Below is a shortened version of our latest quarterly letter to clients. You can read our thoughts on one of our largest positions—Mastercard/Visa—that trailed the S&P by over 25 percentage points. We also introduce a more recent holding that had outstanding performance last year. If you'd like the full letter, please contact us.

Dear Friends,

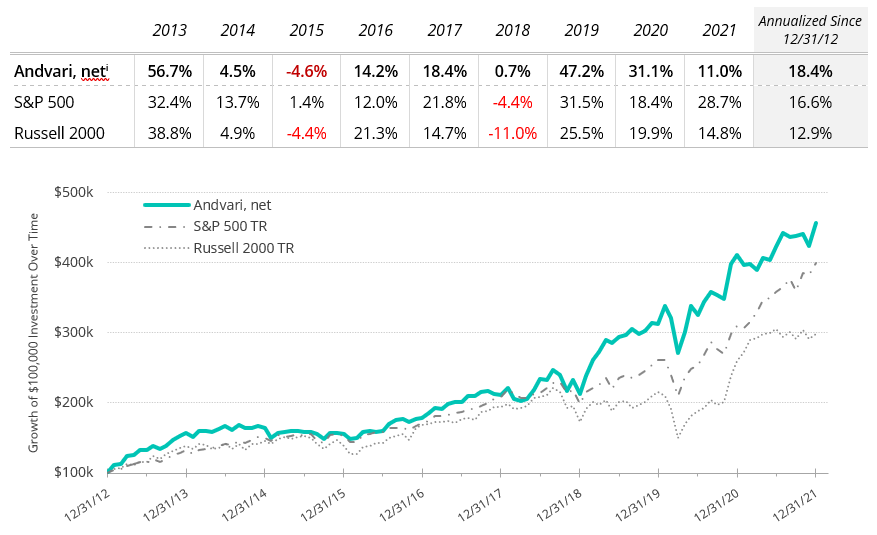

For the year of 2021 Andvari was up 11.0% net of fees while the S&P 500 was up 28.7%.i Andvari clients, please refer to your reports for your specific performance and holdings. The table below shows Andvari’s composite performance against two benchmarks while the chart shows the cumulative gains of $100,000 investments.

ANDVARI’S HOLDINGS

After outperforming the market by a wide margin in 2020, it is hard not to feel disheartened when we underperformed by a wide margin in 2021. Out of the positions we started the year with and which we still own, 2 in our top 5 largest trailed the S&P 500 by more than 25 percentage points during 2021. These two positions were Liberty Broadband and Mastercard/Visa.

We must remember our goal is to outperform the market, net of Andvari’s fees, over the long term. We pursue this goal by concentrating our money in our best ideas. Andvari currently has nine equity positions (some positions are comprised of two stocks, such as Mastercard/Visa). Our top five positions account for more than 70% of net assets under management. There are two notable side effects to this style of investing. One is increased volatility and the other is inevitable periods of underperformance relative to the market.

…

MASTERCARD & VISA

Mastercard and Visa (“MA&V”) enable the majority of non-cash payment transactions that occur throughout the world. Importantly, they do not issue credit or debit cards. They do not extend credit. They do not dictate or receive revenues from interest rates or other fees that issuing banks charge their card holders. MA&V revenues come from taking a tiny cut of each debit or credit card transaction that passes through their networks.

MA&V’s share price performance lagged the market this year by over 25 percentage points each. Shareholders seem to have several worries. First, Amazon.com has publicly complained about the interchange fees Visa has set for credit card transactions in the United Kingdom. Amazon warned it would stop accepting Visa credit cards for its U.K. business starting in January 2022. With a contract between Amazon and Visa up for renewal, Andvari believes this is simply a negotiating tactic by Amazon. It is still in the interest of both parties to ensure consumers have a variety of ways by which they can pay for goods.

Another worry for MA&V shareholders has been the fast-growing “buy now, pay later” (BNPL) tech companies. The BNPL companies (e.g., Affirm, Klarna, Afterpay) give merchants the ability to offer customers the choice of paying over time for a purchase via a short-term loan. These companies have been growing extraordinarily fast. For example, in Affirm’s most recent quarter, growth in payment volume was 84% over the prior year. Although the total volume of the BNPL crowd is still a small fraction of the volume going through MA&V, some still worry the BNPL companies are stealing business from MA&V. There are three reasons not to worry.

First, BNPL users can choose to use a debit or credit card as the way to make their scheduled payments. If a BNPL customer uses a debit card for 4 smaller transactions instead of 1 big transaction, that is good for MA&V. Second, MA&V both have their own BNPL offering that merchants can use. BNPL has been another way to expand the use of credit and debit cards.

Third, we simply do not believe BNPL is taking customers away from MA&V and credit card issuers. Most of the new BNPL customers were never credit card users to begin with. Oppenheimer’s Chris Kotowski recently wrote about the ability of the BNPL companies to grow like weeds: “Giving credit to those who generally can’t get it has a way of doing that.”

To illustrate why BNPL is not taking much business from MA&V and the card issuers, let’s look at JPMorgan Chase’s $143 billion credit card loan portfolio. 88% of the value of its portfolio is associated with a FICO score of 660 or greater. These are consumers with above average and higher credit. It’s unlikely people who are already credit-worthy need an installment plan to buy a new pair of sneakers.

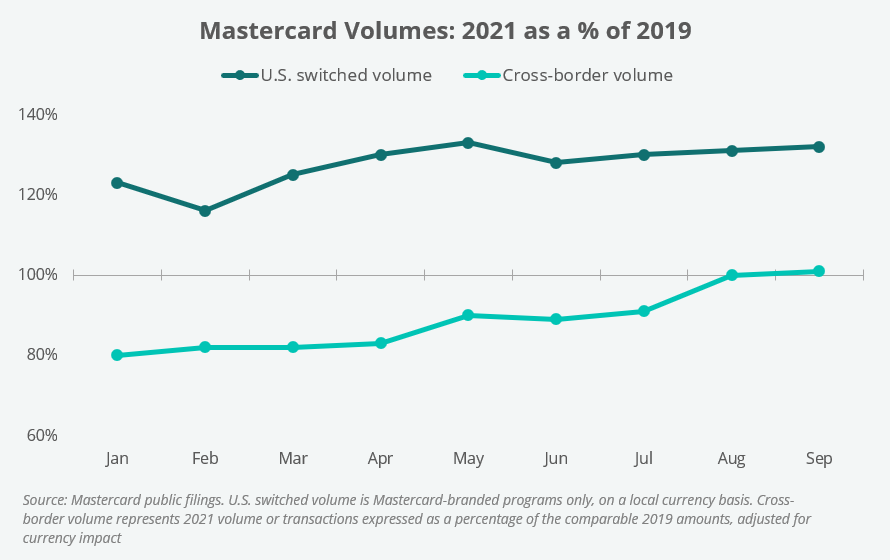

The last thing to weigh on MA&V has been depressed levels of international travel and tourism. MA&V earn higher fees on cross-border transactions relative to local transactions. Cross-border revenues have been slower to recover (relative to local transactions in the U.S.) for MA&V due to COVID-related worries and travel restrictions. However, they will eventually recover. It’s just a matter of time.

With MA&V as a top position in Andvari portfolios, their poor share price performance during 2021 was a big hit to Andvari’s overall performance. Going forward, we expect this position to outperform the market as Amazon resolves its issues with Visa, as shareholders worry less about BNPLs, and as international travel returns to normal.

NOVANTA

Andvari started a position in Novanta within the last two years. We’ve allowed it to fly under the radar. However, with Novanta being a top performing position in Andvari’s portfolio during 2021, it’s appropriate to introduce you to the company.

Novanta is a company in a similar vein as Danaher and Roper. The company acquires niche businesses that make highly engineered solutions based on proprietary technology. These solutions are typically embedded in customer products for about ten years and provide enormous value for their cost. For example, Novanta’s subsidiaries provide the sub-systems that enable the precision motion required by robotic surgery or the proper functioning of high throughput DNA sequencers.

Novanta has also developed its own program of continuous improvement and growth: the Novanta Growth System (NGS). There is still ample room to apply NGS across current subsidiaries as well as all future acquisitions.

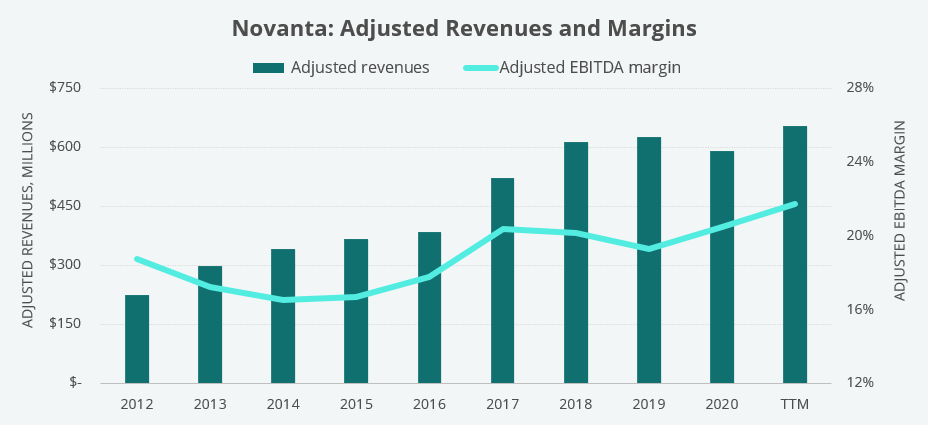

From 2012 to the last trailing twelve months (as of 9/30/21), Novanta has grown adjusted revenues at a 13% annualized rate. Adjusted EBITDA has grown at a 14.9% annualized rate. The company has achieved these growth rates by divesting and acquiring several businesses since 2012. Importantly, the company has acquired businesses using its cash flows and debt, not by issuing equity and diluting current shareholders.

As of the last twelve months, Novanta earned about $650 million in revenues with EBITDA margins in the high teens. With a focus on acquiring niche businesses and applying NGS, Novanta is still in the early stages of compounding value at high rates.

ANDVARI TAKEAWAY

After outperforming the market for a string of years, Andvari underperformed the market by a wide margin in 2021. Our results were to be expected given our concentrated style of investing. However, we still earned a return that is above the long-term market averages. With many of our largest holdings underperforming the market in 2021, we believe Andvari’s portfolio is ready for a rebound.

As always, I love to hear from clients and interested parties about anything on your mind. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

DISCLOSURES AND END NOTES

[i] Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees (assumed to be 1.25% per annum, paid quarterly, as currently advertised), net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The indexes are listed as benchmarks and are total return figures and assumes dividends are reinvested. The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The Russell 2000 Index is an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal. Investment strategies managed by Andvari Associates LLC may have a position in the securities or assets discussed in this article. Securities mentioned may not be representative of the Andvari's current or future investments. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.