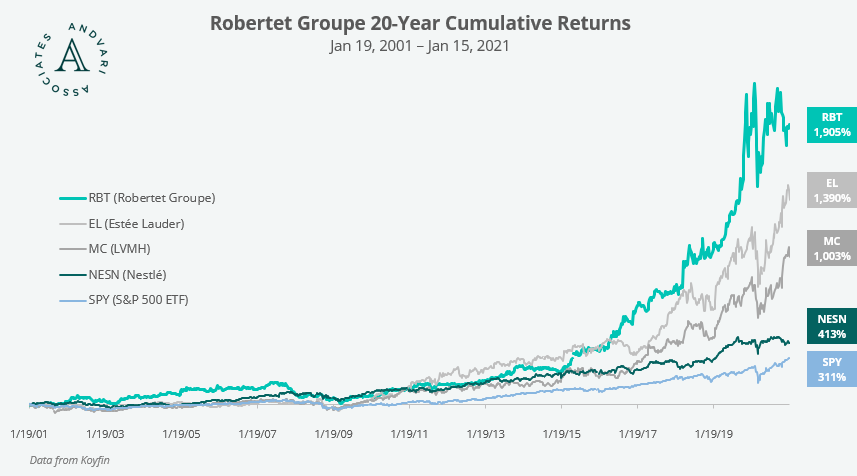

One of the best businesses Andvari has studied is France-based flavor and fragrance company Robertet Groupe. It’s a relatively unknown name, but the 170-year-old company embodies a handful of powerful investment frameworks that we value. Robertet has generated extraordinary returns over the last 20 years.

Every investor knows some of the large companies that are likely Robertet customers: Nestlé, Estée Lauder, or LVMH. The potential end products in which Robertet’s products are found range from coffee creamers and sodas to shampoos and luxury perfumes. Few people likely know that a company like Robertet has produced shareholder returns better than even some of its best customers.

5 Keys to Multigenerational Success

There are surely additional drivers behind the company’s enduring success, but we point to five that stand-out as recurring themes in our process.

The first is that Robertet is still a family-controlled business. Founded in 1850, the 4th and 5th generation of the Maubert family are currently running the show. They own a bit less than 50% of the company and control 67.5% of the voting rights. They have skin in the game and have had the freedom to reinvest in the business for the next decade rather than just the next year. Although a non-family controlled business can certainly think and act for the long-term like Robertet, we believe the odds of this happening are greater with a family-controlled business.

The second investment framework we note is Robertet’s strong pricing power. The pricing power comes from a combination of two factors. One is Robertet’s products are highly valuable components to the end product. The other is Robertet’s products account for a tiny portion of the total costs. A fragrance from Robertet might make up 4%–6% of the total cost of a luxury perfume.

Source: Robertet Groupe

Thirdly, Robertet is a “picks and shovels” type of company. The company isn’t taking risks to find a gold mine—they have a much more dependable business of selling all the tools to the prospectors. In this case, the prospectors are all the brands out there trying to create a unique food, beverage, or scented product. Robertet has hundreds of solutions to offer and can work closely with customers to choose (or design) the right flavor and fragrance for the end product. This degree of customer intimacy also acts as a barrier to competition.

Furthermore, when a Robertet flavor or fragrance has been selected for an end product, this basically becomes an annuity stream. It is highly risky for a Robertet customer to switch to a competing product. Altering the taste and scent of the end product could alienate end customers.

Lastly, these qualities translate into highly attractive financials for Robertet. Revenues are stable and predictable, gross margins are above 50% and annual capital expenditures are just 4% of sales. The company has accumulated multiple generations-worth of intellectual property. 170 years of know-how is yet another high barrier to new competition.

Andvari Takeaway

With Robertet, we see a company run by owner-operators, that has pricing power, is a provider of “picks and shovels” to its customers, and that has annuity-like revenue streams. Companies that embody multiple investment frameworks like Robertet are always on our radar as potential, long-term investments.

-

_________

--

-

_________

-

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. Andvari may re-evaluate its holdings in such positions and sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC