Below is a selection from Andvari's latest quarterly letter. Please enjoy.

Dear Friends,

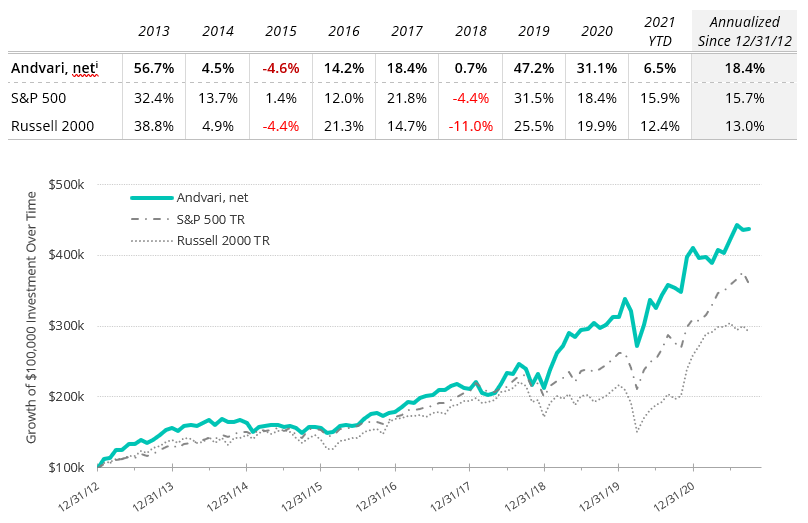

For the first nine months of 2021 Andvari is up 6.5% net of fees while the S&P 500 is up 15.9%.[i] Andvari clients, please refer to your reports for your specific performance figures. The table below shows Andvari’s composite performance against two benchmarks while the chart shows the cumulative gains of $100,000 investments.

ANDVARI HOLDINGS

During the third quarter, one of our largest and longest-held investments—“Company A”—announced the largest acquisition in its history. Company A will increase its revenue base by about 40% by acquiring “Company B”. Company B has a set of genetic analysis products that enable labs and pharmaceutical companies to perform certain types of diagnostics more quickly and at a lower cost.

Andvari believes the best is still yet to come with our investment in Company A. Depending on the size and pace of future acquisitions, this serial acquirer can grow revenues 4x–5x over the next ten years while maintaining high margins and cash flows. As Company A grows, it will have ever-increasing cash flows to allocate to larger and larger acquisitions. Cash flows will compound. At a minimum, Andvari expects over the long run to earn annualized returns in the low-teens as shareholders of Company A.

A new entrant to Andvari’s portfolio is Chemed. We sold our investment in a large, customer-focused enterprise software company to make room for this overlooked holding company based in Cincinnati, Ohio. Chemed’s two subsidiaries are Roto-Rooter (plumbing and drain cleaning) and VITAS Healthcare (hospice care provider). Chemed checks many of the boxes within Andvari’s qualitative-based investment framework:

- Stable and predictable revenues from two recession resistant businesses;

- Low capital expenditure requirements;

- Roto-Rooter and VITAS have good organic and inorganic growth opportunities as both are the largest players in markets that are still highly fragmented and populated mainly with “mom-and-pop” competitors;

- Management has demonstrated excellent capital allocation skills; and

- Management is long-tenured and highly aligned with shareholders.

…

ANDVARI PARTNERS LP

In the prior quarter’s letter we mentioned the launch of Andvari Partners LP, Andvari’s first investment fund. The fund’s track record officially started in early August. For more information we urge you to contact us at info@andvariassociates.com.

ANDVARI TAKEAWAY

For the first nine months of 2021, Andvari still trails the market by a wide margin. However, we’ve caught up a bit in the third quarter. Looking at our collective performance over the past three and five years, Andvari has outperformed the market net of management fees. This outperformance is in spite of the fact that Company A—our largest holding now—has significantly underperformed against the market this year. Finally, we are strong believers in Company A and in our new Chemed investment.

As always, I love to hear from clients and interested parties about anything on your mind. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

DISCLOSURES AND END NOTES

[i] Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees (assumed to be 1.25% per annum, paid quarterly, as currently advertised), net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The indexes are listed as benchmarks and are total return figures and assumes dividends are reinvested. The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The Russell 2000 Index is an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.