Andvari’s focus today is on finding and investing in high quality companies led by exceptional managers. When Andvari started out in 2013, we had a different mindset. We chose to take advantage of our size and flexibility, often by finding small/mid cap companies in the process of turning around their operations.

Our experience in the realm of turnarounds was mostly positive. In hindsight, however, these types of investments were a misallocation of our time and capital. We could have been invested in high quality businesses from Day 1 where our capital could have compounded for longer periods of time.

Investors who can identify these types of situations, invest (and exit) at the right time, and then repeat the process over and over, are remarkably skillful. But looking at ourselves, we no longer approach investing in this way. Why not?

Imperially in Trouble

This aspect of what we do is existential and we could write a lot on it. Instead, we want to focus on just one historical example to convey the idea.

Imperial Holdings was a turnaround situation that worked out well in the short-term and poorly in the long-term. The company went public in 2011. Their primary business is to invest in life settlements where the company purchases life insurance policies. Assuming good underwriting, one can theoretically earn a decent return by buying hundreds of policies at a discount, continuing to pay the premiums, and then collecting the death benefits.

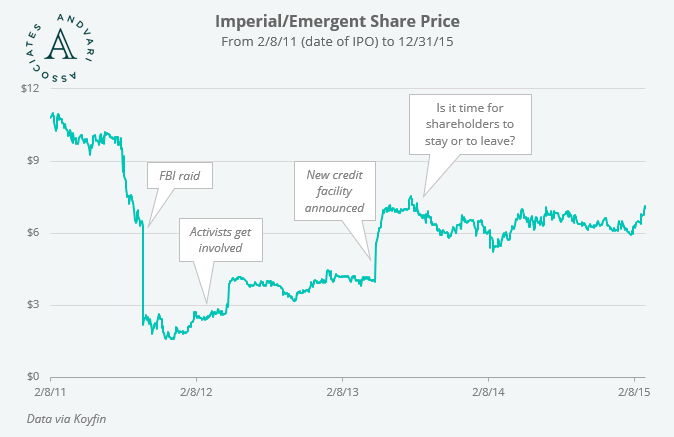

Shortly after the IPO, the FBI raided Imperial’s offices in Boca Raton, Florida. The stock cratered from $10 to less than $2 per share. This is when activist investors got involved. Imperial had valuable assets and their problems—shareholder lawsuits, SEC investigation, securing the resources to continue its operations—were serious, yet fixable.

From the time that activists got involved, the company fixed their problems one by one. The share price rebounded from $2 per share to $7 per share. The chart below roughly tracks the sequence of events:

Despite a quick, positive outcome, the gains enjoyed from late 2011 to mid-2013 would eventually disappear. Imperial’s business ultimately proved to be just ‘average’.

The True Cost of Average

At the outset of a situation like this, a good long-term investor would see Imperial was an average business at best. It operated in the heavily regulated world of insurance and finance. It used expensive debt to fund its operations. The value of its portfolio of life insurance policies could decline if the original underwriting assumptions turned out to be too optimistic. None of these attributes are the markers of a great business.

Despite not being a great business, the share price had more than doubled since the FBI raid. This could have persuaded an investor that Imperial was a better business than it actually was. One could have concluded the company was still a bargain: in March 2014 it had a share price in the $6–$7 range against a book value of $9.11 per share. An investor could easily struggle with whether to continue holding or to realize gains and move on.

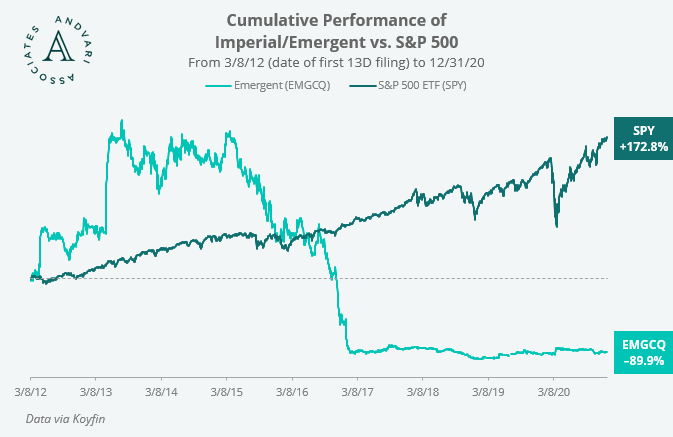

Not long after Imperial fixed its old problems new problems emerged. More cash was leaving the business than coming in. Underwriting turned out to be inadequate. The company could not access less expensive capital. The company changed its name to Emergent Capital and it turned into a penny stock in 2017. Emergent declared Chapter 11 bankruptcy in October 2020.

What We Learned

Studying these types of investments is instructive for several reasons:

- You Often Get What You Pay For – Andvari better appreciates how there is higher risk in owning, over the long-term, the average or below-average business. Although it’s possible to earn good returns by buying any business (good or bad) at the right price, we believe when the holding period is 5+ years, owning a great business carries less risk.

- The Overlooked Risks of Reinvestment – Compounding capital at high rates—especially in a taxable account—is a challenge with smaller turnaround investments. If and when the turnaround succeeds, the investor must sell their position and look for the next opportunity. Capital gains will be realized and the next opportunity might not even be immediately available, both of which reduce long-term performance.

- Ockham’s Razor Shows the Way – In our view, life is simpler and less stressful when you buy great businesses, run by good people, for a fair price. If you find the right ones, it might be decades before you realize gains. The longer one owns a good business, the greater the opportunity to compound your knowledge of the business and its management. If any surprises occur, in our experience it’s usually a positive surprise for a great business and a negative surprise for a mediocre business.

We acknowledge the allure of special situation investing and turnarounds (and the amazing skills required to do it well—and please make no mistake, some investors are masters at it). We have learned enough about ourselves to know it is not for us. We have generally chosen to prize ‘quality’ over ‘cheap’, ‘long term’ over ‘short term’, and ‘simple’ over ‘complicated’.

Andvari Takeaway

As Warren Buffett wrote in Berkshire Hathaway’s 1989 letter to shareholders, “Time is the friend of the wonderful business, the enemy of the mediocre.”

Although Andvari had some good results to offset our poor results in this space, the opposite could have easily been the case. Short-term gains could have lured us into holding on for too long. In a situation like Imperial, any gains would have been erased (and then some). We use this example to explain why Andvari prioritizes high quality companies: so our capital and our knowledge about them can compound over long periods of time.

-

_________

--

-

_________

-

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. Andvari may re-evaluate its holdings in such positions and sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC