One of Andvari’s largest and longest-held investments is Charter Communications, which we own via Liberty Broadband. On the back of several recent sell-side downgrades, shares of Charter have declined from all-time highs of $821 on 9/2/21 to $606 as of 12/13/21. Fears related to slowing customer additions and increasing capital expenditures are overblown. Charter is a high quality business and now is not the time to cut the cord on this investment.

Charter is the second largest cable company in the United States. It serves more than 31 million customers in 41 states through their Spectrum brand. Its network passes over 54 million households and businesses. Some of the qualitative features of Charter’s business include…

PREDICTABLE, RECESSION RESISTANT REVENUES

Customers sign up for one- or two-year contracts and pay on a monthly basis. This is also a recession resistant business. Internet, TV, and mobile phones are three things most people cannot live without. Thus, revenues and profits are extremely predictable.

HIGH FIXED COST NETWORK

Over the last two decades, the cable industry has invested over $300 billion in infrastructure. From 2016 to 2020, Charter alone has invested just shy of $37 billion. To replicate Charter’s network from scratch would be virtually impossible. Even Google, despite its vast resources, ultimately pulled the plug on its Google Fiber efforts.

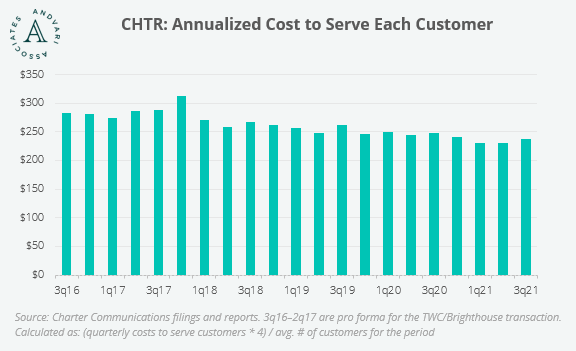

Although Charter is a capital intensive business, we love that each new customer it signs up is more profitable than the prior one. This occurs naturally with a high fixed cost network. More customers means lower costs on a per customer basis. Spreading costs—that are relatively fixed—among a greater number of customers leads to profits growing faster than revenues over time.

CAPITAL ALLOCATION AND STRUCTURE

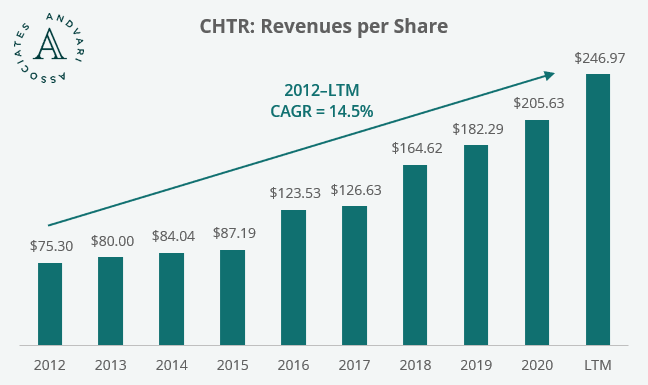

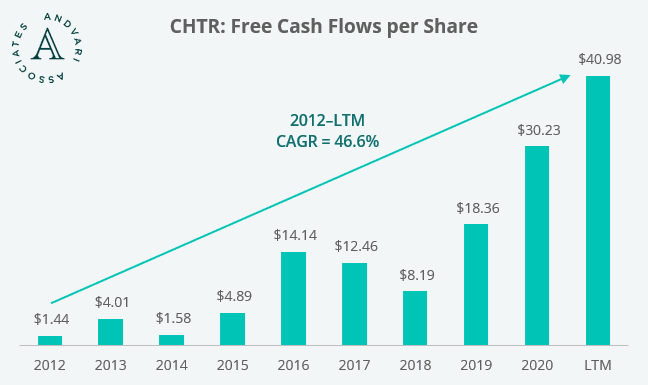

Because of the predictability of its revenues and its growth, Charter has taken on debt that it has used to repurchase its own shares. This is the heart of its levered equity return framework. Thus, as Charter has grown its revenues at mid-single digit rates and profits at high single-digit rates, on a per share basis these have grown at much higher rates.

Also, Charter’s capital structure is efficient and optimal. As of 9/30/21, the company has a leverage ratio of 4.32x (over the last twelve months, Charter has $20.25 billion of adjusted earnings before interest, taxes, and depreciation and amortization that supports a net debt load of $80 billion). The weighted average cost of debt sits at 4.5%. The weighted average life of its debt is 14.1 years.

HIGH QUALITY AND ALIGNED MANAGEMENT

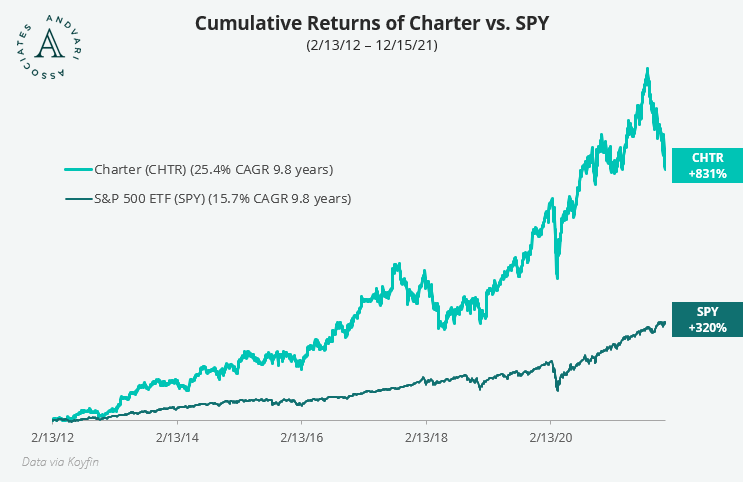

Tom Rutledge took over as CEO of Charter on February 13, 2012. During Rutledge’s tenure thus far, Charter’s cumulative share performance is 831% versus 320% for the S&P 500.

Rutledge has been richly rewarded for achieving excellent performance for all shareholders. He now owns shares of Charter worth $1 billion. CFO Chris Winfrey owns shares worth $370 million. We believe they have every desire and incentive to continue growing shareholder value over the long run.

ANDVARI TAKEAWAY

Andvari remains a shareholder of Charter through Liberty Broadband because of the quality of the business and a superb management team that is aligned with shareholders. We particularly like the predictability and resilience of the business. Given the decline in share price since September, we expect Charter to outperform the market over the next five years. If you'd be interested in a more detailed report on Charter, please contact us.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had a position in Charter via its ownership of Liberty Broadband. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC