Doma is a recently public company that is taking on the most antiquated portion of the home purchase market: the title, escrow and close portions. Doma has some excellent qualities Andvari likes to see in a potential investment. It's founder-led and it's the founder's second act. Incumbent competitors are at a disadvantage having prospered too long based on inertia rather than innovation. Finally, the financials can scale extraordinarily quickly as Doma gains name recognition, takes market share, and expands into adjacent lines of business.

What Does Doma Do Exactly?

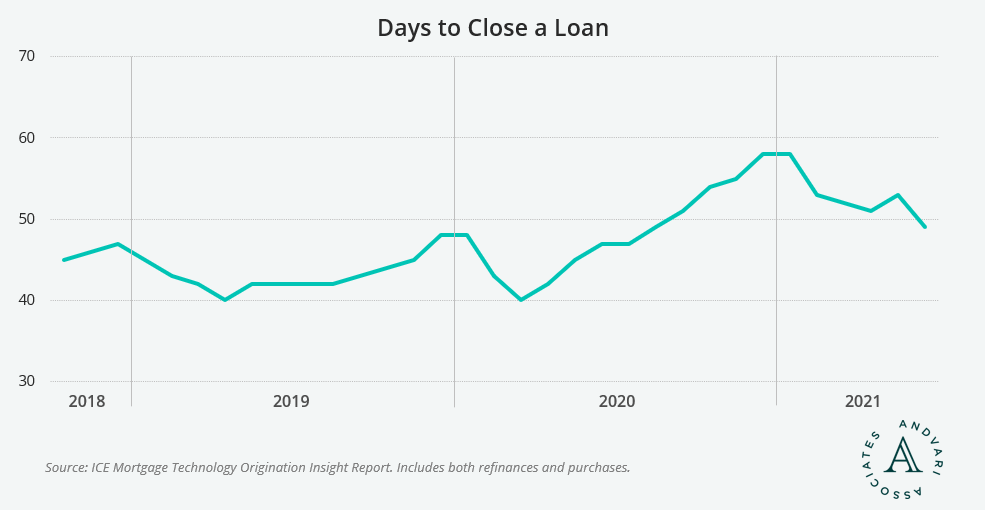

Doma has created a platform that "seeks to eliminate all of the latent, manual tasks involved in underwriting title insurance, performing core escrow functions, generating closing documentation and getting documents signed and recorded." The platform accomplishes this by using data analytics, machine learning and natural language processing. Looking at just the title portion of Doma's services, Doma can underwrite title insurance in mere minutes as opposed to the usual 3–5 days it would take one of its legacy competitors. If a lender uses all of Doma's services, the typical 40 to 50 day mortgage closing time can be shortened by 15 to 25%.

Second Act of an Already-Proven Founder

Max Simkoff founded Doma in 2016 and remains the CEO. However, this is not the first company he founded. Max previously co-founded Evolv in 2006 and sold it in 2014 to Cornerstone for over $40 million. Evolv used similar technology as Doma, but instead applied it to evaluate the skills, work experience and personalities of a company's employees and job candidates. The fact that Simkoff has experience creating a successful business based on similar technology increases the odds he will be successful in this second act.

Fat and Lazy Incumbents

The big four legacy providers of title & escrow services are Fidelity National Financial (FNF), First American Financial (FAF), Old Republic (ORI) and Stewart Information Services (STC). The four have 80% market share in the US. For the past few decades they have just coasted on the benefits they've accrued as they consolidated the market.

These legacy providers have had little incentive to invest to the extent Doma has. Trying to catch up to Doma now would mean spending upwards of $65 million over many years. And even if they were successful in catching up in terms of technology, they'd still have to lower their fees to match Doma's level. This is a "high risk, low reward" proposition from the perspective of the incumbents.

One great piece of advice that applies to life, sports, and investing: "Go to where the competition isn't." Looking at the competitors Doma has, it's as if they don't have competition. From Andvari's perspective, we like situations where there is little to no true competition as it increases the odds of success.

Growing Revenues and Capturing Market Share

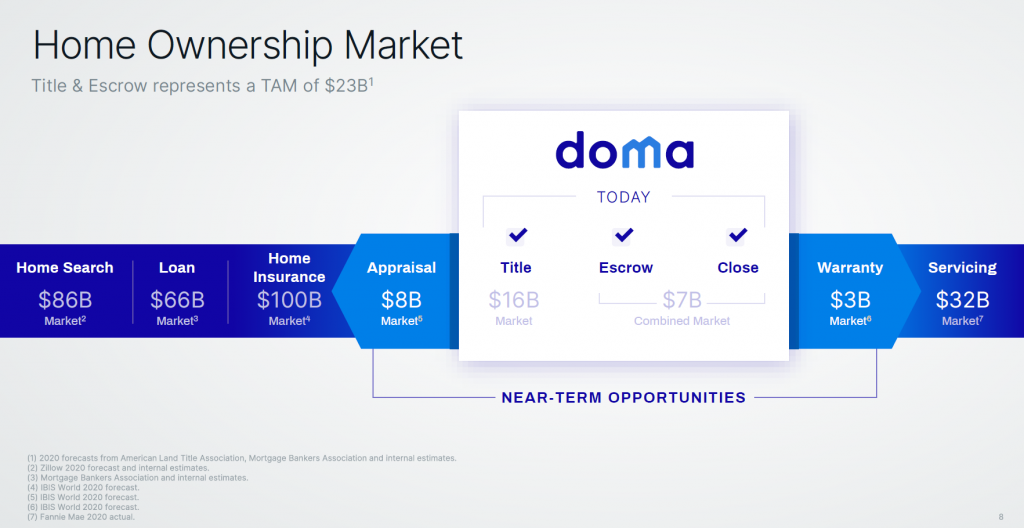

Another great thing about Doma is they operate in a large and steadily growing U.S. residential real estate market. In 2020, there were nearly 6.5 million homes sold. There were also 12 million mortgage originations with 40% from purchases and 60% from refinancings. Virtually all these mortgages required the services (title insurance, escrow, and closing) that Doma can provide.

Scaling the Business

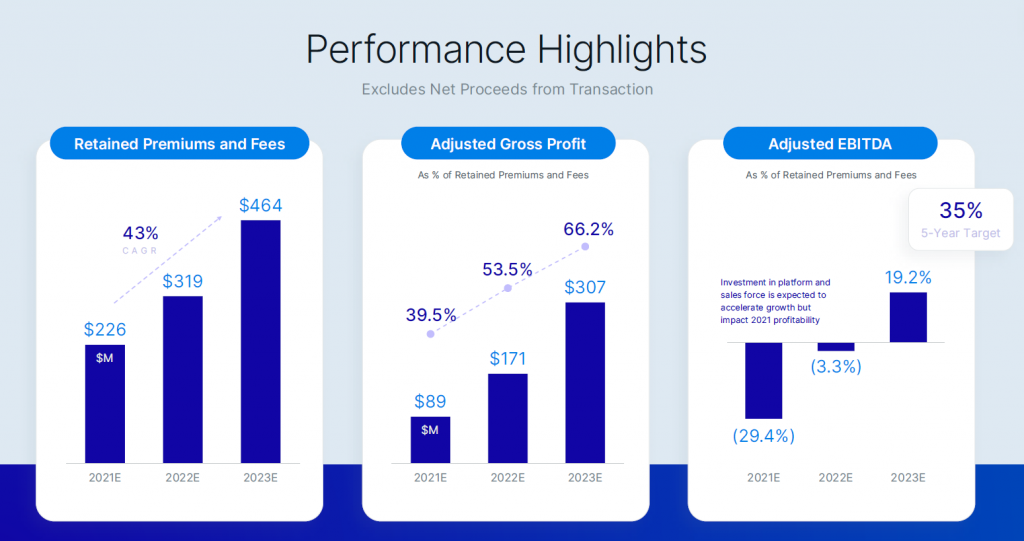

As the disruptor in their small, $23 billion section of the nearly $320 billion home ownership market, Doma has grown and can continue to grow quickly. They will do this organically, through acquiring other small title agencies and plugging them into their platform, and by expanding into adjacent services like appraisal and warranty. It seems highly likely that Doma can meet their goal of doubling revenues in the next 3 years. In the process, their market share will go from 1–2% to nearly 5%. Given their tech advantage, it also seems highly likely Doma will eventually be as or more profitable than their legacy competitors.

Andvari Takeaway

Doma has some great qualities that Andvari believes can make for a potentially good investment. This company is founder and CEO Max Simkoff's second act. He built and sold a company before which makes it more likely he can do it again, perhaps with even greater success. Doma has created a much better service that is both cheaper and higher quality. Finally, the incumbent competitors have been lazy and it seems inevitable they will cede more market share to Doma.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. Andvari clients do not currently have a position in Doma. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC