Below is our latest letter to clients. Please share and enjoy.

Dear Friends,

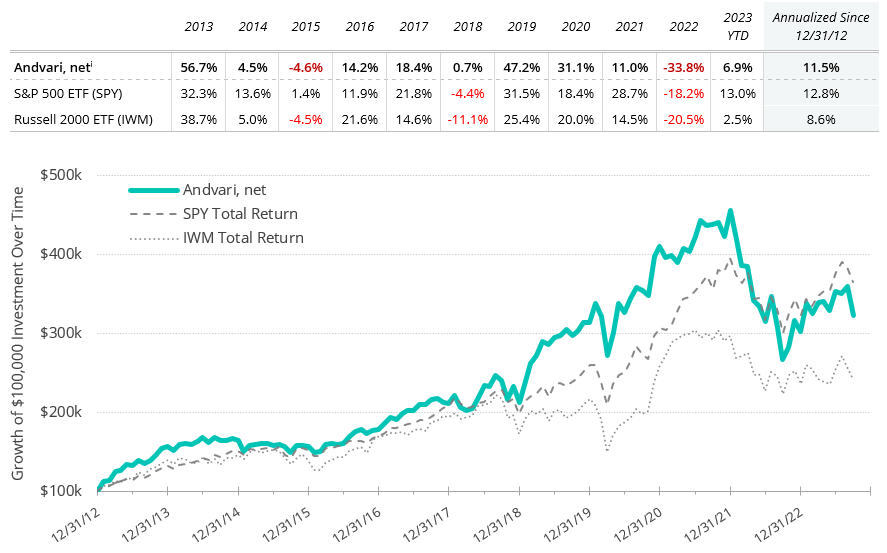

For the first nine months of 2023 Andvari was up 6.9% net of fees while the SPDR S&P 500 ETF was up 13%.* Andvari clients, please refer to your reports for your specific performance and holdings. The table below shows Andvari’s composite performance against two benchmarks while the chart shows the cumulative gains of a $100,000 investment.

ANDVARI HOLDINGS

After good results for the first half of the year, Andvari’s performance suffered at the end of the third quarter for two reasons. First, renewed fears of interest rates remaining higher for longer impacted multiple holdings that are most sensitive to rates. These include companies like American Tower and Digital Bridge. American Tower is a REIT (real estate investment trust) that owns and leases antennae space on cell towers while Digital Bridge is an investment manager that invests in the digital infrastructure space. Both companies require debt in their operations and the prospect of higher interest rates continues to impact share prices in the short term. Companies with high growth prospects, like Topicus.com and Tyler Technologies, also declined. A third group also declined: our investments in fixed income and preferred securities for retirement accounts naturally declined in value as the prices of these securities go down when interest rates go up.

As an aside, American Tower is not a new holding of Andvari. We’ve owned it in the past. Although we may have started putting American Tower back into client portfolios a bit early, we believe shares are extremely attractive. First, the shares trade at a current 3.8% dividend yield at the end of October. This yield is near the highest in American’s entire history as a public company. Second, the company will likely grow dividends per share by 9% annually over the long term. As a nice kicker, Andvari believes American Tower will sell its assets in India before year’s end, which will free up capital it can use to pay off debt and repurchase shares.

The second reason for the third quarter decline in Andvari’s performance is due to our holdings in the life sciences industry. This is an industry that continues to weather difficult times. During 2021 and 2022 many pharmaceutical companies, labs, and hospitals stocked up on more supplies than they inevitably needed in 2023. The life sciences industry has thus experienced declines in revenue growth due to the “de-stocking” of its customers. Andvari remains ready to add to our positions in this industry as we believe the above-average prospects for growth in revenues and profits outweigh any declines in valuation caused by this one-off de-stocking period.

INTRODUCING ROLLINS

Rollins is the holding company for multiple pest control businesses of which the largest and best-known is Orkin. After market close on September 6, the company announced the Rollins family would be selling up to $1.76 billion worth of its 50.5% ownership stake in Rollins. This caused the share price to decline nearly 10% the following morning. We decided to take advantage of this decline.

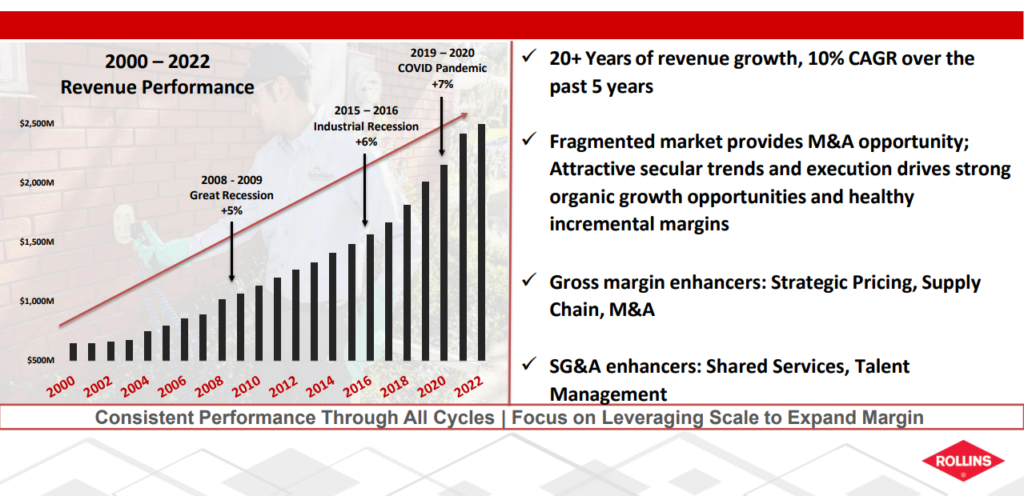

Andvari has admired Rollins for over a decade as the business has many attractive qualities. First, the company has the wind at its back as it operates primarily in the warmer climates of the southern states of America. This region is where bugs and other pests are most pernicious. This also happens to be the region where people continue to migrate for work and for retirement. This migration is a steady trend that will continue to drive the growth of Rollins at an above average rate for decades to come.

Second, Rollins is one of the largest companies that is consolidating a very fragmented industry. For context, there are 17,670 pest control companies in the U.S. with combined annual revenues of $11.04 billion.1 Over just the last three years, Rollins has acquired over 100 pest control businesses. Rollins’ annual revenues in the U.S. will be about $2.87 billion for 2023, so this means it has about a 26% market share. A tremendous opportunity to grow organically and through acquisitions still remains for the company.

Third, Rollins provides valuable services that are a small portion of the total cost of either owning a home or operating a business. For a business owner, rules and regulations make it so they must purchase pest control services from someone. This gives Rollins’ pest control brands the ability to raise prices 4%–5% a year very easily. We also view pest control services as non-discretionary and recession resistant. Few home or business owners will tolerate pests within their dwellings. Thus, revenues for Rollins are highly predictable: about 80% of revenues are recurring.

Fourth, the size and scale of Rollins gives it an advantage over smaller competitors on two fronts: purchasing supplies and acquiring other pest businesses. On the supplies front, scale enables Rollins to purchase at lower prices for its stable of pest brands. On the acquisition front, because Rollins has acquired hundreds and hundreds of businesses over the decades, it has become a very disciplined buyer that will walk away from deals that are too expensive. Further, when Rollins acquires a pest control business, it can easily improve the acquired company by helping them increase prices, modernize marketing tools, share best practices, and by providing capital for faster growth.

Fifth, the pest control business—like most service businesses—is one that does not require large capital expenditures. Over the last ten years, capex has ranged between $18 million and $42 million annually. This is all while annual revenues have increased from $1.3 billion to nearly $3 billion today. Rollins gushes free cash flows that it uses to acquire more businesses, pay an increasing dividend, and occasionally repurchase shares.

Finally, Andvari likes the fact this business is unlikely to ever become obsolete due to changes in technology. Rodents and pests will always be around and there will always be a need for pest control services. Methods used to combat critters and creepy crawlies in twenty or fifty years are unlikely to be much different than the methods of today.

When you put all the above together, you wind up with a business with excellent financial characteristics. Average annual revenue growth has been 8.2% over the last ten years. Profits have grown faster than revenues. Gross margins are above 50% and EBITDA margins are now at 22.3%. The incremental margins—the percentage of every additional dollar of revenue growth that is converted to EBITDA—are very good: they range from 30% to 40%. Andvari believes both gross and EBITDA margins can slowly go higher over the long term. We also believe we purchased Rollins at a reasonable price that will allow us to compound our money at above average rates.

ANDVARI TAKEAWAY

Performance remains volatile for the market in general and Andvari in particular due to our concentrated investment philosophy. Although increased volatility has temporarily harmed short-term performance, this has also set the stage for what we think will be stronger performance going forward. Importantly, although it is never easy to experience volatility, we should all welcome these periods as they afford all investors the opportunity to invest at more favorable prices in companies we know well—or to finally invest in companies we’ve followed for a long time, like Rollins.

As always, I love to hear from clients and anyone else. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

DISCLOSURES AND END NOTES

* Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13, managed under the primary Andvari investment strategy. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees—assumed to be 1.25% per annum, paid quarterly, as currently advertised—net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The index ETFs are listed as benchmarks and are total return figures and assumes dividends are reinvested. The S&P 500 ETF (SPY) is an exchange traded fund based on the S&P 500 index, which is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The Russell 2000 ETF is an exchange traded fund based on the Russell 2000 Index, which is an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal. Investment strategies managed by Andvari Associates LLC may have a position in the securities or assets discussed in this article. Securities mentioned may not be representative of the Andvari's current or future investments. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.

- This figure is according to the 2022-2023 annual report of the National Pest Management Association. Rollins says they have more than 20,000 competitors in the United States.[↩]