Recently, Andvari’s founder and Chief Investment Officer, Douglas Ott, discussed Mars Incorporated in a Preferred Shares podcast. Preferred Shares was created in partnership with Lawrence Hamtil (co-founder and principal at Fortune Financial Advisors) and Devin LaSarre (author of the Invariant newsletter). The podcast explores the forgotten and lesser-known subjects of business, history, and business history.

In this latest episode, Douglas, Lawrence, and Devin discuss the history of Mars, its culture of quality and excellence, its extreme secrecy, how and why it got into the pet food and pet care business, and many other interesting anecdotes. Below is an edited transcript of a portion of the podcast where we discuss the corporate culture of Mars Inc.

LAWRENCE HAMTIL

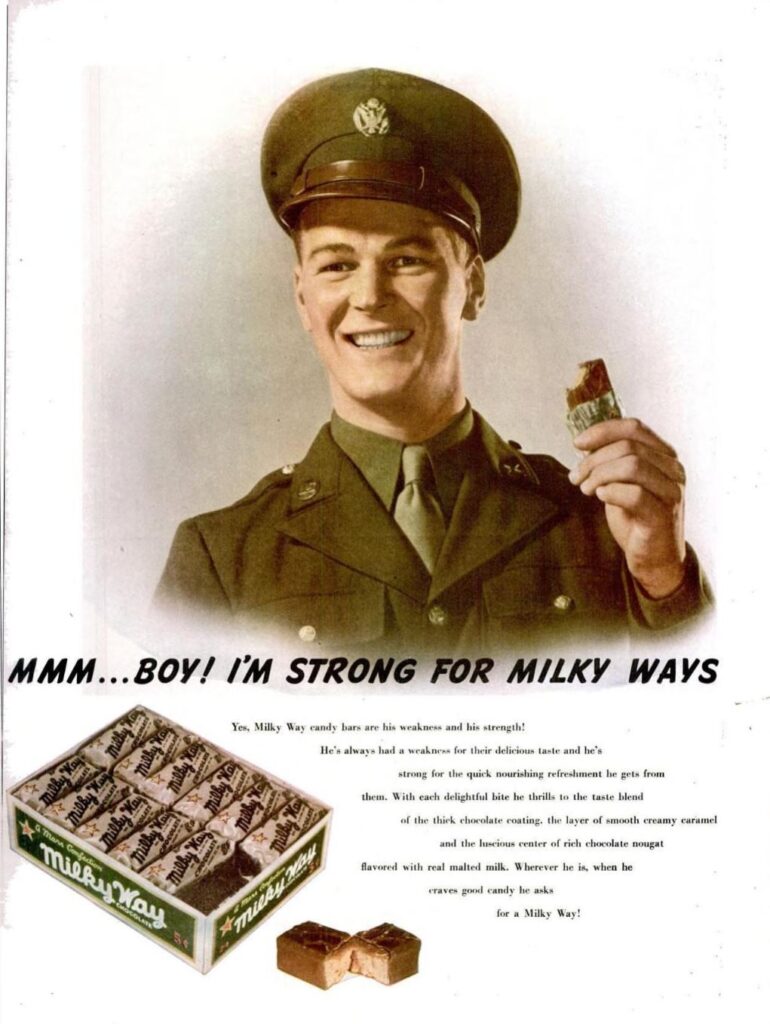

So along the way, Frank Mars has a heart attack or a stroke. He ends up passing away. And Forrest goes back to the US to claim his share of his father's company. And he eventually, I think this is sort of a polite way to put this, but he kind of bullies his sister and some other holders into selling him their shares and so he combines his father's company with his company and that is really where the modern Mars story begins. He then pretty much overhauled the corporation from that standpoint. He got rid of a lot of executives he thought were just hangers on and people who were there to cash a check. He got rid of corporate cars, corporate expense accounts. One of the funny stories is that he was so dramatic he gets down in the boardroom in front of the employees and says, "I'm a godly man. I'm going to pray. I pray for Milky Way, I pray for Snickers." He's basically saying Mars better be your religion because this is what we do here. Profit is the goal and that's the only reason we show up to work.

DOUGLAS OTT

And another example is this mix of thriftiness and egalitarianism. He knocked down almost all the walls of the corporate headquarters. There are no offices for managers and employees. It was an open floor plan.

LAWRENCE HAMTIL

Also, everybody knew what everybody else was making. There was nothing hidden as far as their salaries are concerned. So, it's sort of like part Adam Smith, part Mao Tse-Tung, as far as Forrest's corporate ideology went. But one of the interesting things was he was always interested in streamlining. Unlike a lot of chocolatiers or confectionary entrepreneurs, he was always focused on making the highest quality products with the least amount of human interaction. If you think about that, it's a big deal, because human interaction introduces chances for germs and impurities.… He invested large sums of money back into the company, never relied on debt, and as far as we know, didn't take many dividends out for himself. He had a time card just like his employees did. His children, when they went to work for the company, were given time cards.

DOUGLAS OTT

That's another interesting thing, Lawrence, is I don't know if that policy is still in effect, but everyone had a time card to punch in, even the CEO, like you said. And if they were on time for work throughout the entire year, you got a 10% bonus, right?

LAWRENCE HAMTIL

I think that's true and everybody's compensation was tied to the performance of the company. So you sank or swam together. The company makes more money, you make more money. The company sales are down, your salary is also going down. So everybody was very much sort of the mindset that this is a team, this is what we're out to build, and our goal is not just to make money but also to dominate.…

DOUGLAS OTT

Other areas of the company's operations also speaks to that striving towards the highest quality. Another example is that they overpay their employees and managers. In one or two articles I read, it said the pay is two times that of a similar position for one of their competitors like Nestle or Hershey. Two times the compensation! And that affords Mars the ability to pick the cream of the crop in terms of employees and managers.

If you'd like to hear the full conversation about Mars, please follow this link to the Preferred Shares podcast.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had no position in any company mentioned. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2023 Andvari Associates LLC