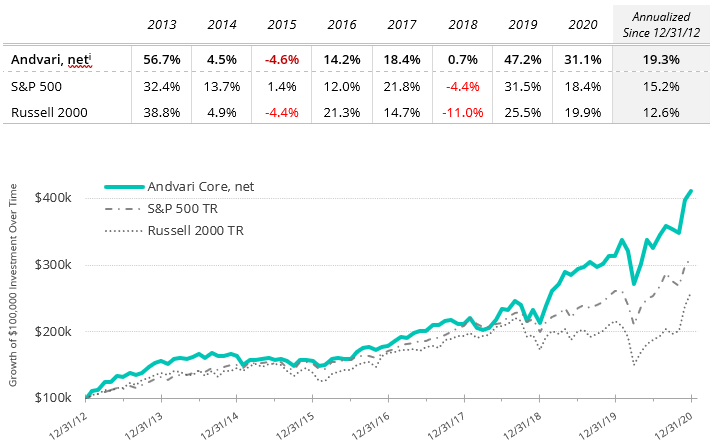

For the full year of 2020 Andvari is up 31.1% net of fees while the S&P 500 is up 18.4%.[i] We are proud to finish another year of composite outperformance against the market. The numbers also do not tell the full story. Andvari manages separate accounts for individuals and institutions with diverse needs. Many clients require fixed income exposure and less concentration relative to other accounts Andvari manages. These factors all impact the firm’s aggregate performance.

Andvari clients, please refer to your upcoming reports for your specific performance figures. The table below shows Andvari’s composite performance against two benchmarks while the chart shows the cumulative gains of $100,000 investments.

Market Commentary

The S&P 500 continued its rebound that began in March. The CDC has approved two different COVID-19 vaccines with more expected. Distribution of the vaccines began in December and should be available to anyone in the general population starting in the second quarter of 2021. With the prospect of daily life getting back to normal, investor confidence has increased and remains elevated. The market and the share prices of many Andvari holdings continued to reach all-time highs in December.

Andvari Holdings

The companies owned by Andvari proved to be highly resilient during 2020. They are high quality, led by excellent managers and/or founders, and can deploy their capital at high rates of return for a long period of time. For our two largest holdings, we are just several years away from a full decade of ownership.

The most notable event in Andvari portfolios was one holding, Liberty Broadband, acquiring another holding, GCI Liberty. This was an all-share transaction. Andvari supported it. Broadband is now over 20% of Andvari’s assets under management.

Like Broadband’s management, we believe the transaction creates meaningful value. First, the two companies generate immediate savings from duplicative public company and overhead costs. Most importantly, the transaction means Broadband has a 25% stake in Charter Communications (the second-largest cable operator in the U.S. by subscribers) and also owns 100% of GCI.

GCI is Alaska’s largest communication company with over $900 million in annual revenues and capable of producing $150 million in free cash flow. With access to a cash producing asset in GCI, Broadband has greater flexibility to deploy capital. In fact, after the announcement of the deal last August, Broadband increased its share repurchase authorization from $200 million to $1.2 billion. Broadband remains an attractive investment and Andvari looks forward to many more years as shareholders.

Another Andvari holding that made a significant acquisition last year is Roper Technologies. We’ve owned Roper since 2015 and it is a company laser-focused on compounding their cash flows. Their objective is to use their excess cash flows to acquire other businesses that improve Roper’s overall financial characteristics. Over the last two decades, Roper has evolved from a maker of industrial pumps to a conglomerate that owns dozens of high-tech and software businesses.

Roper announced last August they’d be acquiring Vertafore for $5.35 billion, the largest acquisition in its history. Vertafore is a leading provider of software-as-a-service solutions for the property and casualty insurance industry. The business seems a great fit for Roper: it has strong cash flows, it doesn’t require capital to grow, it’s a leader in a niche market, and revenues are recurring in nature.

