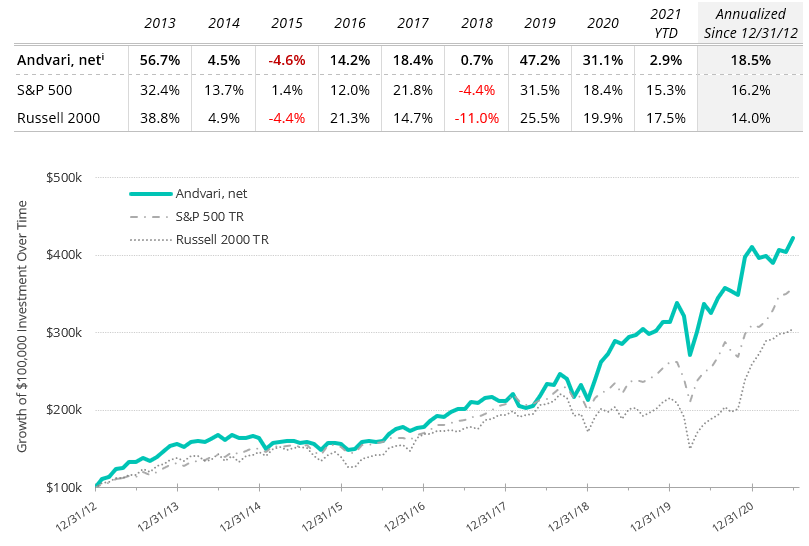

For the first half of 2021 Andvari is up 2.9% net of fees while the S&P 500 is up 15.3%.[i] Andvari clients, please refer to your reports for your specific performance figures. The table below shows Andvari’s composite performance against two benchmarks while the chart shows the cumulative gains of $100,000 investments.

ANDVARI HOLDINGS

Andvari's largest positions continued to lag the market and remain a drag on performance year to date. The holdings that worked well in 2020 are not working as well so far in 2021. However, just because a company's share price has declined does not mean that the value of its business has also declined. We are extremely bullish on the long-term prospects for our holdings that have lagged the market this year.

LATENT VALUE

Andvari's second largest holding has now lagged the market over the last twelve months and over the last three years. Still, we remain confident there is tremendous potential for the company and its shareholders. There is enormous latent value that has yet to surface.

This is a company with a market cap of $1.4 billion, revenues approaching $150 million, and over $250 million of cash on its balance sheet. Importantly, over the last several years this company has upgraded the quality of its management team and its board of directors. The management team now includes a handful of former Danaher employees. The new directors on the board have experience leading business units with billions of revenues.

It is hard to overstate the significance that the managers of our company have Danaher on their résumés. Danaher is a company that has built enormous wealth for its shareholders over the last 37 years. From 1995 to 2020, Danaher shareholders enjoyed a total cumulative return of 7,801% versus 880% for the S&P 500 index. Danaher did this by using its cashflows to acquire dozens of companies and instituting a culture of continuous improvement.

Knowing what Danaher was able to achieve gives us confidence in the latent value of our investment. It took Danaher eight years (12/31/85 to 12/31/93) to grow revenues from $100 million to $1 billion. During this phase of Danaher's growth, their shareholders vastly outperformed the market. Although nothing is certain, the odds are skewed in our favor that our holding, run by former Danaher managers, can grow quickly over the next decade and deliver outstanding returns to shareholders in the process.

LAUNCHING ANDVARI PARTNERS LP

After starting Andvari in 2011 with just $3.5M of "friends and family" money, it is a pleasure to share some exciting news. Andvari’s first investment fund, Andvari Partners LP, has been launched.

The philosophy underpinning the fund strategy is identical to Andvari's existing approach. We intend to invest in nearly all the same names we currently own. Just fewer of them. Owning fewer names and managing fewer separate accounts is something we have long sought. Our progression towards fewer names has been careful and measured given the significant retirement assets we manage.

We strive to invest in the way we think will lead to the best, long-term outcome. High concentration mixed with our qualitatively-driven selection process and our long holding periods is how we get there. The new structure gives us the increased freedom to make that happen. For more information on Andvari Partners LP, please contact us (info@andvariassociates.com).

ANDVARI TAKEAWAY

Andvari remains steadfast in our investment approach and philosophy. We wrote last quarter about continually looking to be invested in fewer and better companies. These are companies that can compound our wealth at above average rates for decades rather than several years. When the market ignores the latent value of one of our holdings for too long, we usually view this as an opportunity to add to that holding.

This is exactly what we have done over the last six months. We have added to this already sizeable holding. With the effects of the COVID global pandemic subsiding, our holding will find it easier to do business and close new sales. We also expect our holding to put its cash pile to work by announcing a large acquisition in the next 6–12 months. These both will be catalysts for future increases in its share price and the intrinsic value of the business.

As always, I love to hear from clients and interested parties about anything on your mind. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

DISCLOSURES AND END NOTES

[i] Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees (assumed to be 1.25% per annum, paid quarterly, as currently advertised), net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results.

The indexes are listed as benchmarks and are total return figures and assumes dividends are reinvested. The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The Russell 2000 Index is an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage.

One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal.

The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.