Below is a selected portion of our latest letter to clients. Contact us for access to the full letter. Please share and enjoy.

Dear Friends,

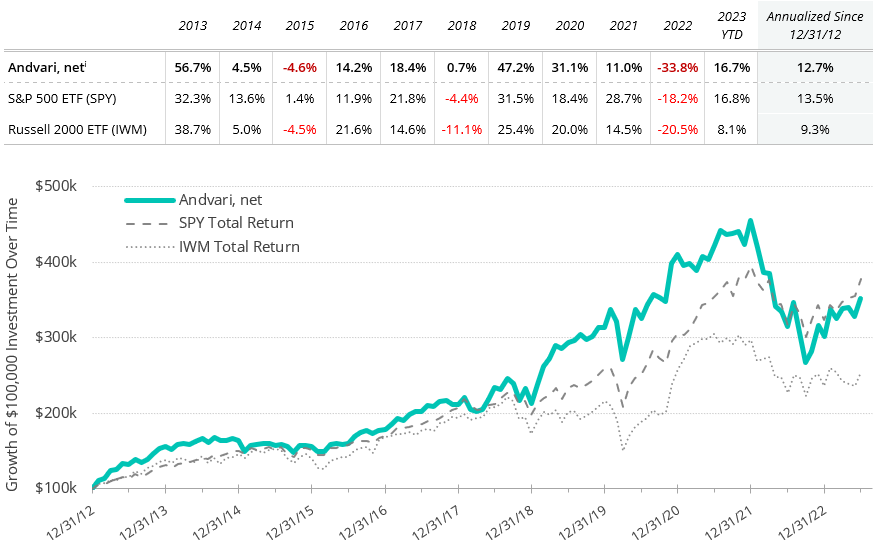

For the first quarter of 2023 Andvari was up 16.7% net of fees while the SPDR S&P 500 ETF was up 16.8%.* Andvari clients, please refer to your reports for your specific performance and holdings. The table below shows Andvari’s composite performance against two benchmarks while the chart shows the cumulative gains of a $100,000 investment.

ANDVARI HOLDINGS

With one of Andvari's holdings having a large unrealized loss, we've decided to realize a portion of these losses in the coming months. This will offset some gains we've already realized and we will also be able to reinvest the proceeds in some other attractive opportunities. We have started to acquire a basket of companies that are similar in style to the one we'll be selling.

The basket contains a handful of serial acquirer types of businesses. They all produce free cash flows above and beyond what they need to reinvest in their own business, so they choose to use their excess cash to acquire other businesses. Here are summaries of just two in this basket of serial acquirers.

KELLY PARTNERS GROUP

Brett Kelly founded Kelly Partners in 2006 in Australia as a specialist chartered accounting network. Since its founding, the results have been incredible. Revenues started out at less than a million and will likely be above $100 million in their 2024 fiscal year. In other words—revenues have doubled five times since founding. This is a result of good organic growth and by acquiring many other like-minded accounting firms. Since going public in 2017, 31 accounting firms have joined Kelly Partners, 24 of which have come in just the past three years.

Andvari believes there are two main reasons for the recent increase in the pace of acquisitions. First, Kelly Partners has grown its reputation as a great permanent home for the accounting firms built up over the decades by accountants looking to retire. Second, Kelly has developed a repeatable system of best practices and standards that enables them to increase the growth and profitability of acquired accounting firms. For example, Kelly Partners operates with 30%+ EBITDA margins while the average accounting firm in Australia is at 19%.

When it comes to the qualitative aspects of the company, there are several we like. First, Kelly Partners is consolidating share in a highly fragmented market. Second, the accounting business itself is solid and predictable. Accounting relationships with private businesses and their families can last several generations. People and businesses will always have taxes to pay. Further, the complexity and quantity of tax rules only seems to increase.

The last qualitative aspect to the company is the founder and CEO Brett Kelly. He is by all accounts a great person and leader. His actions mirror his words. He is aligned with shareholders as he still owns 50% of the company. Kelly speaks Andvari’s language of accounting, investing, and capital allocation. His investing and business heroes are ones that inspire us as well. Like Berkshire Hathaway, Kelly Partners has an owner's manual that serves as a handbook for current and prospective shareholders to better understand the business. There is no doubt Brett Kelly knows what it takes to enable success for his employees, customers, and shareholders.

The opportunity to acquire and improve more accounting firms is still significant. Kelly Partners is just beginning to expand in the United States and the United Kingdom. We expect the company to double revenues another two times over the next decade.

[Section on Kingsway Financial Services removed. Contact us for access to the full letter.]

ANDVARI TAKEAWAY

We’re thankful for good positive performance thus far this year but we remain unsatisfied. Performance over the last two years has negatively impacted Andvari’s long-term, aggregate net performance. As unpleasant as this has felt for me personally, I do my best to remind myself that performance can come and go in waves. Bouts of under and outperformance inevitably occurs in a concentrated investment strategy such as the one Andvari employs. However, periodic suffering is the price one pays for a chance at earning above-average long-term returns.

Rather than focusing too much on short-term performance, or anything else over which we have little to no control, we remain focused on what we can control. And that is identifying and studying high quality businesses with high quality managers that can deploy capital at high rates of return for a long period of time. Buying shares of these businesses at sensible prices skew the odds in our favor of producing excellent returns over the long-term.

As always, I love to hear from clients and anyone else. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

DISCLOSURES AND END NOTES

* Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13, managed under the primary Andvari investment strategy. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees—assumed to be 1.25% per annum, paid quarterly, as currently advertised—net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The index ETFs are listed as benchmarks and are total return figures and assumes dividends are reinvested. The S&P 500 ETF (SPY) is an exchange traded fund based on the S&P 500 index, which is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The Russell 2000 ETF is an exchange traded fund based on the Russell 2000 Index, which is an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal. Investment strategies managed by Andvari Associates LLC may have a position in the securities or assets discussed in this article. Securities mentioned may not be representative of the Andvari's current or future investments. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.