Andvari is pleased to share a shortened version of our recent research report on Novanta (NOVT). We provide a summary of the important intangible business qualities we seek. We also share a full summary of the corporate history that led to a Chapter 11 bankruptcy and then subsequent amazing turnaround.

Access to the full, 13-page thesis is available through our client/prospective client document portal. If you would like access to the portal or the individual report, please contact Info@AndvariAssociates.com.

Executive Summary

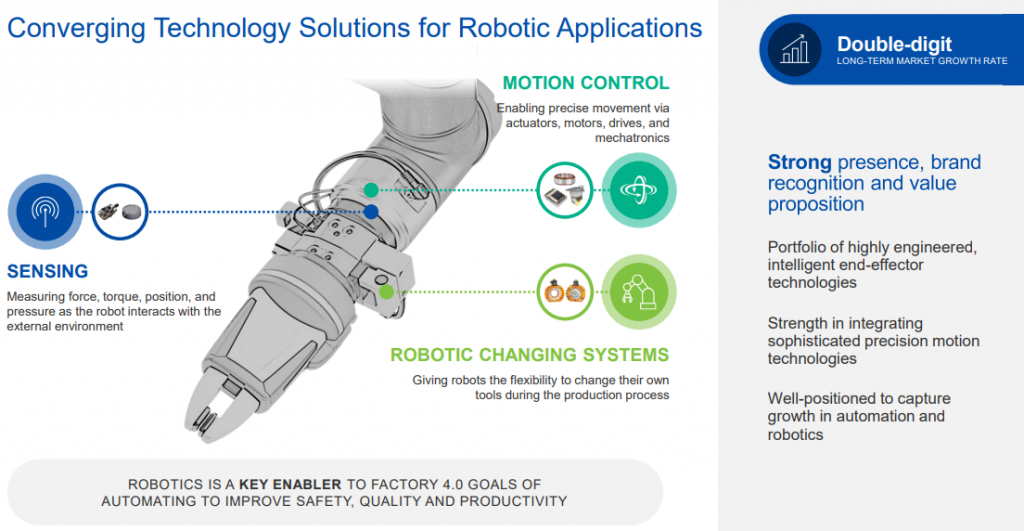

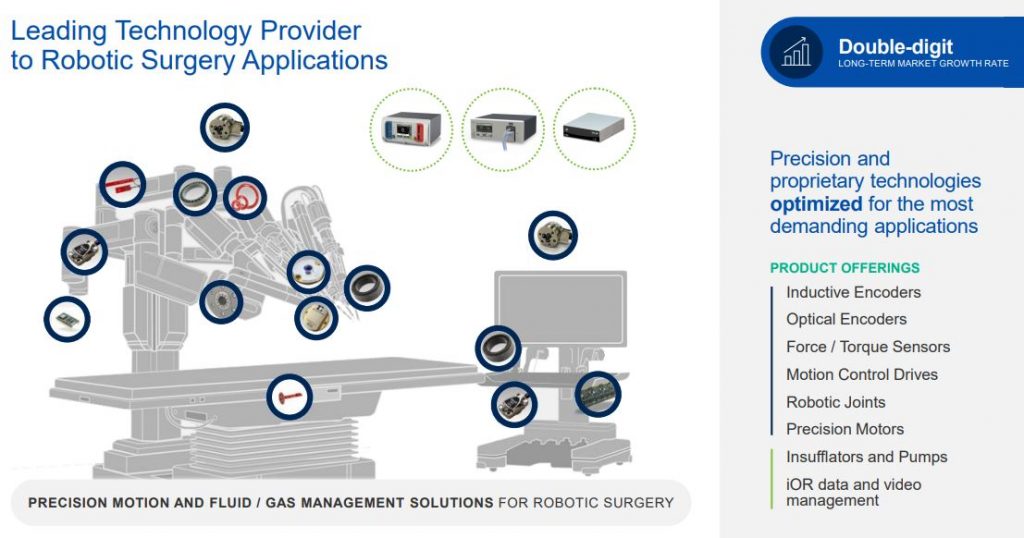

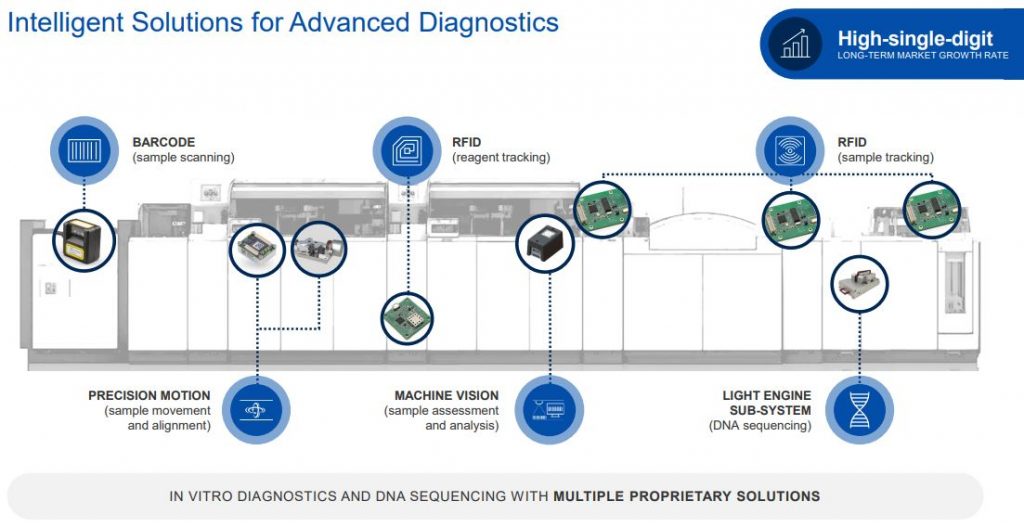

Novanta supplies technology solutions to medical and advanced industrial original equipment manufacturers (“OEMs”). The company has deep proprietary expertise in photonics, vision, and precision motion to engineer core components and sub-systems. Since 2012, revenues have grown from $225 million to $835 million. Free cash flows and operating profits have grown at an even faster rate.

The company has several attributes that has driven and will continue to drive its success. First, Novanta management have been adept capital allocators. They’ve divested businesses with limited prospects and have acquired over half a dozen companies with brighter futures. The M&A process prioritizes cash returns and return on invested capital.

Second, the products sold by Novanta’s subsidiaries add a huge amount of value for being a relatively minor part of the total cost. Further, these products are designed into OEM systems with typical life spans of 7–10 years. This gives them pricing power and predictable streams of revenue. Third, Novanta has an active and effective R&D department which is launching new products at an ever-increasing rate and driving a high-single-digit organic growth rate.

Finally, the company has their “Novanta Growth System” (NGS), a system of continuous improvement and lean manufacturing. This has helped sustain and improve improved both margins and revenue growth. Novanta is able to consistently realize synergies and extract additional value from acquisitions after implementing NGS. Also important is the fact that there are many former Danaher managers and executives now at Novanta.

With a current revenue base of ~$835 million, Novanta has ample room to grow organically and via M&A. Further, Novanta will improve over time through application of NGS. Andvari believes Novanta will grow revenues at high single or low double-digit rates and cash flows at a slightly faster rate. At the current share price, Novanta can provide shareholders annualized returns in the range of 10%–13% over the next 8.5 years.

History

The history of Novanta begins with two companies, General Scanning, Inc. (GSI) and Lumonics. GSI was founded in Massachusetts in 1968. Lumonics soon followed, incorporating in 1970 under the laws of Ontario. Both GSI and Lumonics designed, developed, manufactured, and marketed laser-based advanced manufacturing systems for semiconductor, electronics, aerospace, and automotive industries. In 1999, they combined in a merger of equals to create GSI Lumonics, Inc. This created the largest publicly traded company in the industrial laser systems industry. Charles Winston, the CEO of GSI and former management consultant, became the CEO for the newly combined company.

Over the next 10 years, GSI Lumonics acquired more companies to expand its product offerings, addressable industries, and geographic markets. At the same time, they were divesting non-core, lower margin business lines. Management eventually transitioned its focus to developing laser products and components for OEMs instead of selling fully integrated laser systems directly to end markets (a trait that continues to define Novanta today).

In 2006, Dr. Sergio Edelstein took on the role of CEO after Charles Winston stepped down. Edelstein’s tenure would be brief due to a disastrous turn of events. In 2008, GSI acquired Excel Technology for $360 million in cash. GSI took on $210 million in debt to help fund the transaction. Soon after, GSI failed to file quarterly reports to the SEC due to discovered accounting errors. Upon further investigation, accounting errors had tainted multiple years of reports. The failure to file quarterly reports breached the terms of their debt, but senior creditors agreed not to take any actions if GSI brought in financial advisors.

In the following months, Sergio Edelstein resigned as CEO, GSI’s market cap plummeted from $325 million to $31 million, their shares were delisted and put on the pink sheets, and by mid-2009 they entered into a pre-agreement Chapter 11 bankruptcy. GSI also recorded a $215 million impairment charge to goodwill and Stephen Bershad, a major shareholder, urged shareholders to replace the existing board.

GSI emerged from Chapter 11 in 2010 with the company’s prior shareholders retaining approximately 86.1% of the company’s capital stock. The remaining 13.9% of the capital stock was issued to the holders of the senior notes, and their $210 million in debt was restructured to $107 million. 5 members of the board resigned, Stephen Bershad was added as a director, and John Roush was hired as CEO.

Under the new leadership, GSI would prioritize long-term growth instead of short-term margins, seek out acquisitions primarily in the medical devices market, and divested 12 businesses with limited growth prospects. By 2016, 45% of total revenues would be from medical sales, and GSI was renamed to Novanta. With the turnaround of the business complete, John Roush stepped down as CEO and passed the reins to Matthijs Glastra, the COO of Novanta. Since Glastra became CEO on August 2, 2016, Novanta’s share price increased from $15.55 to $112, an annualized rate of growth of 40%.

After consistently divesting underperforming businesses and reinvesting the proceeds into businesses with secular growth trends, Novanta transformed itself from a distressed company entering chapter 11 to an 11-bagger in 11 years.

Again, access to the full, 13-page report is available through our client/prospective client document portal. If you would like access to the portal or the individual report, please contact Info@AndvariAssociates.com.

_________

_________

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. At the time of publication of this blog, Andvari clients had a position in Novanta. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC