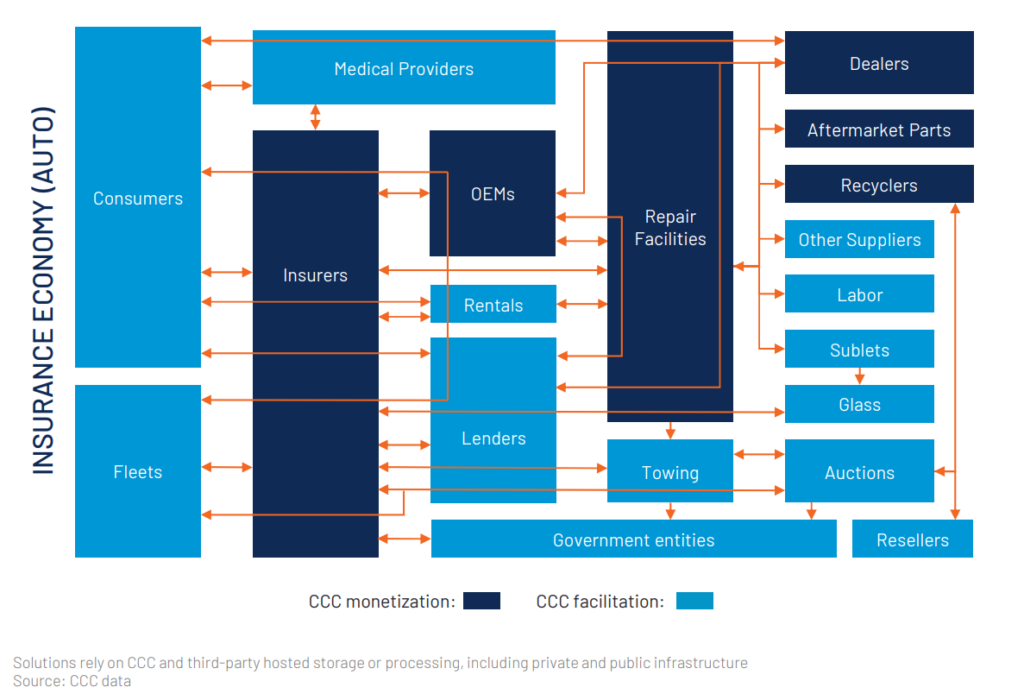

CCC Intelligent Solutions (CCCS) is a business that is central to the auto repair ecosystem. Its software helps coordinate the collective efforts of: auto insurers like GEICO and Progressive; salvage and auction companies like Copart and IAA; and repair shops such as those under the wing of Boyd Group. As part of its efforts, CCCS also collects data on over $100 billion of annual transactions in this space. It then regularly publishes a report—entitled “Crash Course”, naturally—that details all the trends affecting the auto repair journey. With their most recent “Crash Course” report, CCCS affirms that the trend of rising costs to repair a vehicle are still in place.

VEHICLE COMPLEXITY

The main trend contributing to increasing repair costs is that new vehicles continue to grow in complexity. Although complexity has allowed for vehicles that are “safer, more reliable, and more comfortable”, the average new car now has somewhere between 1,400 and 1,500 semiconductor chips and roughly 30,000 parts. Further, the electronic parts of a car now account for 40% of its total cost.

All the benefits allowed for by electronics and new material types come at a cost. These new parts and features are costlier to repair. The repair shop industry still grapples with an inadequate number of technicians who can tackle modern vehicles. Claims cycle times have increased along with costs. Thus, insurers are more and more likely to declare a car “totaled” after it’s been in an accident.

CCCS cites research from AAA regarding the repair costs that are over and above the normal bodywork required following a collision:

“ADAS-equipped vehicles can add up to 37.6% to the total repair cost after a crash due to expensive sensors and calibration requirements. Even minor incidents that cause damage to this technology found behind windshields, bumpers, and door mirrors can add up to $1,540 in extra repair costs.”

REPAIR COSTS

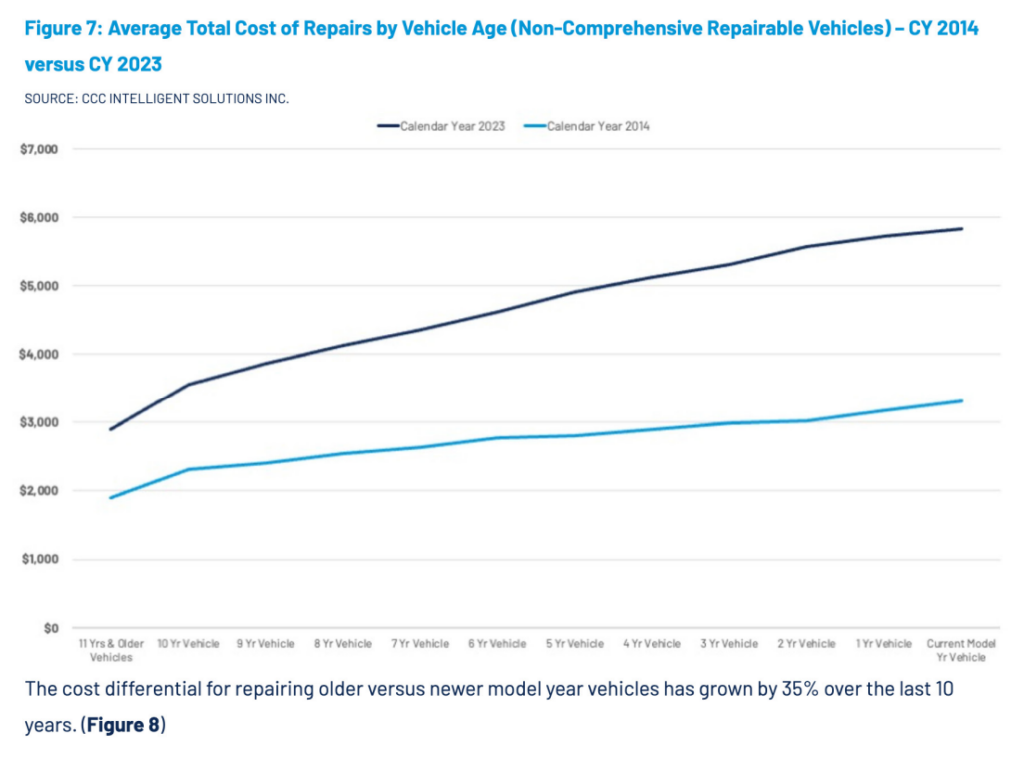

CCCS data shows that newer cars are in fact costlier to repair than older model cars. The following chart shows the average cost of repairs by vehicle age. “The cost differential for repairing older versus newer model year vehicles has grown by 35% over the last 10 years,” according to CCCS.

Tim O’Day, President and CEO of Boyd Group, confirms repair costs are higher for newer vehicles during Boyd’s 11/10/23 earning call:

“[W]e do continue to see increasing repair severity. And I would expect … that will continue over time. If we look at … newer vehicles, say, the 1- to 3-year-old range, the average repair cost of those vehicles is meaningfully higher than you would see in 4 to 7 and then 8 plus.… Newer cars are more expensive to repair anyway. But the newer vehicles also have more technology. So I think that's a trend that likely or not is more than likely to continue.”

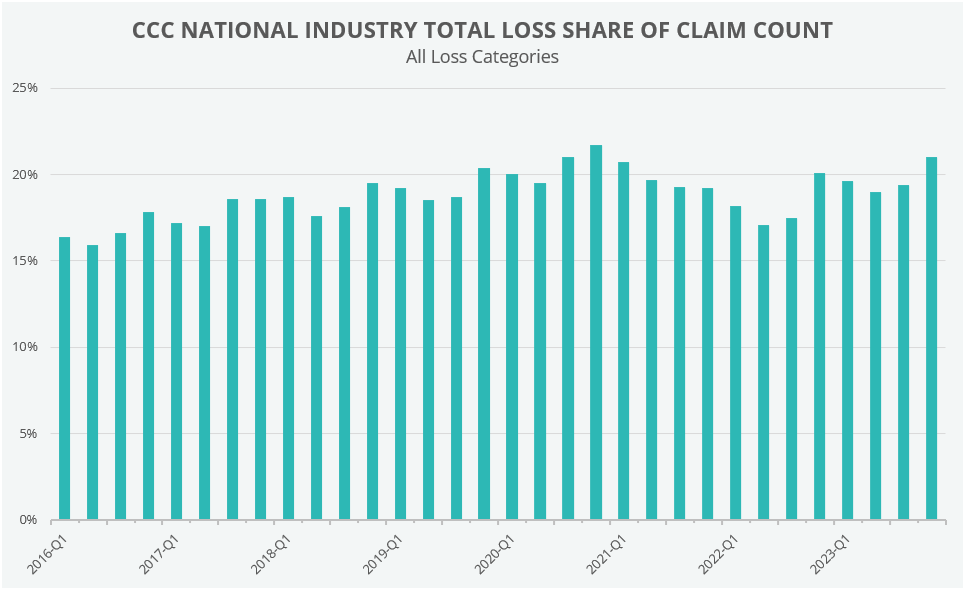

TOTAL LOSS FREQUENCY

When the total cost to repair a vehicle exceeds the value of the vehicle, the insurance company will usually deem it a total loss. With rising costs to repair, there has been a concurrent increase in the total loss frequency. The chart below shows the total loss frequency increasing from 16.4% to 21.0% over eight years.

Once the insurer deems a vehicle a total loss, this is where companies like Copart and IAA step in. They collect the vehicle with a tow truck, clean them up a bit, test whether it can drive, take some photos, and then put it up for auction on their websites for anyone around the world to bid on.

Jeff Liaw, co-CEO at Copart, has often stated that it is his and Copart’s belief that the total loss ratio will eventually reach 30% over time due to increasing vehicle complexity and repair costs. Another factor that could boost total loss frequency would be some insurance carriers abandoning their practice of repairing cars when they should not. On Copart’s 2/22/24 quarterly conference call, Liaw noted that there is also still a wide difference total in loss practices on the part of carriers:

“I think there is long-standing conventional wisdom among some folks that drivers and owners prefer to have their cars back, and … insurance companies will sponsor repairs of cars that they economically should not. So that behavior does continue in the industry. And as a result then, we see a pretty wide dispersion of total loss practices across all carriers, though virtually all of them have increased total loss frequency over the long haul. As for your question about where total loss frequency—can it exceed 30%? I think the answer is affirmatively yes.”

ANDVARI TAKEAWAY

To say the U.S. car market is large might be an understatement. There are 283.4 million registered vehicles and 239 million registered drivers. Americans purchased 15.5 million new cars in 2023 and the total miles traveled by all vehicles in 2023 was nearly 3.3 trillion. Given these numbers, there inevitably will be accidents. According to CCCS Solutions, there were about $275 billion worth of auto insurance claims in the U.S. in 2022.

The auto repair ecosystem is a vital component to the logistics and mobility of any country. As such, the various players in the repair ecosystem, from the insurers to the body shops and from the salvage yards to software providers like CCCS, have a nice steady tailwind thanks to the enormous U.S. auto market. Further, all players in this ecosystem are fairly recession resistant. Despite all the new technology that makes driving safer, there will always be accidents, in good times and bad. This industry is a space in which Andvari maintains a keen interest.

DISCLOSURES AND END NOTES

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Andvari Associates LLC and are subject to change without notice. This document and the information contained herein are for educational and informational purposes only and you should not be considered a recommendation to buy or sell any particular security. You should not assume any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable. Consider the investment objectives, risks, and expenses before investing.

Investment strategies managed by Andvari Associates LLC may have a position in the securities or assets discussed in this article. Securities mentioned may not be representative of the Andvari's current or future investments. Andvari clients own shares in Copart. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.