Dear Friends,

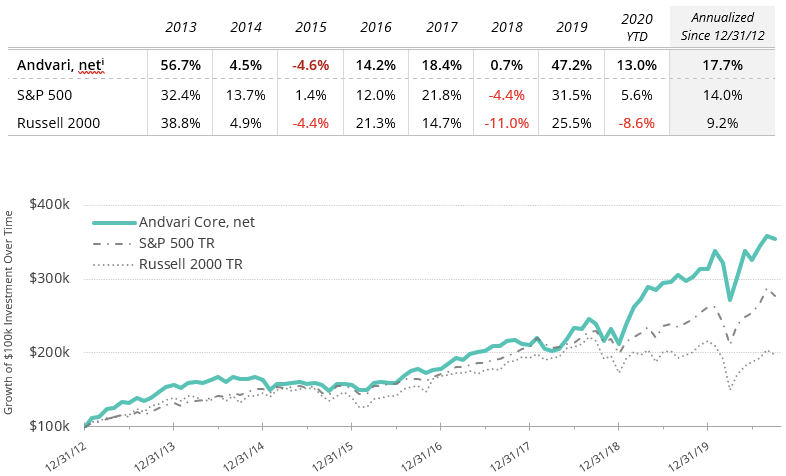

For the first nine months of 2020, Andvari is up 13.0% net of fees while the S&P 500 is up 5.6% (see Disclaimers at bottom). Please note we have updated the historical performance figures below to assume our recently increased management fee of 1.25% per annum for new clients with accounts less than $1M (up from 1.0%) has been in place for all clients since inception. Andvari clients, please refer to your upcoming reports for your specific performance.

The table below shows Andvari’s performance against two benchmarks while the chart shows the cumulative gains of $100,000 investments.

Market Commentary

Markets continued their rebound from March lows. The S&P 500 advanced in July and August. The index reached a new all-time high in early September and then declined to produce a negative return for the last month of the quarter. Volatility in the markets will likely increase over the next quarter or two. First, there’s uncertainty around the November elections. Second, there’s uncertainty around the size and timing of the next round of fiscal stimulus for the economy. Third, there’s uncertainty on how bad or good the upcoming flu season will be.

As always, the unpredictable outcomes of political and economic events have little to no bearing on Andvari’s investment strategy. The companies we currently own and the companies on our watch list are highly likely to flourish over the long-term in all types of environments. Andvari’s job is to stick to our investment process and to focus on what is most knowable and predictable.

Andvari Holdings

The biggest portfolio news pertains to two of our core holdings. Liberty Broadband announced it would acquire GCI Liberty in an all-share transaction. Liberty will give GCI shareholders 0.58 shares of Liberty for each share of GCI they own. This combination will result in Liberty Broadband becoming Andvari’s largest position at nearly 20% of total net assets. Importantly, Liberty will have a highly valuable collection of assets after this transaction. It will own a 26% stake in Lending Tree and 100% of Alaska’s largest cable company. Broadband’s crown jewel will be its stake in Charter Communications. Charter is the second largest cable company in the U.S. and has the best management team in its industry.

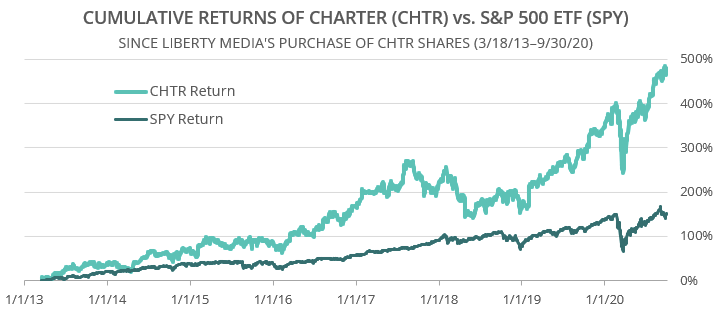

Andvari has understood the attractiveness of U.S.-based cable systems since we officially began working in the investment profession in 2009. In fact, our investment in Charter pre-dates the founding of Andvari itself. Friends and family that followed us to Andvari were invested in Liberty Media over eight years ago. Liberty Media then acquired a 27% stake in Charter on March 18, 2013, and then eventually spun that out into Liberty Broadband.

The U.S.-based cable systems have monopolies in the communities in which they operate. Their revenues are highly predictable with customers signing annual (or longer) contracts. Furthermore, cable companies have an advantage over the traditional telecom companies (AT&T and Verizon) when it comes to delivery of broadband internet. Due to the nature of their infrastructure, cable companies can deliver the highest per dollar amount of internet speed and can upgrade the speed in the future at significantly lower relative cost. Cable companies will continue to benefit as more households consume their media and entertainment via the internet. We have added to and allowed our interest in Charter to grow over time. We remain bullish on the company and its ability to deliver great value to its customers and to us as shareholders.

Repeatable Process and Concentration

Andvari has outperformed the market since inception for two, big reasons. First, is a repeatable framework around our investment process. Second, is our ability and willingness to concentrate in the best ideas that arise from our process. To be clear, we do expect the markets to work against us at any point and potentially for extended periods of time. In the long run, however, we believe a disciplined process provides us with the foundation to be successful and ultimately beat the market.

Qualitative Assessments

Regarding the repeatability of our investment process, it starts with Andvari’s watchlist of 100+ companies. We have curated this list—over the eleven years of our professional career—based on three, general criteria. First, we focus on the qualitative aspects of a company that can skew the odds of excellent shareholder returns in our favor. Second, we seek companies with attractive growth profiles. Finally, we seek companies with opportunities to reinvest their cashflows at high rates of return for many years. Andvari then removes or adds companies to our watchlist or current portfolio depending on whether there’s deterioration or improvement in any of these criteria. The longer we can remain invested in companies with high marks in quality, growth, and reinvestment opportunities, the longer we can compound our capital at hopefully high rates.

Understanding the qualitative is the most time-consuming part of Andvari’s process. Here, Andvari wants:

- An understanding of the full history of the company and how it has evolved over time.

- Excellent managers of the business who are motivated by more than just money. We favor founders who are still running the business.

- We are attracted to entrepreneurs and leaders with unique, non-traditional backgrounds.

- Managers and employees whose wealth is tied to long-term results.

- Managers with a record of saying what they will do and doing what they say.

- Managers that focus their energy on customers and running the business, not promoting the company to investors.

- Directors on the Board that are tangibly additive, not just rubber stamps.

- A corporate culture that will increase the likelihood of excellent results.

- Competitively advantaged business models.

Growth Profile

For the growth part of our investment process, Andvari makes its own assessments of the total addressable market for a company. We seek answers to questions like:

- Are revenues predictable or variable?

- Is revenue growth sustainable for the long-term or is recent growth related to a temporary fluke or fad?

- Is the company benefiting from rules and regulations or are they inhibited by them?

- Is the industry consolidating?

- As the business grows, are profits likely to increase at a faster rate?

- Is fast revenue growth likely to attract undisciplined competitors?

Reinvestment Opportunities

Although opportunities for reinvestment overlap with growth, it is important enough to be a separate consideration in our process. Ideally, Andvari wants a business to reinvest all its cash back into the business at high returns. If management cannot reinvest back into the business, we want to know whether they are skilled at acquiring other businesses or returning capital back to shareholders in the form of dividends or share repurchases.

The types of reinvestments are varied and unique for each business. If it’s a company like CoStar, spending hundreds of millions on advertising for its Apartments.com website continues to be a good investment. The website is the number one marketplace for apartment owners to market their inventory to people seeking to rent. A dominant position for Apartments.com translates into extremely high margins over the long-term.

If it’s a company like Tyler Technologies, the best reinvestment opportunity might be to spend heavily to improve its software products. Better products with greater functionality could be the deciding factor in winning a contract from a local government. Given Tyler’s relationships with its government customers can last decades, spending heavily in the short term to boost the odds of forging super-long customer relationships is an excellent investment.

Summary

Throughout our professional careers, we at Andvari have always tried to keep a level head and not worry too much about the future and its unforeseeable effects on our lives and on our investments. We think it is much better to reserve our time and energy for what’s within our control. At Andvari, what’s within our control is the privileged task of studying great businesses in which to collectively invest our hard-earned savings.

So far, we think Andvari has earned its keep. We’ve outperformed the S&P 500 index net of our management fee by: (1) having a repeatable investment process by which we continually curate a list of high quality companies and (2) being willing and able to concentrate our money in the best ideas. Though markets may work against us at any point and potentially for prolonged periods, Andvari is confident it can continue to produce differentiated results by executing on these two criteria.

As always, I love to hear from clients and interested parties about anything on your mind. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

-

ANDVARI NEWSLETTER

Once every two weeks, Andvari shares insights on great companies, exceptional leaders in business, and related topics in a digestible email format. Click here to sign-up.

-

-

IMPORTANT DISCLOSURE AND DISCLAIMERS

[i] Andvari performance represents actual trading performance of all, actual fee-paying clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees (assumed to be 1.25% per annum, paid quarterly, as currently advertised), net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The indexes are listed as benchmarks and are total return figures and assumes dividends are reinvested. The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The Russell 2000 Index is an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.