CCC Intelligent Solutions (“CCCS”) is a company that is recently public. The company helped pioneer Direct Repair Programs for the auto insurance economy in 1992. Since then, CCCS has built a software platform and network that solves the needs of auto insurance companies and auto collision repair shops. Andvari has added CCCS to its watchlist as it has many of the hallmarks of a high quality business for which we always seek.

SOLVING PROBLEMS FOR HIGHLY COMPLEX AND REGULATED INDUSTRY

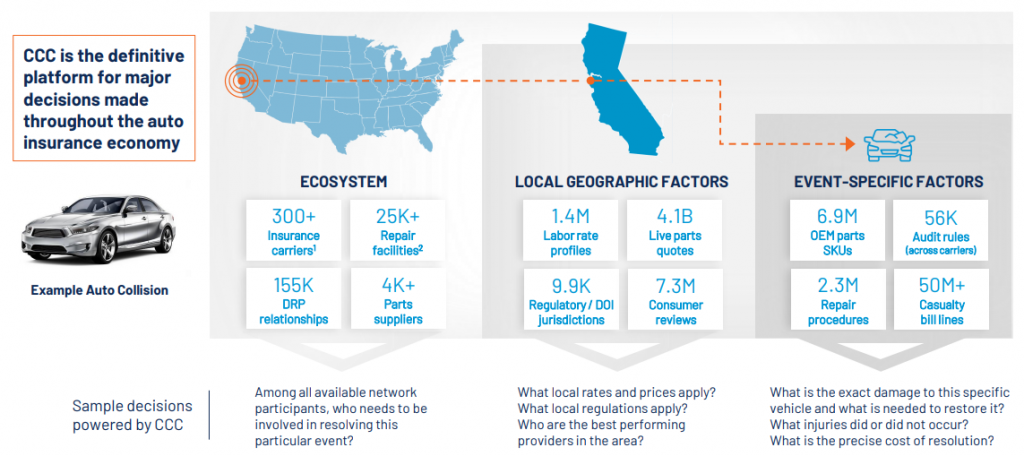

How an auto collision is handled by all industry participants is highly complex. A single collision event can require the resolution of hundreds of transactions and decisions. Who will be the best repair facility and part supplier? What local rates and prices apply? What local regulations apply? What’s the damage to the vehicle and what is needed to restore it? The slide below shows all the different variables that must be considered.

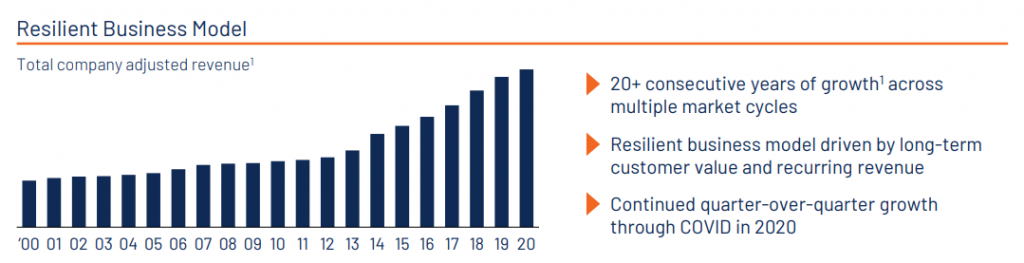

Building a system to handle such complexity has taken decades and hundreds of millions of dollars. The time and money it would take a new competitor to effectively compete against CCCS is substantial. Andvari views this both as a formidable moat for the company against new competition and as the source of CCCS’s attractive financials.

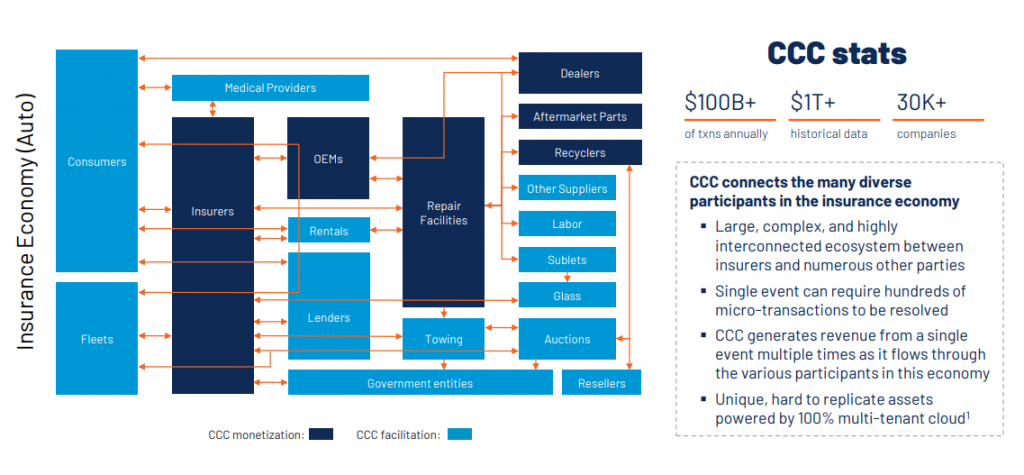

NETWORK AND ECOSYSTEM EFFECTS

More than 300 insurers and over 26,000 repair facilities are connected to CCCS’s network. Parts suppliers, auto OEMs, and financial institutions are also connected. This network creates value for all connected parties by enabling collaboration, streamlining of operations, and the reduction of claims management costs.

Andvari always appreciates how network effects can strengthen business. A strong network effect helps retain customers and increases the likelihood of adding new customers. This makes revenue growth stronger and more certain. A company with a dominant network, which CCCS might have, is a moat that a competitor usually has low odds of duplicating.

TREASURE TROVE OF DATA

CCCS has processed $1 trillion of historical data through its network. It is now processing $100 billion of transactions annually. They use the data to help reduce costs for insurance carriers and drive revenues to repair shops. This treasure trove of data will be extraordinarily hard for any other company to replicate and acts as another barrier to new competition.

STICKY CUSTOMERS AND PREDICTABLE REVENUES

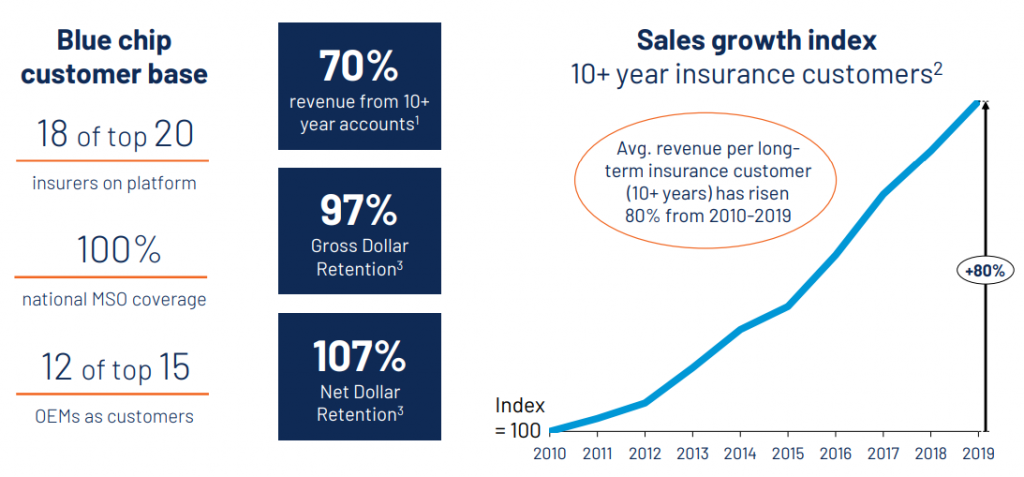

CCCS’s business model enables sticky customer relationships and highly predictable revenues. Average contract length is around 3-5 years in length. 96% of revenues are recurring software revenues. As of 2019, gross dollar retention was 97% while net dollar retention was 107%. Given its customer-centric approach to business, it’s not surprising CCCS has a high net promoter score of 80. For comparison, Starbucks has an NPS of 77 and Apple has an NPS of 47.

Another awesome data point is that 70% of CCCS revenues come from accounts that are 10 years or older. Furthermore, the average revenue per long-term insurance customer has risen 80% from 2010 to 2019.

CAPITAL EFFICIENT BUSINESS MODEL

With gross margins in the mid 70s and adjusted EBITDA margins in the mid-30s, the company spits out cash. Andvari loves software businesses like CCCS as they require little capital to grow. CCCS aims to have capex as a percent of revenue in the 4-7% range and working capital as a % of revenue in the low single-digits. A capital efficient business enables higher cash flows that can be used to reinvest in the business, acquire other businesses, or else be returned to shareholders. Cash can compound at a higher rate in businesses like this.

MANAGEMENT WITH SKIN IN THE GAME

Githesh Ramamurthy is the Chairman and CEO of CCCS. He’s been with the company for 29 years and is the beneficial owner of a little over 33.5 million shares (5.6% of outstanding shares). At a share price of $11.53, Githesh’s stake in CCCS is worth nearly $390 million. As a group, directors and executives own 6.2% of shares outstanding. We believe this is more than enough motivation for them to continue to create value for themselves and all other shareholders.

ANDVARI TAKEAWAY

From a high-level view, CCCS possesses many of the characteristics of a high quality business. It has a deep understanding of a highly complex and highly regulated industry. It’s software platform benefits from network effects and has an enormous treasure trove of historic data. Revenues are sticky and predictable, margins are high, cap-ex is low, and the CEO and Chairman has an enormous stake in the company. CCCS is worthy of addition to any watchlist as it has high potential to grow and compound shareholder value for years to come.

Further reading:

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had no position in CCCS. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC