Below is our latest letter to clients. You may download the full PDF here. Please share and enjoy.

Dear Friends,

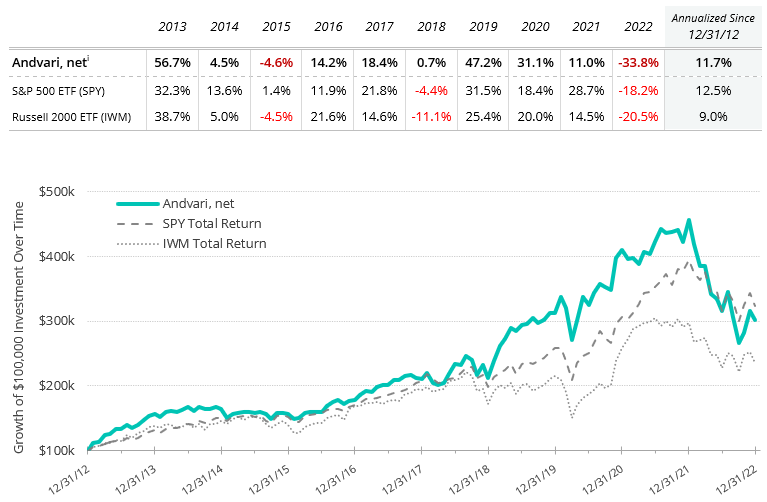

For the full year of 2022 Andvari was down 33.8% net of fees while the SPDR S&P 500 ETF was down 18.2%.* Andvari clients, please refer to your reports for your specific performance and holdings. The table below shows Andvari’s composite performance against two benchmarks while the chart shows the cumulative gains of a $100,000 investment.

Terry Smith is the founder of a successful investment firm based in London. Back in 2012 when a Brit won the Tour de France for the first time, Smith wrote a note comparing investing to the Tour. It is an apt comparison as both are endurance races. The Tour has 21 stages and takes place over 23 days. The winner of the Tour is the cyclist with the least amount of time accumulated over all the stages. Likewise, success in investing can only be determined by the accumulation of performance over a long period of time. In the case of investing, it is decades.

Another trait the Tour and investing share is the fact the victor is unlikely to be the person who has won every single stage or had the highest return in every calendar year. Since the Tour’s inception in 1903, there is no Tour winner that has won all 21 of the stages. The most number of stage wins by a cyclist in a single Tour is eight. This has happened only four times in Tour history: Charles Pélissier in 1930, Eddy Merckx in 1970 and 1974, and Freddy Maertens in 1976. Furthermore, of these three cyclists, only Merckx became the ultimate Tour winner. This is because there are a variety of terrains and events that favor different types of cyclists. There are stages where the terrain is flat, there are stages for a cyclist to race individually against the clock, and there are stages that go straight up into the mountains. Thus, as Smith wrote, “[T]he search for an investment strategy or fund manager which can outperform the market in all reporting periods and varying market conditions is as pointless as trying to find a rider who can win every stage of the Tour.”

At Andvari, we believe the best way to compound our capital is to own a small group of high quality businesses, with great management teams, and where there is an opportunity for the businesses to reinvest their cash flows at high rates of return for a long period of time. If we can purchase these businesses at sensible prices, we believe this skews the odds in our favor of outperforming the major stock indexes, net of our management fee.

However, this investing method assuredly means our results will be more volatile in the short term. Andvari underperformed the S&P 500 ETF (SPY) in the last 5 out of 10 calendar years. Our composite 10-year annualized net performance of 11.7% puts Andvari slightly behind the 12.5% annualized performance of the SPY and comfortably ahead of the Russell 2000 ETF’s 9.0% annualized performance. Interestingly, if in 2022 Andvari had simply achieved the same monthly performance of the S&P 500 ETF, and subtracted our management fee to get the net performance, Andvari’s 10-year annualized net performance would have been 13.9% versus 12.5% for the SPY.

ANDVARI FRAMEWORK

Although Andvari’s performance in 2022 hurt our long-term performance, we are confident as ever about the future. We are closing in on ten years of being in business and excited about the next ten years. Thus, it’s an appropriate time to share our thoughts on what it means to be a high quality business.

When Andvari researches a business, we desire quality businesses because these tend to be the ones an investor can own for a long time. Being able to own a business for a long time is good because this allows the beauty of compounding to unfold. In terms of financials, quality to Andvari usually means a business with high margins, high returns on invested capital, and a track record of growth. However, simply looking at the financials is never enough. A business that looks high quality based on past results does not mean it will continue to be high quality going forward. Thus, Andvari seeks the underlying reasons behind superlative financial results. We want to understand the competitive advantages the company has and how likely they will persist, grow, or shrink.

Here’s a list of some questions Andvari asks that help us measure the quality of a business:

- Does management have skin in the game? Appropriate incentives? A good record of allocating capital? Andvari wants managers to think and act like owners of the business. If they aren’t the founder, the managers should have a meaningful amount of their personal wealth tied to the value of the business. Having skin in the game increases the likelihood of management growing the value of the business over the long term.

- How close is the relationship between the business and its customers? Being a trusted partner and providing highly customized solutions tends to mean the business can charge more and be less susceptible to competition.

- Is it a dominant player in a niche market? This question gets to the level of competition a business faces. If the business is the dominant player in a small, specialized market, it likely has several important things. One is pricing power over its customers. Another is intimate knowledge of a specific industry that they have accumulated over decades. Finally, a small market also dissuades huge companies from entering to compete. It is too risky to try to take some share of a small market that in the end won’t move the needle for a big company.

- Is it hard (or nearly impossible) to compete with this company? From Andvari’s perspective, life tends to be easier when you don’t have to worry about competitors. Here are two examples of when a company might have de minimis competition. First, a company might benefit from network effects like Meta’s Facebook and Instagram, Google’s search engine, or the payment rails of Visa and Mastercard. Second, a company’s product may have become a de facto standard for its users. Think of the credit rating services of Moody’s and S&P, Autodesk’s CAD software for engineers and architects, or Adobe’s software for creative professionals.

- Does is it have a product that provides a high amount of value relative to its cost? If the answer is yes, the company has leeway to continually raise prices or use value-based pricing, both of which can enable higher margins and above-average growth.

- Does the company require a lot of investment to sustain or grow its business? Andvari prefers businesses that require little or no investment to sustain and grow its business. Spending no money to grow 5% is better than spending lots of money to grow 5%.

- How cyclical is the business? How predictable or recurring are revenues? Is it resistant to recessions? Andvari prefers businesses that are less cyclical, more predictable, and that can perform relatively well during an economic downturn. With greater predictability of revenues, a management team has an easier job deciding whether to reinvest in their business or to return capital to shareholders.

- Can the company reinvest its free cash flows back into the business? Is management thoughtful about allocating capital? Andvari prefers a business that can invest all its cash at high returns. If the business still has extra cash after reinvesting in their business, we want a management team that will allocate that capital in an intelligent fashion. This could mean returning capital to shareholders via dividends or share buybacks or acquiring other businesses.

When the answers to these (and many other) questions are to our satisfaction, we often find a business with above average gross margins, above average returns on invested capital, more predictable revenues, and above average rates of growth. We also might find other positive qualities. For example, when a product has a high value to the customer relative to the cost, the company making the product has pricing power. This means it can easily raise prices for a long period of time. Furthermore, there also might be little or no customer churn, which in turn means the business can spend less money on sales and marketing. With less money spent on sales and marketing, the business can keep the savings for itself, pass the savings on to customers, spend more money on research and development, or return it to shareholders in the form of dividends or share repurchases, or some combination of all the above!

ANDVARI HOLDINGS

As of January 27, Andvari clients own up to ten different stocks in their portfolios. In alphabetical order, we give an overview of each.

Adobe

Adobe is one of several software companies we own. Its suite of creative products (Photoshop, Illustrator, Acrobat, Lightroom, etc.) are the industry standard for creative professionals. Adobe also has a suite of customer experience products that help other businesses sell more easily to consumers. All of Adobe’s products have high switching costs and sold on a subscription basis.

Adobe’s business qualities enable extremely high margins and predictable, recurring revenues. The company had revenues of $17.6 billion in its last fiscal year with operating margins in the mid-30s. The company has also grown revenues at double-digit rates every year since 2015. Despite a good record of investing in its businesses, it still has an excess of cash on its balance sheet. As such, Adobe has returned cash to shareholders in the form of share buybacks. Since 2015 the company has returned a total of $24.5 billion.

Constellation Software

Founded in 1995 by Mark Leonard with just $25 million, Constellation Software (CSI) is now worth over $35 billion. CSI acquires and manages vertical market software (VMS) businesses. It’s pitch to owners of these businesses is similar to the pitch Warren Buffett has made to hundreds of other business owners. CSI will be the permanent home for these businesses. Although the owner will receive less for their business than if they had sold to a private equity buyer, they can rest assured knowing Constellation will take a hands-off approach to the business they spent decades building.

The hallmark of a VMS business is that its product is tailored to a very specific industry, like equipment rental, public transportation, or mine planning. This requires direct industry knowledge and working very closely with customers. The software is usually mission critical for VMS customers and thus it provides a tremendous value relative to its cost. Revenues of a VMS business are very sticky and predictable and margins are high.

One downside to many VMS businesses is that organic revenue growth tends to be low. Also, cash tends to pile up in these businesses as there is no easy way to reinvest the money back into a business with low growth. This is where CSI again resembles Buffett’s Berkshire Hathaway. If a VMS business is unable to reinvest its capital, CSI takes it back to redeploy into other opportunities. CSI has redeployed capital by acquiring over 600 VMS businesses since its founding.

Even though CSI now has over $6 billion in revenues, there is still ample opportunity to redeploy capital at high rates of return. The founder Mark Leonard still owns 7% of the company, a stake that is now worth over $2.5 billion. Mark also stopped taking a salary and incentive compensation in 2015, turning himself into more of a partner than an employee. Mark’s wealth grows only when the value of CSI’s shares grows. This is an excellent arrangement.

Copart

Willis Johnson founded Copart as an auto salvage business in 1982 and the company is now the largest auctioneer of damaged and totaled vehicles in the world. It sells more than 3.5 million vehicles per year and operates more than 250 locations in 11 countries. It lists 250,000 vehicles for auction every day.

Copart’s primary customers are auto insurance companies. This would be the GEICOs, the Progressives, the State Farms, and many others around the world. When a policy holder’s car is damaged, the insurance company makes a determination of whether to repair the car or to consider it totaled and pay the owner the value of the car. The insurance company will total the car if repair costs outweigh the pre-accident value of the car. If they total the car, the insurance company writes a check for the pre-accident value of the car and then uses Copart to auction the car to salvage any remaining value.

Copart is a company of extraordinary quality. It is the number one player in an effective duopoly. The business has multiple layers of competitive advantages. First, it owns over 80% of the land it uses for its salvage yards and car parks. Copart bought most of this land decades ago. Having accessible land closer to where most accidents happen decreases the costs of towing. Copart also never has to face rent increases or a landowner choosing not to re-lease to Copart. Finally, because of zoning restrictions and the growth of cities, it is impossible for a competitors to duplicate Copart’s land advantage.

Second, Copart has built the largest and most liquid online auction market for totaled vehicles. This means insurance companies will get higher auction values. Copart should continue to slowly gain market share from its competitor. Thirdly, Copart has invested to build up specialized infrastructure to handle the times when weather catastrophes strike its auto insurance customers. In 2013, CEO Jay Adair wrote about Copart’s response after Hurricane Sandy:

Even our experience with Hurricane Katrina did not prepare us for the damage done by Hurricane Sandy. The inflow of flood-damaged cars was far more immediate and compressed. We mobilized the full force of our Catastrophe Action Team, marshaling more than 325 employees and 575 car transporters. In 90 days, we picked up more than 85,000 vehicles in a market that normally wouldn’t do that many vehicles in a year. Employees from as far away as England and car transporters from as far away as Seattle were sent in; and at one point, Copart had more than 14 additional yards created to deal with so many vehicles. At the peak of the effort, we picked up more than 2,300 cars in one day, or almost one car every 25 seconds. We consumed almost 11 acres a day in storage capacity. The cost to Copart was no small issue either, as we expended over $36 million to handle the additional volume.

Copart’s catastrophe team most likely is a money-loser, but it’s an invaluable capability to Copart’s insurance customers. From a long-term perspective, it’s an investment that’s all about retaining clients and gaining market share. The investment has paid off because several large insurance carriers have shifted more of their business to Copart after Sandy.

In regards to future growth for Copart, the company has the wind at its back because insurance carriers will choose to total more and more vehicles involved in accidents. They will total more cars for two reasons. One reason is the cost to repair a car will continue to rise. There is an increasing amount of technology, sensors, cameras, and computer chips in vehicles. These parts cost thousands of dollars and it takes more time for repair shops to install and recalibrate this technology. The other reason is the average age of cars will continue to slowly increase. Older vehicles are simply worth less than the total cost to repair, and thus are more likely to be totaled.

Finally, Copart is a shining example of capital allocation. First they have always invested for the long-term. The evidence here is the fact they choose to buy and own their land rather than lease. Second, they have continually reinvested in their business. Total capital expenditures as a percent of revenues has recently been in the range of 10%–20%. However, about 80% of this spending has been for new land and expanding current locations. Thirdly, when management has felt Copart shares were undervalued, they have repurchased large chunks of stock. Over the last 20 years, Copart has reduced shares outstanding from 739 million to 476 million.

Costar Group

CoStar is a provider of online real estate marketplaces (LoopNet and Apartments.com are the best known ones) as well as data and analytics services to the commercial real estate industry. CoStar’s products are essential to its customers, the products provide a high value relative to their cost, and revenues are mostly recurring. 93% of the top 1,000 commercial real estate brokerage firms are CoStar customers. Virtually all large apartment complex owners advertise their inventory on Apartments.com. If you have commercial property to sell or lease, the best place to go is CoStar’s LoopNet because they have 20x the monthly web traffic of its next closest competitor.

Andy Florance is the CEO and founder. He started the company in 1987 and has grown revenues to over $2 billion annually. The company has a market value of $32 billion. There is still room for decades of growth and reinvestment: CoStar can grow much larger in Europe; it has an online real estate auction platform called Ten-X that can become much larger; and CoStar might soon become a real challenger to Zillow in the online residential real estate market.

Digital Bridge

Digital Bridge is one of the world’s largest digital infrastructure investment firms. It invests in data centers, cell towers, and fiber networks. Its founder and CEO is Marc Ganzi who sold his previous business, Global Tower Partners, to American Tower for $4.8 billion. Everything we know about Ganzi points to him being a highly driven workaholic who is focused on creating value for himself and all other shareholders.

The investment management business on its own is incredibly attractive. Margins are high and management fees are sticky. For Digital Bridge in particular, Ganzi puts it this way: Digital Bridge is “[m]anaging long-term capital on behalf of the leading global LPs and shareholders in a sector with strong secular tailwinds led by a team with a 25-plus year track record of execution.” With shares currently trading in the low teens, Ganzi stands to receive a $100 million payout if the share price reaches $40 by mid-2024. If the stock market fails to recognize the value of the business by then, it’s highly possible Ganzi will once again sell to a larger competitor to realize the true value of the business he has built.

Mastercard

Mastercard is the second largest payment technology company in the world. Its network enables the transfer of value and information between banks, merchants, and consumers. Despite the seeming ubiquitous presence of debit and credit cards, about 85% of the world’s purchase transactions are still in cash or check.

Due to its network effects, sharing an oligopoly with Visa, and providing an extraordinary amount of value to its stakeholders, Mastercard enjoys high free cash flow margins that are in the mid-40s. It has minimal debt on its balance and returns the majority of its cash flows to shareholders in the form of share repurchases and a small, but fast growing, dividend. We continue to own Mastercard as it wages its “war on cash.”

Mesa Laboratories

Mesa sells equipment, instruments, and consumables for niche applications in the highly regulated life sciences, healthcare, and pharma markets. More than 60% of revenues are recurring or highly predictable. All its products provide high value relative to their cost. The company has high margins, robust cash flows, and minimal capex needs.

Furthermore, Mesa has vastly increased its potential since the hiring of CEO Gary Owens from Danaher. Danaher is a public company with an extraordinary business system of continuous improvement, problem solving, and listening to the customer, which enabled exemplary shareholder returns over the last 20 years. Gary has been created and implemented Mesa’s own business system—The Mesa Way—that has helped boost margins, increase growth, and increase customer satisfaction. The board has been upgraded with individuals with experience leading businesses with billions of revenues. Mesa is well positioned to continue growing as a serial acquirer of other high quality businesses.

S&P Global

S&P is another company we own that is part of a duopoly in the business of credit rating. S&P and Moody’s have roughly equal market shares and rate more than 90% of all bonds worldwide. The service provides high value for the cost. A company that chooses to issue debt without a rating will pay an interest rate that could be higher by half of a percent. The cost of a higher interest rate far exceeds any savings gained by not using the services of S&P.

We think of S&P as a toll road that earns fees from its customers in exchange for cost-effective access to capital. As such, the company has extraordinary margins and pricing power and requires little of its own capital to grow. Even after fully reinvesting in its business, S&P still has an excess of cash. In 2021, S&P produced $3.5 billion of free cash from $8.3 billion of revenues. The company returns the majority of its free cash to investors in the form of dividends and share repurchases.

Topicus.com

Topicus is a spin-out from Constellation Software. It operates in almost exactly the same way as Constellation, but its focus is on acquiring VMS companies in Europe.

Tyler Technologies

Tyler is the only public company focused on software for state and local governments in North America. Since 1998, Tyler has acquired over 40 software companies. Annual revenues have grown from $50 million in 1998 to now over $1.8 billion while cash flows and profits have grown at a faster rate.

Tyler has few competitors that can match its offerings and service levels. Large, potential competitors stay away Tyler’s market because the sales cycle is measured in years and products require too much customization. Once Tyler wins a client, they usually stick around for decades. Client retention for Tyler is nearly 100%, which gives them highly predictable revenues. Also, Tyler management has a record of effective capital allocation. Finally, Tyler has the wind at its back as local governments continually upgrade decades-old systems. Tyler will steadily increases its market from the low-teens into the 20s and 30s over the next decade.

ANDVARI TAKEAWAY

In 2023, Andvari will have been in business for ten years. Our goal since the beginning has been to achieve above average performance, net of our fees, for ourselves and our clients, over the long term. Our method towards this goal is through a concentrated portfolio of high quality businesses purchased at sensible prices. Although poor performance in 2022 hurt Andvari’s long term performance, we are still proud of our accomplishments over the last ten years. It is in Andvari’s nature to strive for excellence and we are excited for the challenge of the next ten years.

As always, I love to hear from clients and anyone else. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

DISCLOSURES AND END NOTES

* Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees—assumed to be 1.25% per annum, paid quarterly, as currently advertised—net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The exchange traded funds (ETFs) are listed as benchmarks and are total return figures and assumes dividends are reinvested. The SPY ETF is based on the S&P 500 Index, which is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The IWM ETF is based on the Russell 2000 Index, an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal. Investment strategies managed by Andvari Associates LLC may have a position in the securities or assets discussed in this article. Securities mentioned may not be representative of the Andvari's current or future investments. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.