It’s now been forty years since the founding of Autodesk. The company started from nothing and its AutoCAD product is now the de facto standard in two-dimensional computer aided design (CAD) software. Millions of engineers, designers, and architects around the world use Autodesk's software to aid them in their work.

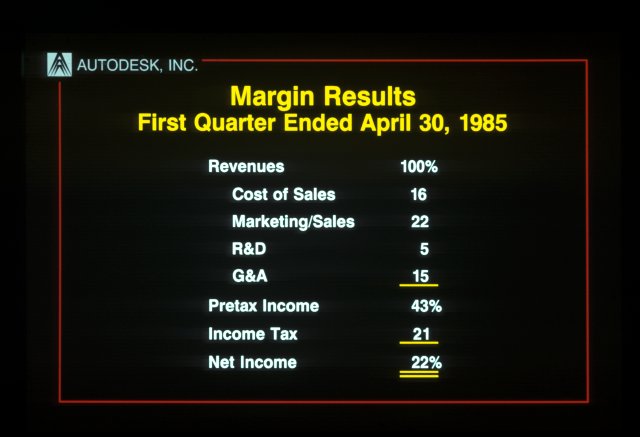

Andvari has long considered Autodesk to be a high quality company. Due to the mission-critical nature of Autodesk products to its architect, design, and engineering customers, Autodesk has long had predictable and growing revenues, high margins, and high returns.

As with all companies in which Andvari is interested, we go back as far as possible to learn about the founders and the evolution of the business. Although Autodesk had over a dozen co-founders, there are really two that are most important: John Walker and Dan Drake. Below, we summarize some of Dan Drake’s important insights we gleaned from a 2005 and 2020 interview.

SOFTWARE STARTUP COSTS ARE DE MINIMIS

One of the reasons Andvari likes software businesses is that it takes very little capital. Even back in the early 1980s, when programmers lacked the super cheap resources they have today, it required little capital. Autodesk’s founders put in just a little over $59 thousand in cash and they were off to the races.

SPREADING BETS

The founders of Autodesk knew there was a lot of money to be made in the software business, but they did not initially know which direction they wanted to go. However, they did know that 80% of startups failed. Thus, they decided to spread their efforts across five different projects. Whichever project became a hit, they would stop everything else and focus on that one. AutoCAD became the hit.

The simple lesson here is it can make sense to spread your bets, especially if you don’t have a clear idea yet of what you want to do. But if and when you find the clear winner, it’s best to go all-in on it!

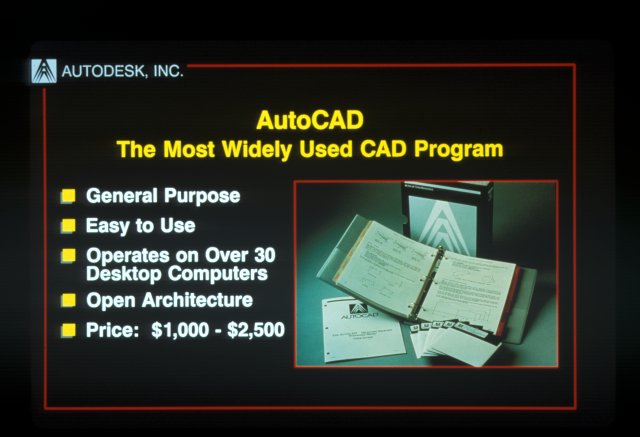

DIFFERENTIATING FROM THE COMPETITION

There were CAD programs in the 70s and 80s, but these were extremely expensive and the software only worked on proprietary machines. If you wanted the software, you had to buy the machine as well. Autodesk differentiated themselves by selling cheap software that could be installed on nearly any personal computer at the time. In 1985, at a time when PCs were not that standardized, AutoCad could work on 31 different PCs. Regarding the price of AutoCAD, Autodesk chose $1,000 as the starting price for the base version because this compared very favorably to the typical $10,000 price point an architect would pay for a proprietary workstation with CAD software.

WHY THE GIANTS NEVER CAME AFTER AUTODESK

The giant tech companies of the day (e.g., IBM, Computervision, and Intergraph) could have crushed Autodesk if they had wanted. The reason it didn’t happen is they didn’t have the will to disrupt their own business model of selling CAD software that was tied exclusively to expensive machines. According to Drake, “[T]hey couldn’t afford to compete with themselves. It would undermine the entire big business.”

The investing lesson here is to try to find a company which has few if any true competitors. In Autodesk’s case, it only competed against other tiny CAD companies at first. Next, because the giants chose not to disrupt their own business to compete against Autodesk, they slowly lost all of their business to a small start-up.

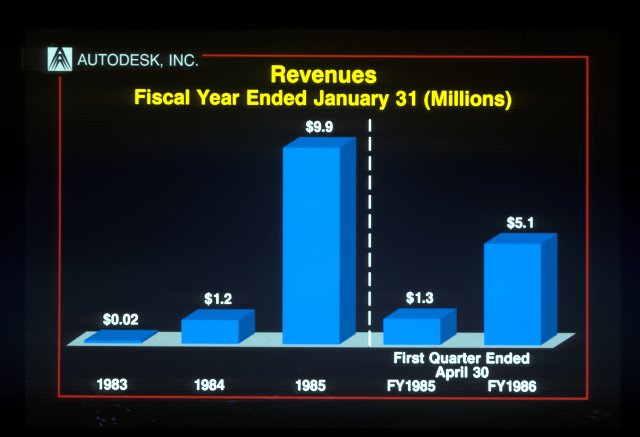

ASTOUNDING GROWTH AND PROFITS

Autodesk achieved astounding growth in its first ten years of existence. Architects and engineers loved its low-priced software that could work on cheap, non-proprietary computers. Autodesk got started in early 1982 without any idea that it would be making and selling CAD software. The company then went public in 1985 with $10 million in revenues. Annual revenues reached $100 million in 1989. Annual revenues in 2022 were $4.4 billion. All this from a group of founders bootstrapping their company with $59 thousand in cash and some computer equipment.

FROM FOUNDER-LED TO PROFESSIONALLY MANAGED

Drake also related that “techies” typically aren’t suited for taking on management responsibilities. It takes a different type of person to be a good manager:

"One thing in management, you have to have a lot of tolerance for people who don’t do things right, and a lot of patience in telling them over, and over and over again, because they keep doing it wrong. None of us was very well qualified for that. Yeah, so [Walker] learned to play these games of pleasing the analysts and so on, but they’re no fun and they distract you from running the company. They are detrimental to the company."

Walker led the company since its founding and only lasted until 1986. Walker had several reasons quitting. First, he enjoyed programming more than running the company. He also knew he was a poor candidate to lead and grow the company from $10 million to $100 million in revenues. Finally, the pressures of leading the company were detrimental to his health.

Andvari knows too well that evaluating management is one of the hardest things to do. We prefer skilled managers who have significant wealth tied to the value of their company. This frequently, but not necessarily, means that a founder is still leading the company in which we’re interested. Two important questions we always wrestle with are: (1) whether a founder has the ability to lead their company for another decade and (2) whether a founder has the self-awareness to recognize when they need to hand the reins to someone else.

ANDVARI TAKEAWAY

We hope you found these historical tidbits about Autodesk to be interesting and helpful. In addition to learning more about a specific company, studying corporate history frequently reinforces important business and investing concepts. What’s most impressive about Autodesk is how little capital it took to start a company that would go from zero revenues to over $4 billion in 40 years. Yet another example of how amazing a software business can be.

Sources and Additional Reading/Viewing

- “Autodesk Oral History Panel”, Computer History Museum, recorded October 15, 2020

- Dan Drake interview by Robert Cringely for NerdTV on October 14, 2005

- “Chapter 8: Autodesk and AutoCAD”, The Engineering Design Revolution by David E. Weisberg

- Autodesk IPO Road Show Slide: 1985

- The Autodesk File: Bits of History, Words of Experience, edited by John Walker

- Autodesk Fiscal Year 1986 annual report

- RetroCAD: AutoCAD Version 1. For the true computer nerds out there, this is a very cool video demonstrating one of earliest versions of AutoCad operating on a DOS-based PC.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had no position in Autodesk. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC