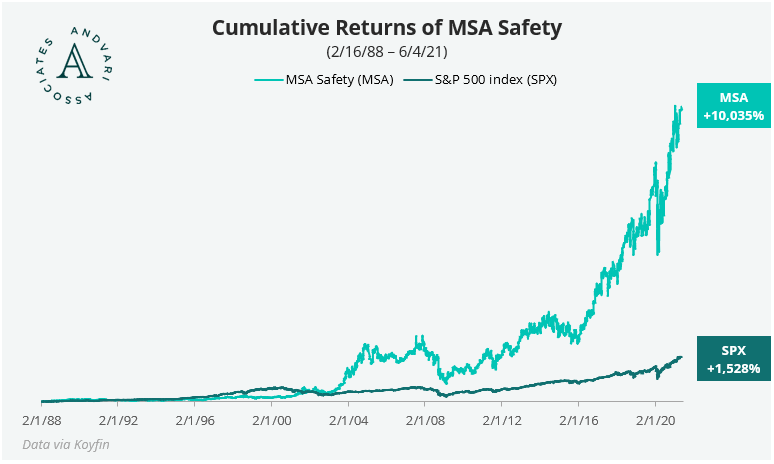

The picks-and-shovels investing theme is a favorite of Andvari’s. The theme takes its name from the California Gold Rush. Prospectors were not guaranteed to find gold but the people selling the picks and shovels earned a good living. Suppliers of goods and services that are essential to the creation of another finished product are fertile grounds for prospective investments. MSA Safety is one company that fits the picks-and-shovels theme—and several others—and has turned into a 100-bagger over the last 33 years.

Originally named Mine Safety Appliances, the company was formed in 1914 after a spate of terrible coal mine explosions. Dozens or even hundreds of miners died in these tragic accidents when an open flame lamp ignited methane gas or coal dust. The Monongah Coal mine was the site of the largest coal mine disaster in U.S. history in 1907 with 362 deaths. Thus, MSA enlisted Thomas Edison to help create an electric cap lamp to replace the open flame lamps used in mines. Over the next 25 years, MSA’s lamps helped reduce mine explosions by 75%.

LIFE SAVING, MISSION CRITICAL PRODUCTS

Although not literally selling picks and shovels, the MSA product range includes breathing apparatus products, fixed gas and flame detection instruments, portable gas detection instruments, and firefighter helmets and apparel. These products are all essential to the safety of miners and others working in hazardous environments. Also, these products are often mandated by government and industry regulations. The life saving, mission critical qualities of MSA's products enables high margins and affords them the ability to more easily raise prices.

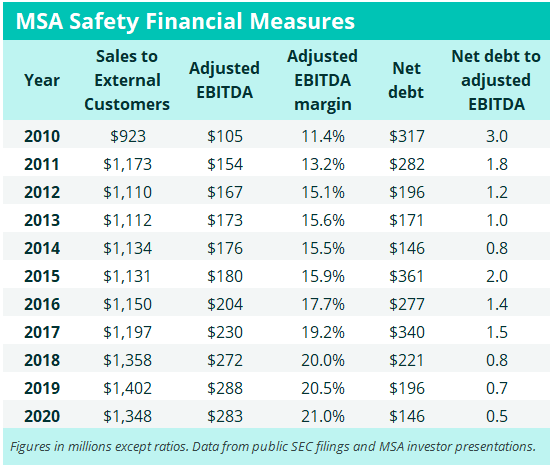

EXEMPLARY FINANCIALS

MSA’s financials are quite good despite them being a manufacturer of physical products. This is because MSA’s products are: (1) essential to safety; (2) are highly-engineered; (3) are mandated by regulations; and (4) are a small part of the total costs borne by the end users. MSA’s revenues are also more stable compared to the industries to which they sell.

LEADING MARKET POSITIONS AND VALUE-CREATING M&A

There are two other factors contributing to MSA’s success. One is that most of their products occupy the #1 position in their categories. Having the best brands allows MSA to charge more and raise prices more easily. The other factor is MSA’s excellent track record of value-creating acquisitions. Although not quite a serial acquirer like Constellation Software or Halma, from 2010 through 2020 MSA has acquired 5 companies for a total consideration of $716 million. It’s acquisition program has succeeded because MSA has stayed inside its circle of competence. They’ve only acquired manufacturers of mission critical products that help protect the lives of people working in dangerous environments.

ANDVARI TAKEAWAY

Although MSA does sell to cyclical industries Andvari categorically dislikes—mining and oil and gas, for example—it would be wrong to totally dismiss MSA as a potential investment. It has many attractive qualities that we look for. It’s products are highly engineered, have leading positions in highly regulated markets, and are non-discretionary purchases that protect the lives of people. Whether it's miners, firefighters, or chemical plant employees, none of them can do their jobs without products from MSA. This all adds up to a company whose shareholders have enjoyed a 100-fold return since 1988.

Further Reading

- Hutchings Museum - Mining: Electric Light & Hats

- National Museum of American History - Electric Lamps

- When Everybody Is Digging for Gold, It’s Good To Be in the Pick and Shovel Business

- MSA Safety March 2021 Investor Presentation

_________

--

-

_________

-

IMPORTANT DISCLOSURE AND DISCLAIMERS

Investment strategies managed by Andvari Associates LLC ("Andvari") may have a position in the securities or assets discussed in this article. In the instance of MSA Safety, Andvari and its clients have never owned shares prior to publication of this educational blog. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice.

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This document contains information and views as of the date indicated and such information and views are subject to change without notice. Andvari has no duty or obligation to update the information contained herein. Past investment performance is not an indication of future results. Full Disclaimer.

© 2021 Andvari Associates LLC