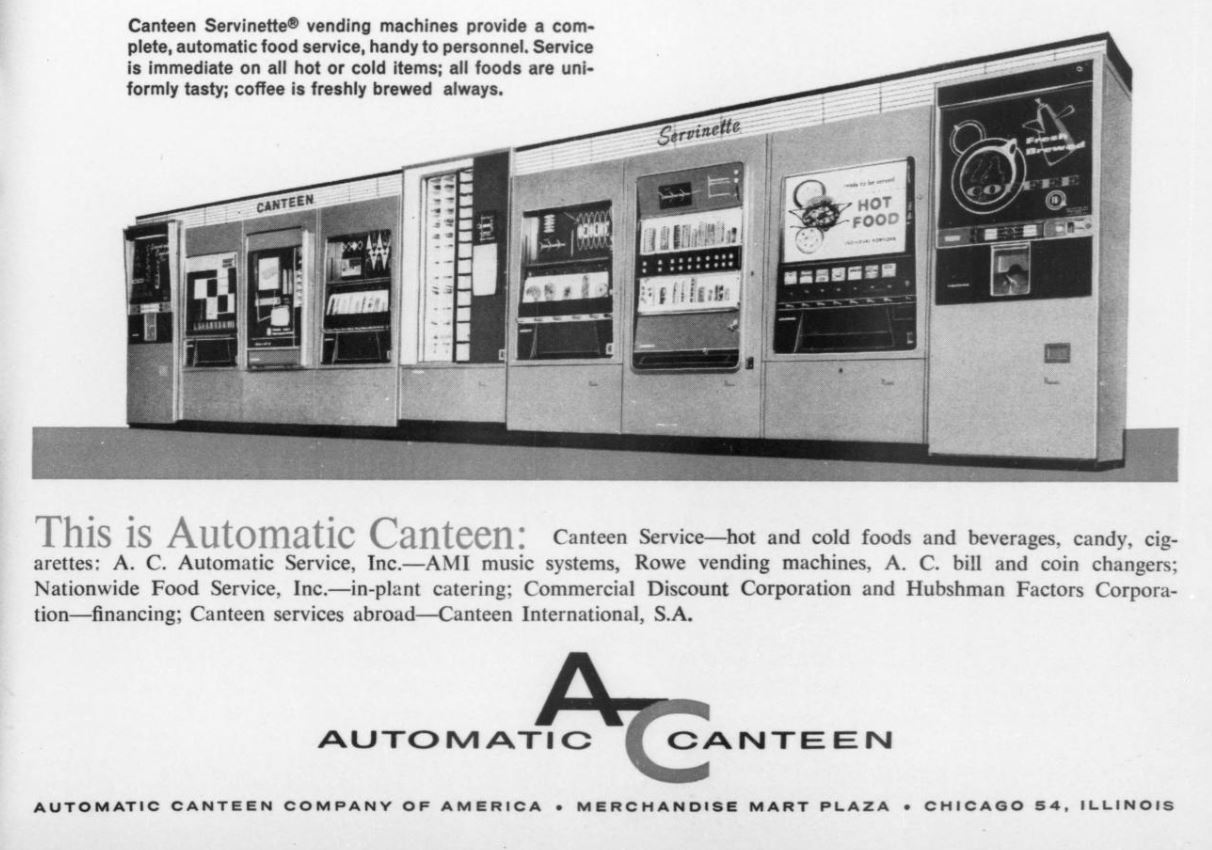

During the research process, one of the stories Douglas focused on was the founding of Automatic Canteen by Nathaniel Leverone in 1929.

INSPIRATION FOR A BETTER VENDING EXPERIENCE

During the early 1900s, Nathaniel had had a successful career as a salesperson for several different businesses. He had also diligently saved and invested his money in Chicago real estate. In 1928, at the age of 44, he had been semi-retired for several years so he could look after his real estate.

The inspiration for founding Automatic came to him after a horrible experience with vending machines in 1928. While waiting on the ‘L’ train in a Chicago station, he looked for a way to pass his time. He spotted a weighing machine. He put in a penny to see his weight and out dropped a card saying he was 260 pounds. Unsatisfied with this spurious result, Nate put in another penny and out popped another card with a number that was drastically lower than his actual 155 pounds.

Nate then tried to buy some gum from a machine. The machine ate his money and returned nothing. He then went to a snack vending machine where all he got was a handful of moldy peanuts.

Although Nate was incensed at this pitiful vending experience, this is where he got the idea and desire to start his own vending company. He thought to himself (emphasis Andvari’s), “If inefficient service could keep those machines on walls all over the country, how much more could be accomplished by an honest, well-organized method of doing business!”

THE BUSINESS PRINCIPLES OF AUTOMATIC CANTEEN

Nate started Automatic Canteen soon after in 1929. He started with eight business principles which we share verbatim. Nathaniel wrote, for a vending machine to succeed, it must:

- Give the public a square deal by operating machines that invariably returned the coin if no merchandise was vended.

- Give the public a square deal by selling full-size, standard units of merchandise of known value.

- Protect owners of locations where machines were placed by sharing receipts honestly and equitably.

- Protect the public by servicing machines at least once a week so that only strictly fresh merchandise would be vended.

- Immediately win the public's confidence by selling only goods of wide consumer acceptance.

- Reduce, if not eliminate completely, the temptation of the public to cheat the machines, with slugs, by creating mechanisms which would reject them.

- Create such a big volume that a small profit would insure a reasonable total profit.

- Be manned by a high type of trained service personnel which would constantly build up, instead of tear down, public confidence.

ANDVARI TAKEAWAY

These are timeless principles. Most get to two important ideas. The first is to just always do the right thing. Warren Buffett and Charlie Munger frequently talk about this. Businesses will make more money in the end with good ethics than with bad ethics. Acting with morality is always the best policy. Finally, to paraphrase Munger, if rascals knew how well honor worked, they would all flock to it!

The second timeless principle is to invest the time and money to provide a superior service or product and you’re likely to win business. Although Canteen had a tough road ahead of it—the Great Depression was just around the corner—Nate built a successful business that withstood the test of time. He did this by “simply” improving the experience of his customers in a meaningful way. He championed new technology to combat the use of slugs and to return valid coins to customers when no merchandise was vended. Operational improvements came in the form of regular maintenance of the machines and investing in higher quality merchandise. Starting with zero revenues in 1929, Automatic survived the Great Depression and went on to earn $200 million in revenues in 1963.

Sources and Additional Reading/Viewing

- Preferred Shares Podcast – Episode 1 – Vending Machine Mania

- Nathaniel Leverone, Pioneer in Automatic Merchandising by Gladys Zehnpfennig (Minneapolis, MN: T.S. Denison & Company, 1963)

- "A Dozen Things I’ve Learned from Charlie Munger about Ethics", 25iq, October 23, 2015.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had no position in any company mentioned. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2023 Andvari Associates LLC