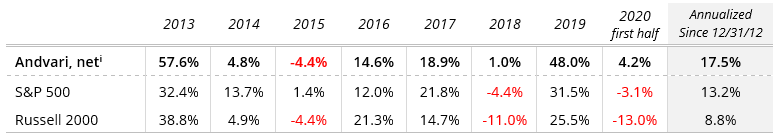

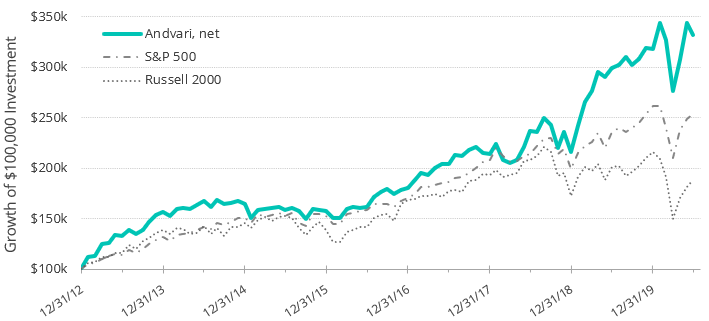

For the first half of 2020, Andvari as a whole is up 4.2% net of fees while the S&P 500 is down 3.1% (see disclaimer at bottom). The table below shows Andvari's performance against two benchmarks while the chart shows the growth of $100,000 investments.

MARKET COMMENTARY

Markets rebounded strongly from March lows. The S&P 500 was briefly flat for the year on June 8 and then fell a bit after that. More important, the economy continues to improve as life slowly gets back to normal. Business activity (as measured by ISM Service Sector indices) has rebounded. Airline passenger traffic at U.S. airports continues to increase from less than 100,000 passengers per day in April to over 750,000 passengers per day on July 6. Finally, job openings in the U.S. unexpectedly increased in May. This all bodes well for the economy and the markets.

ANDVARI HOLDINGS

[SECTION REDACTED - FULL LETTER AVAILABLE BY REQUEST]

A VEHICLE FOR COMPOUNDING CASH

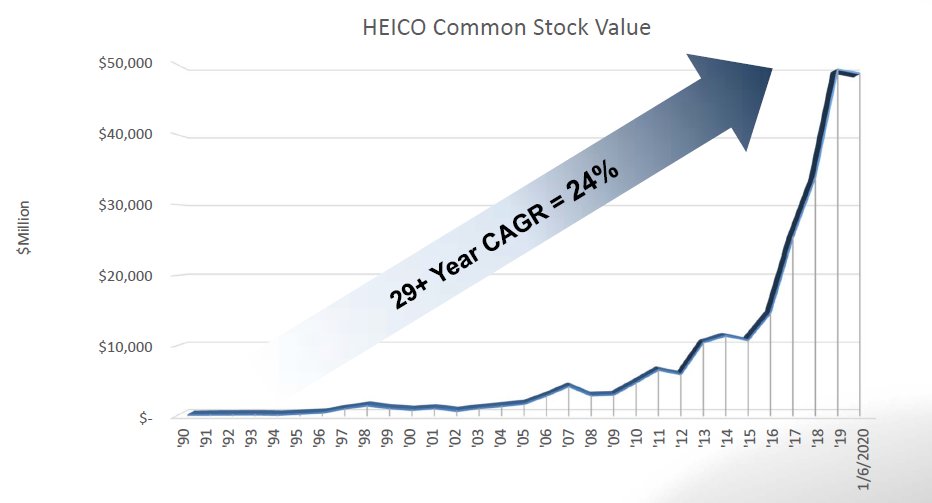

HEICO is the aerospace parts company that is new to client portfolios. The qualitative features sync up with Andvari's investment framework. HEICO makes niche products where there is little competition. They have an intense focus on serving their customers. Management, the Board of Directors, and employees have skin in the game by owning 21% of HEICO's outstanding shares.

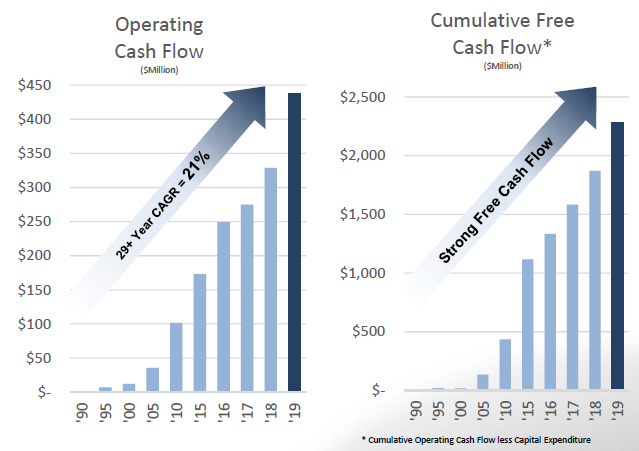

Most interestingly, management does not view HEICO as an aerospace company. Rather, management views HEICO as a "vehicle for generating strong cash flow." Such an expansive view of the company's purpose is attractive to Andvari as a shareholder. An expansive view allows management to consider other (potentially better) opportunities outside the aerospace industry. In these times of pandemics limiting travel by flight, this is a good thing!

Over the decades, HEICO has grown organically and via numerous acquisitions. The company has acquired 78 companies since 1990 and the acquisition formula remains simple. HEICO wants businesses with high margins, high cash flows, and entrepreneurial managers. HEICO is unconcerned with the size of revenues.

Regarding acquisitions, Chairman and CEO Laurans Mendelson on 5/27/20 said this (emphasis Andvari's):

We look at large ones. We look at smaller ones. [A]gain, the key for us is not big. The…investment bankers come to us and they bring us deals where there's 7% or 11% operating margins, they're big. But we're not interested in big. We want cash flow. So we want 20%, 30% operating margins that really earn their keep with great entrepreneurial management. …HEICO is not a company that wants to grow to just be big [in revenues]. We will always grow to be cash flow big. That's where we want to be big. And so the size of the company is not nearly as important as the profitability and the cash flow.

The reason why companies with high cash flows and margins exist is because they aren't continually spending cash on buying or maintaining capital equipment. They're not spending cash to maintain large inventories sitting on factory floors. Their customers pay quickly rather than slowly. As Mendelson says, "We want the cash to come out of the operation. That is why we run the Company, to create an entity that generates a lot of cash."

With that cash flow from its subsidiaries, HEICO uses it to continue growing and compounding returns for shareholders. Using cash to buy back shares or to have a large dividend is counter to that growth objective. As Mendelson explains:

[W]e want to grow HEICO, and buybacks shrink the Company. So, we feel that we would rather spend hundreds of thousands or millions expanding—buying an additional company, adding cash flow and growth—than shrinking the Company. So, we're not in a shrink mode.

That growth mindset is exactly what has allowed HEICO to compound its cumulative free cash flows from $1 million in 1990 to $2.3 billion in 2019. HEICO’s stock performance has been even more impressive. An investment of $100,000 in 1990 became worth about $48.7 million as of January 6, 2020.

With uncertainty still high about the prospects of the commercial aviation industry due to COVID-19, HEICO's message should be reassuring to shareholders. HEICO is not permanently required to operate in the aerospace industry. Even though HEICO's revenues and cash flows comes from its aerospace businesses, management's flexible view of the company means they can buy any business so long as it meets their high standards. Given Andvari's goal of compounding client capital at high rates of return for as long as possible, we are always excited to see a company and a management team thinking like we do.

SUMMARY

Jason Zweig, the Wall Street Journal columnist, recently wrote, "The first half of 2020 should remind us that investing isn't about conquering markets; it's about mastering ourselves." Andvari could not agree more. Although easier said than done, an enormous factor to Andvar''s outperformance over the years has been our ability to keep our cool in the face of uncertainty and volatility.

The first half of 2020 has been like late 2018 in a few respects. Both were periods of extreme uncertainty and volatility. Andvari persevered through late 2018, had good relative performance, and emerged in 2019 with an even higher quality portfolio of investments than before. So far in 2020, Andvari has persevered through volatility, achieved good relative performance, and has emerged with an improved portfolio of investments. We are confident we have positioned client portfolios for continued long-term success.

As always, I love to hear from clients and interested parties about anything on your mind. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

ANDVARI NEWSLETTER

Once every two weeks, Andvari shares insights on great companies, exceptional leaders in business, and related topics in a digestible email format. Click here to sign-up.

-

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. Andvari may re-evaluate its holdings in such positions and sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

Andvari performance represents actual trading performance of all, actual fee-paying clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees (1% per annum), net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The indexes are listed as benchmarks and are total return figures and assumes dividends are reinvested. The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The Russell 2000 Index is an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

© 2020 Andvari Associates LLC