Below is our latest letter to clients. Please share and enjoy.

Dear Friends,

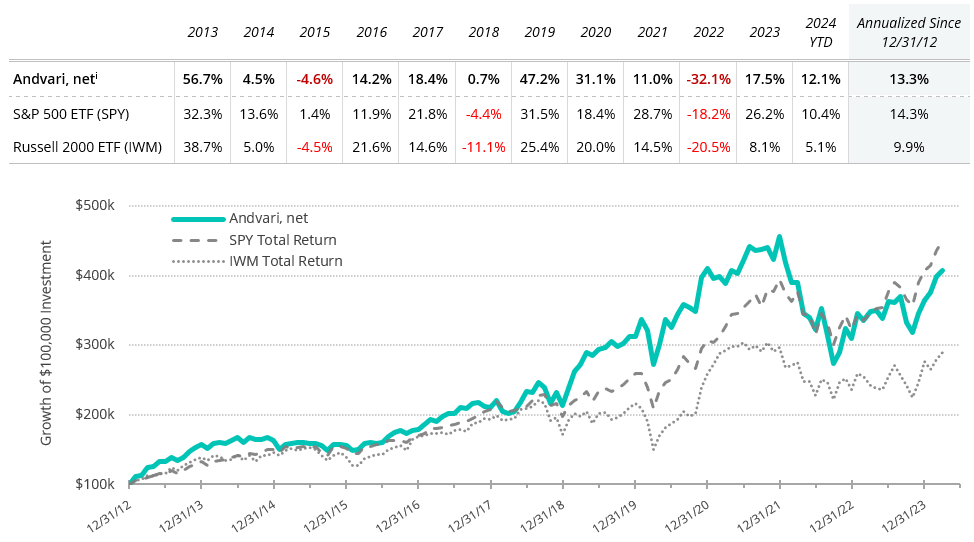

For the first quarter of 2024, Andvari was up 12.1% net of fees while the SPDR S&P 500 ETF was up 10.4%.* Andvari clients, please refer to your reports for your specific performance and holdings. The table below shows Andvari’s composite performance while the chart shows the cumulative gains of a $100,000 investment.

ANDVARI HOLDINGS

In fits and starts, Andvari’s performance continues to climb back from the decline we suffered in 2022. The top two detractors to our performance in the quarter were Mesa Labs and American Tower. The top two contributors to performance were Topicus.com and Mastercard.

We have two holdings on which we can report several notable events. First is Kelly Partners Group, the Australia-based accounting and financial services firm. The company continues on its long-term mission of helping small businesses be better off by the provision of high-quality accounting and tax services. We’re pleased to share that Kelly has expanded into the United States. This is its first foray outside of its home country. After acquiring two accounting firms in the L.A. area, Kelly is now ranked 71 on Los Angeles Business Journal’s Top 100 Accounting Firm list. Notably, L.A. is home to one of the largest populations of Australian expatriates in the world. There are 60,000 Australian businesses in L.A. and until Kelly Partners arrived on the scene, there was not a single Australian-owned accounting firm there. This is a logical place for Kelly to begin its international expansion.

Another event, perhaps even more significant than its entry into the U.S., is its decision to eliminate its monthly dividend. This means Kelly can deploy more capital at much higher rates of return than Andvari can hope to provide. Given Kelly’s large opportunity to acquire and improve accounting firms in English-speaking countries, Andvari applauds the decision to eliminate the dividend.

Finally, as of February, the shares of Kelly Partners now trade in the U.S. via the OTCQX® Best Market. Although this is an over-the-counter market,1 Andvari believes this is a first step towards an aspirational—and perhaps eventual—up-listing to an exchange like the NASDAQ. At the minimum, Kelly can now garner more attention and support from a larger investor base. This will likely help its share price and Kelly will be better able to access capital if necessary.

CoStar Group is the second holding with significant news. As a reminder, CoStar is commercial real estate's leading provider of information, analytics, and online marketplaces. Sensing an opening to compete against Zillow, the leading residential real estate portal in the U.S., CoStar acquired Homes.com in 2021. CoStar is now planning to invest a cumulative $1 billion into this new business segment. Part of this investment will include the largest marketing campaign in the history of the residential real estate industry. If you watched the Super Bowl this year, you likely saw one of their four commercials. Homes.com will be a big advertiser at other major events in 2024.

Thus far, these investments have resulted in Homes.com going from an insignificant player to the second-most trafficked homebuying portal. CoStar announced the Homes.com Residential Network reached more than 149 million unique visitors in February. Further, Homes.com itself had a 567% year-over-year increase in traffic. As it did with Apartments.com, CoStar believes it can grow the unaided awareness from the low single digits to more than 50%.

CoStar then received news that could be a tailwind to its Homes.com business: the National Association of Realtors reached a $418 million settlement of claims that they and the industry conspired to keep real estate agent commissions high. The practice of two agents sharing a commission based on the value of a home is a big reason why commission rates in the U.S. are among the highest in the developed world. The practice also reduced the ability for the home buyer to negotiate on commissions. The commission sharing practice is also why many buyers’ agents steered clients away from homes when the shared commission would be lower than the going rate. Thus, as part of the settlement, the NAR agreed to disallow upfront commission offers from sellers’ agents to buyers’ agents.

The reason this settlement could provide a tailwind to Homes.com is because its business model is geared to the sellers’ agent. This contrasts with the business models of portals like Zillow and Realtor.com, which are geared towards taking the listing data from the sellers' agents, generating leads, and then selling those leads to buyers' agents. Understandably, this practice has been hated by sellers' agents for a long time. Thus, if the commissions of buyers' agents decline because of the changes stemming from this settlement, Zillow could suffer and Homes.com could increase its market share.

SILVER LININGS IN RATES

Although the rapid rise in interest rates contributed to Andvari’s underperformance in 2022, there are silver linings to rates having risen to more normal levels. One benefit is the opening of new opportunities to invest in businesses whose market values have declined too much. The other benefit is pure and simple: the yields on assets like bonds, preferred shares, and certain equities, are at levels finally worthy of notice.

One example of an attractive yielding asset is a bond fund Andvari has used for our clients who desire an income component to the equity strategy Andvari provides. This fund is the Western Asset Premier Bond Fund (WEA) managed by Western Asset Management, an advisor founded in 1971 in Pasadena, CA. We like the group for its value investment approach and its long-term track record in the fixed income arena. Furthermore, Western has an excellent reputation and a historical association with two extraordinary individuals: Lou Simpson and Ron Olson.

Lou Simpson is best known for his long career as the person in charge of GEICO’s investment portfolio. Warren Buffett’s Berkshire Hathaway owned a large stake in GEICO until it fully acquired the business in 1996. With the GEICO acquisition, Buffett acquired both a great business and great people. In his 2004 letter to Berkshire shareholders, Buffett wrote, “Lou is a cinch to be inducted into the investment Hall of Fame.”

What few people remember is Simpson was CEO of Western Asset prior to GEICO luring him away. Although Simpson’s tenure at Western was brief, he was attracted to the group for a reason. We believe at least a small part of his investment philosophy remains embedded within Western.

Ron Olson is the other person of note. Olson has a long association with Charlie Munger and Berkshire Hathaway. In 1968, Olson joined the law firm founded by the late Munger, which is now named Munger, Tolles & Olson. He has been a director on the board of Berkshire Hathaway since 1997. Olson has also been a director at Western Asset since 2005. It’s hard to imagine a better person to be a director on your board than Olson.

Now, getting to some of the specifics on WEA. It is a bond fund with a closed-end format. This means it has a fixed number of shares as opposed to the open-end fund format, which issues new shares to each new buyer. A closed-end fund also means its market price can trade at a premium or a discount to the net asset value (NAV) per share of the fund. In other words, we are frequently able to pay $95 for WEA shares that have a NAV of $100. The converse is also true. We might be able to sell shares at prices greater than the NAV. Currently, the fund has a yield of 7.9% on its market price in addition to trading at a ~6% discount to NAV.

SMOKE SIGNALS

Our second example of a high-yielding security is the stock of Altria Group. Before we get into the details of why we started a position in Altria, a brief history is in order. The company was formerly known as Philip Morris before rebranding to Altria in 2003. Cynically, the rebranding was to minimize the negative attention from its tobacco business. However, the company also owned Kraft Foods and Miller Brewing, so it was logical to reflect its status as a conglomerate. Since rebranding, Altria has slowly “de-conglomerated”. It spun out Kraft in 2007. It spun out Philip Morris International in 2008. In 2021, it sold its Ste. Michelle Wine Estates business. Finally, last month Altria announced it is selling part of its 10% ownership in Anheuser-Busch InBev (BUD).2

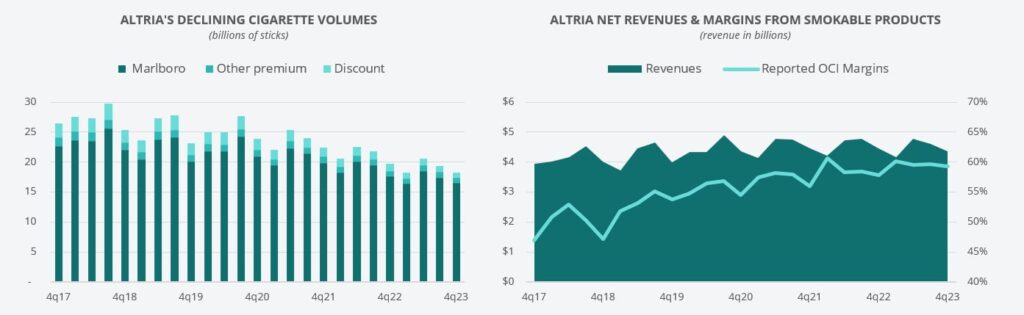

Andvari has followed Altria since we began our investment career. Profitability is extraordinary and the business requires minimal capital expenditures. Despite the volume of cigarettes having steadily declined—a great thing for our population health—Altria has still managed to grow revenues and profits with regular price increases.

Also offsetting the decline in Altria's cigarette business is the growth of its oral tobacco portfolio. Altria, and nearly all other tobacco companies, have developed or acquired multiple next generation products that deliver nicotine in a vastly safer way than cigarettes.3 These reduced risk products continue to grow rapidly. For example, Altria's on! brand of nicotine pouches is growing volumes at an annual rate of >30%. Over a long period of time, the reduced risk products will make up most of the revenues and profits for Altria and other tobacco companies.

As to why Andvari started a position in Altria, it boils down to a combination of a business with excellent qualities and simple math. Andvari likes the business for its high margins, low capex requirements, and predictable revenues. The business also has extraordinary pricing power arising from its addictive products—a nice hedge against inflation.

Then there’s the welcome news of Altria raising cash from its BUD stake (roughly $2.1 billion if they obtain an average selling price of $60 per share for BUD) it will use to repurchase its shares. This is a rational choice because Andvari believes Altria shares are undervalued. Further, with fewer outstanding shares, Altria will have smaller total dividend payments to shareholders.

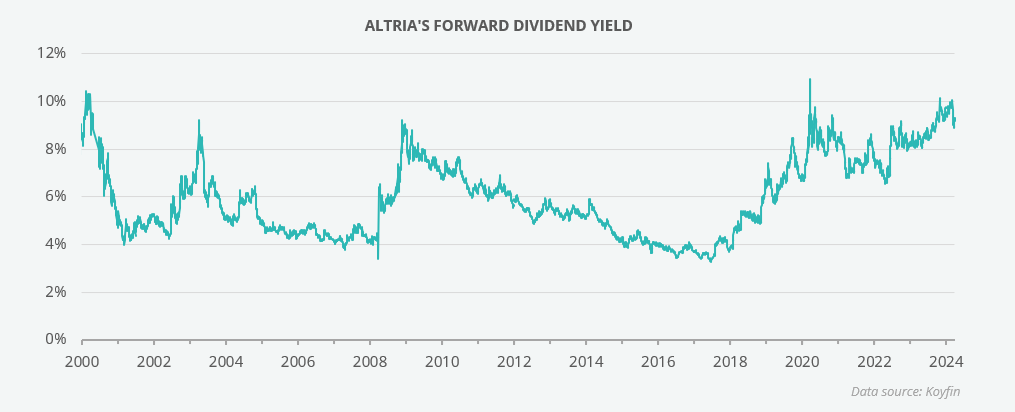

The math behind our purchase is simple. The dividend yield on Altria shares was at a level seen only two other times since the year 2000. Thus, Andvari purchased a security at a 9.7% dividend yield that can grow its dividend per share at an annual rate of 2%–3%. The odds are with us this type of investment will provide good long term returns.

ANDVARI TAKEAWAY

We're pleased to report positive results for this quarter and the positive developments at Kelly Partners and CoStar. The businesses within our investment portfolio continue to focus on their respective opportunities and all the things within their control. In the short term, the rapid rise in interest rates negatively impacted the market prices of many securities, but at the same time, it opened new investment opportunities for Andvari.

Over the long term, Andvari remains optimistic we can provide investment results that will make a difference for our clients. We intend to do this by investing in great businesses with great managers that have ample opportunities to deploy capital at high rates of return.

As always, I love to hear from clients and anyone else. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

DISCLOSURES AND END NOTES

* Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13, managed under the primary Andvari investment strategy. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees—assumed to be 1.25% per annum, paid quarterly, as currently advertised—net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The exchange traded funds (ETFs) are listed as benchmarks and are total return figures and assumes dividends are reinvested. The SPY ETF is based on the S&P 500 Index, which is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The IWM ETF is based on the Russell 2000 Index, an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal. Investment strategies managed by Andvari Associates LLC may have a position in the securities or assets discussed in this article. Securities mentioned may not be representative of the Andvari's current or future investments. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.

- Brokerage firm Schwab describes over-the-counter securities as ones “that are not listed on a major exchange in the United States and are instead traded via a broker-dealer network, usually because many are smaller companies and do not meet the requirements to be listed on a national exchange.”[↩]

- South African brewer SAB acquired Miller in 2002 to form SABMiller, with Philip Morris retaining a 36% ownership share. In 2015, Anheuser-Busch InBev acquired SABMiller.[↩]

- Nicotine itself is not the primary cause of smoking-related diseases. The smoke produced by the burning of a cigarette contains over 6,000 chemicals, of which 100 have been classified as causes or potential causes of smoking-related diseases such as lung cancer, cardiovascular disease, and emphysema. Thus, tobacco companies have created products that do not require the burning of tobacco to deliver nicotine. Altria has research showing the reduction of harm in their smokeless tobacco, heated tobacco, and e-vapor products.[↩]