Leap of Faith

Growing up, Indiana Jones and the Last Crusade was a film I watched numerous times. Nearly three decades later, it’s interesting how one of the final scenes adds valuable perspective to my current job as a professional investor.

Near the end of the Last Crusade when Indy is inside the ancient temple containing the Holy Grail, he reaches a wide chasm with no visible bridge. With his father’s journal guiding him, Indy realizes a leap of faith is required to cross. Indy had to believe in something he could not see—that there would somehow be solid footing underneath. Indeed, there was.

The conceptual leap of faith symbolizes an odd mix of two opposing attributes: arrogance and humility. As an investment advisor, our job is to be arrogant enough to behave as if we “know” what the future is likely to bring. We must also be humble enough to accept that even the best laid plans can go awry. It seems self-evident a successful investor has both attributes. Humility without any amount of arrogance (a kinder word might be “confidence”) can beget uncertainty, inactivity, and poor performance. Unbridled arrogance can lead to aggressive, reckless behavior that often ends in misery. A well-calibrated concoction of these two qualities should lead to good long-term results.

Humility in All Things

As this year has reminded everyone, we all should do well to remain humble. There will always be new challenges to face after we have surmounted prior challenges.

I informed Andvari clients in late 2017 of the turmoil that would be happening in my life. That year, my wife Leann’s cystic fibrosis had progressed to the point where a double-lung transplant was the only way to improve her quality of life. I would be moving to North Carolina with Leann who would be entering Duke University’s lung transplant program. A great deal of my time would be spent caring for Leann and not client portfolios.

What I told clients in 2017 remains true today. Despite the extraordinary personal demands I would experience in 2018, Andvari’s investment philosophy allows us to navigate tough waters more easily. This is deliberate. Clients could and can depend on the following attributes we hold dearly.

A Strategy to Endure and Prosper

First, Andvari’s core strategy is to have less than 20 individual holdings in client portfolios. We want the top 10 holdings to make up roughly 75% of the total portfolio. We believe greater concentration in our best ideas produces better results over the long-term. Fewer investments make it far easier for us to keep up with what we own and what we would like to own.

Second, Andvari wants to own great companies with exceptional management teams which can compound capital at high rates for decades. These types of companies generally require less day-to-day attention.

Third, I, as Andvari’s founder, am personally invested in nearly all the same securities in which clients are invested. We strive for total alignment.

In 2018 I endured an extreme moment of volatility at home. A turbulent fourth quarter for the market landed on top. Leann tragically passed away one month into a period where the S&P 500 dropped 13.5%. A year that could have been disruptive for clients was not—most Andvari clients had positive performance for the year while the S&P 500 was down 4.4%.

I credit the composition and structure of Andvari portfolios for the fortunate performance in both 2018 and 2020. These outcomes, however, could never have been feasible were it not for a patient and aligned client base. In addition to the strategic lessons I drew from that eventful time, I also learned a tremendous amount about how important it is to have high-quality clients to serve.

A collection of investments that can be well-tended to in even the most trying of circumstances is what I seek from an investment standpoint. A clientele that is understanding of time spent to care for an ailing loved one or patient enough to endure a global pandemic is what I wish for my business.

Summary

Although 2020 was a difficult year for many people, I’m happy Andvari provided excellent results to its clients. We truly admire the small group of businesses we own. We aspire to hold them for decades. Owning great businesses that grow at above-average rates is how the magic of compounding works.

As always, I love to hear from clients and interested parties about anything on your mind. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

-

Disclosures and End Notes

The opinions expressed herein are those of Andvari Associates and are subject to change without notice. Past performance is not a guarantee or indicator of future results. You should not consider the information in this communication a recommendation to buy or sell any particular security. You should not assume any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable. Consider the investment objectives, risks, and expenses before investing.

[i] Andvari performance represents actual trading performance of all, actual fee-paying clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees (assumed to be 1.25% per annum, paid quarterly, as currently advertised), net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The indexes are listed as benchmarks and are total return figures and assumes dividends are reinvested. The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The Russell 2000 Index is an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.