A recent report found that nearly a fifth of S&P 500 CEOs spent part of their careers at just two companies: General Electric (GE) and Procter & Gamble (P&G). This is not terribly surprising. First is simply the large size of these global behemoths. But perhaps more important is that both, over multiple generations, have done an extraordinary job of internal development of young executives and managers. Knowing the location of outstanding “executive training grounds” that are producing the next great crop of CEOs is one part of Andvari’s process in finding investment opportunities and judging the quality of leadership.

GE'S CORPORATE UNIVERSITY

Let’s demonstrate by using GE. The company was the first to establish a corporate university in the country. It did so by purchasing in 1956 a 50+ acre site in Crotonville, NY for its Management Research and Development Institute.

Despite its troubles in the recent decade, GE developed numerous executives who climbed the ranks within GE and then led other public companies. Here are some of the most notable examples:

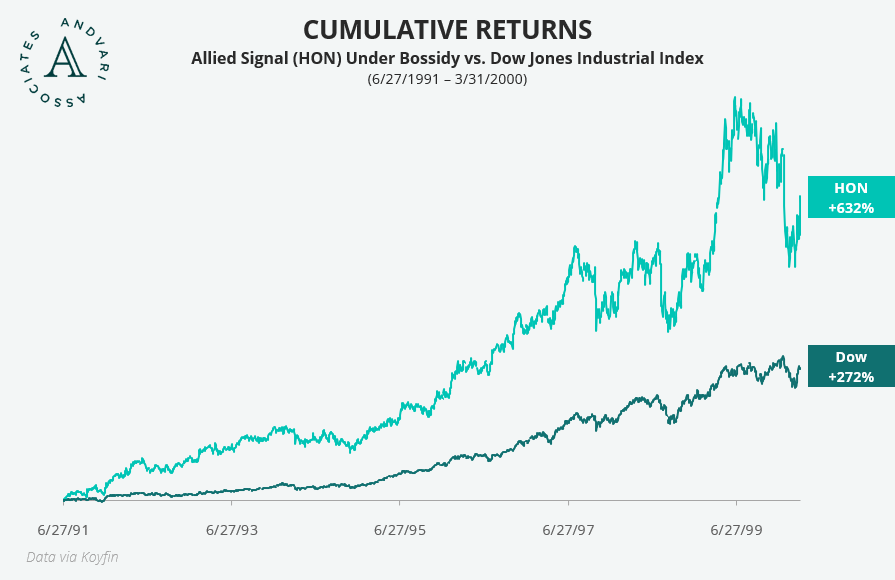

- Larry Bossidy joined GE in 1957 and rose through the ranks over the next 34 years. Because Bossidy was too close to the mandatory retirement age at GE, he left in 1991 to become CEO at Allied Signal, a company in need of turning around. Bossidy executed a successful turnaround and his career culminated with Allied acquiring Honeywell. For more on Bossidy, see Andvari’s blog, “The Cultural Component to 10-Bagger Returns”.

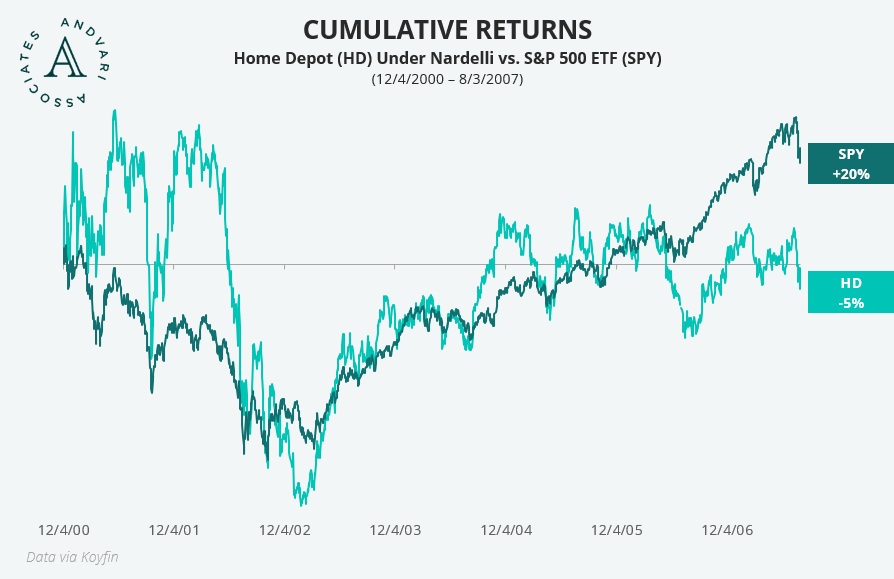

- Robert Nardelli joined GE in 1971 as an entry-level engineer. He worked his way up and eventually became CEO of GE Power Systems. Nardelli lost out to Jeff Immelt to become GE’s next CEO. Nardelli then became CEO of Home Depot in December 2000 and then CEO of Chrysler in August 2007.

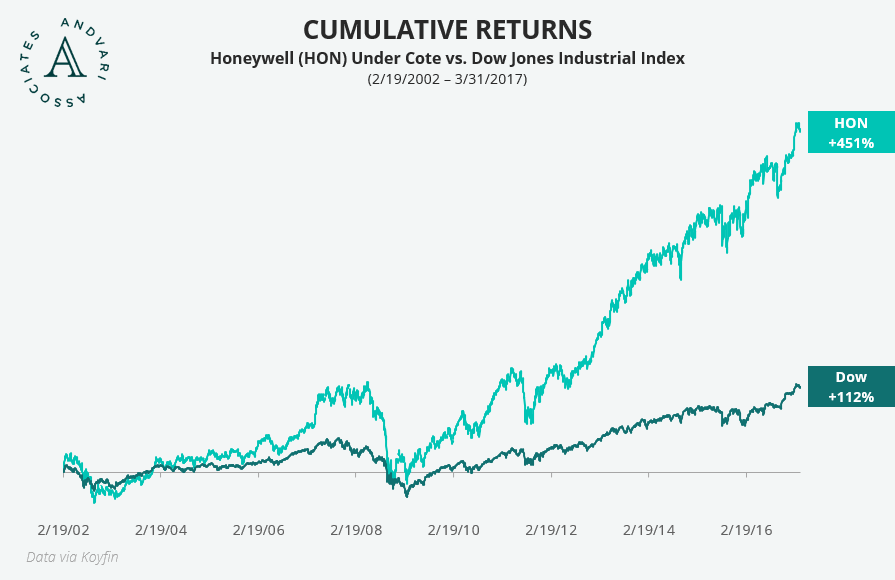

- David Cote started working at GE in 1974 as an hourly laborer on the nightshift while he attended college. Cote joined GE full-time in 1976 and became CEO of GE Appliances in 1976. He was also passed over for Jack Welch’s position. Cote left GE to become CEO at Honeywell in 2002, where he created extraordinary shareholder value during his tenure. He stepped down as Honeywell CEO in March 2017.

- Joseph Hogan started at GE in 1985 and advanced through the Plastics division. He led GE Medical Systems and then GE Healthcare beginning in November 2000. Hogan then left GE to lead ABB Group (a large manufacturer of industrial equipment based in Switzerland) in September 2008 at the age of 51. Hogan then became CEO at Align Technology in June 2015.

- Scott Donnelly started at GE in 1989 as a manager in the Ocean Systems Division. He worked his way up in several different divisions and ultimately became CEO of GE’s jet-engine business. He left GE in July 2008 to become COO at Textron. Donnelly then became CEO of Textron in December 2009 where he still serves as CEO as well as Chairman.

GE certainly has a storied history of developing executives who can lead large organizations. However, for the GE executives who left to lead another public company, their track record for producing decent returns for shareholders has been mixed.

If one had followed Nardelli to Home Depot, the returns would have been slightly negative. If one had been a shareholder of Allied Signal during Bossidy’s leadership, returns would have been excellent. An investor would also have enjoyed excess returns by being a shareholder of Honeywell during Cote's time as CEO.

HOME DEPOT UNDER BOB NARDELLI

ALLIED SIGNAL UNDER LARRY BOSSIDY

HONEYWELL UNDER DAVID COTE

ANDVARI TAKEAWAY

Following the managers that earned their stripes at a high performing organization can be a useful way to identify potential investment opportunities. And it need not apply to business. Just look at the Bill Walsh era of the San Francisco 49ers. Walsh turned the last place 49ers into an organization that won 3 super bowls over the span of 8 years. After this performance, seven of Walsh’s assistant coaches would become head coaches at other teams across the NFL. These seven would earn a cumulative three Superbowl wins.

Nevertheless, it's important to remember following a leader from a lauded organization doesn't always work out. Just consider the difference in outcomes between Bob Nardelli and David Cote. Under Nardelli, Home Depot underperformed the market and Chrysler went bankrupt. On the other hand, Allied Signal shares outperformed under Bossidy, and then Honeywell outperformed under David Cote . There’s no sure thing in business, but it is still worth the time to track the managers who have graduated from their executive training grounds.

Sources and Additional Reading/Viewing

- “Allied Picks Chief and Wall St. Approves”, June 28, 1991, New York Times.

- "Jack Welch proteges who led Corporate America", March 2, 2020, Reuters.

- “Home Unimprovement: Was Nardelli’s Tenure at Home Depot a Blueprint for Failure?”, Jan. 10, 2007, Knowledge at Wharton Podcast.

- “Chrysler: The End of Bob Nardelli. Again.”, April 21, 2009, Wall Street Journal.

- “How Do You Make Better Managers?”, June 9, 2014, Slate.

- Article about GE’s famed corporate university in Crotonville

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had no position in any company mentioned. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC